Learn the essential steps to achieve and sustain financial independence in our comprehensive guide. From budgeting and investing to creating multiple income streams, discover the path to financial freedom.

What is Financial Independence?

Financial independence is often described as the point where your passive income exceeds your expenses. But it’s much more than just having money. It’s about having the freedom to make life choices without being constrained by finances.

Imagine this:

- Waking up every morning without the pressure of going to a job you dislike.

- Having the time and resources to pursue passions, hobbies, or travel the world.

- Spending precious moments with loved ones without worrying about work deadlines or bills.

Financial independence doesn’t necessarily mean early retirement. It’s about having the financial security to design a life you love, whether that involves starting a business, working on creative projects, volunteering, or simply enjoying more leisure time.

It’s about achieving peace of mind, knowing that you are in control of your financial destiny. It’s about removing the anxieties associated with money and replacing them with the freedom of choice.

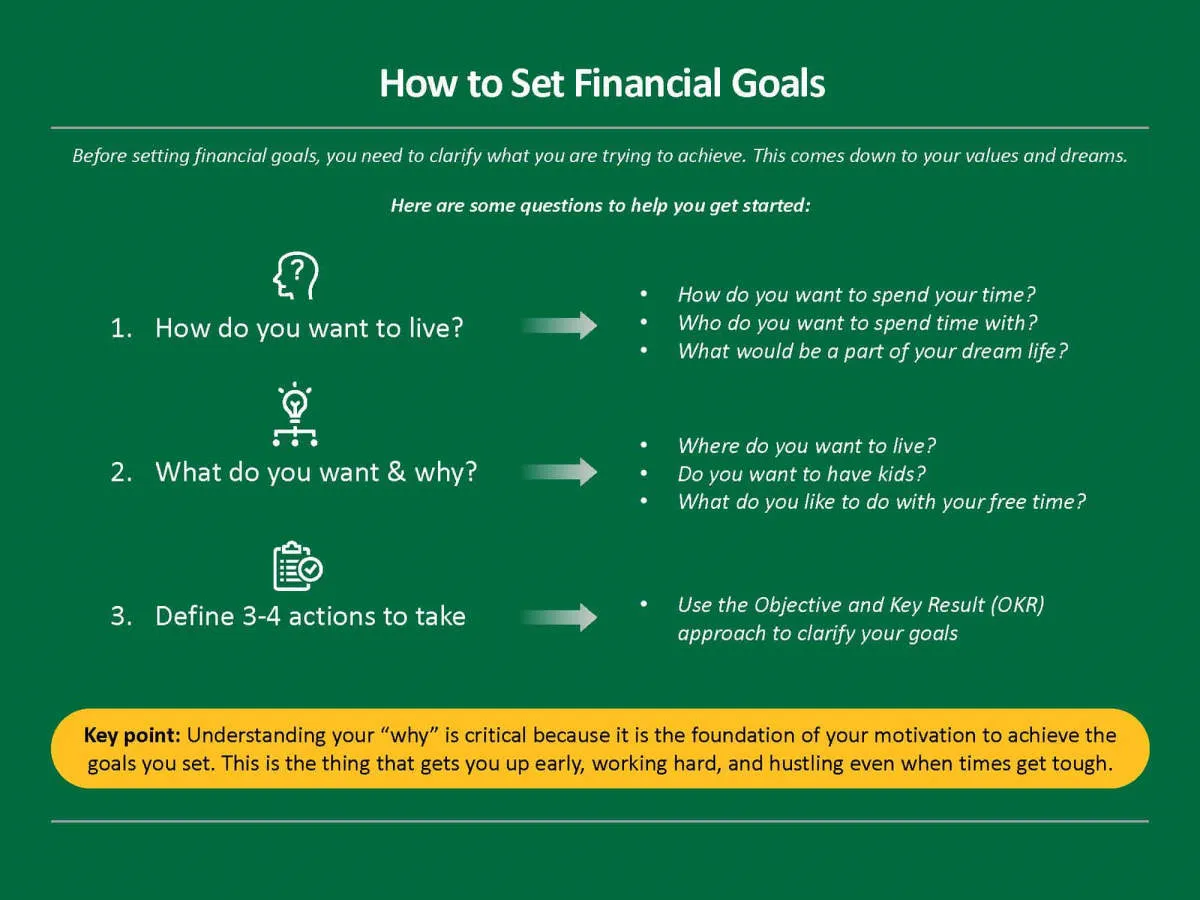

Setting Financial Goals

The cornerstone of financial independence rests upon well-defined financial goals. These goals act as your compass, guiding your financial decisions and actions. Without them, it’s easy to drift aimlessly, making it far more challenging to achieve the financial freedom you desire.

Consider these key points when setting your financial goals:

1. Identify Your “Why”

What fuels your desire for financial independence? Is it early retirement, travel, starting a business, or simply the peace of mind that comes with financial security? Clearly defining your “why” will fuel your motivation and help you stay committed when facing challenges.

2. Be SMART

Ensure your goals adhere to the SMART criteria. They should be:

- Specific: Clearly define what you want to achieve (e.g., “save $20,000 for a down payment”).

- Measurable: Quantify your goals to track progress (e.g., “save $1,000 per month”).

- Attainable: Set realistic goals within your reach.

- Relevant: Align your goals with your values and aspirations.

- Time-Bound: Establish deadlines to provide urgency and accountability.

3. Categorize Your Goals

Categorizing your goals based on their timeframes helps prioritize your efforts:

- Short-Term Goals: Achievable within 1-2 years (e.g., paying off credit card debt, building an emergency fund).

- Mid-Term Goals: Achievable within 3-5 years (e.g., saving for a down payment, funding a child’s education).

- Long-Term Goals: Goals that take 5+ years to achieve (e.g., retirement planning, financial independence).

4. Regularly Review and Adjust

Life is dynamic, and your goals should be too. Regularly review your financial goals, at least annually, or when significant life changes occur. Adjust them as needed to stay aligned with your evolving circumstances and aspirations.

Building Multiple Income Streams

One of the most effective ways to achieve financial independence is to create multiple income streams. Relying on a single source of income can be risky. If that source disappears, your financial security could be in jeopardy. By diversifying your income, you create a safety net and accelerate your path to financial freedom. Here’s how:

1. Identify Your Skills and Interests

Start by considering what you’re good at and what you enjoy doing. Do you have skills that could be monetized? Are you passionate about a particular hobby that could be turned into a side hustle? Some popular options for generating multiple income streams include:

- Freelancing: Offer your skills in writing, graphic design, web development, or other fields online.

- Online business: Start an e-commerce store, sell digital products, or create an online course.

- Real estate: Invest in rental properties for passive income.

- Investing: Build a portfolio of stocks, bonds, and other assets.

- Gig economy: Participate in the gig economy by driving for a rideshare service, delivering food, or completing other tasks.

2. Start Small and Scale Up

You don’t need to quit your day job to start building multiple income streams. Begin with a side hustle that fits into your current schedule and gradually expand it as your income grows. Focus on developing one stream at a time, ensuring it’s profitable before moving on to the next.

3. Automate and Delegate

As you build multiple income streams, look for opportunities to automate processes and delegate tasks. This will free up your time and allow you to focus on higher-level activities that generate more revenue. Consider using tools and software to automate tasks like social media scheduling, email marketing, and customer support.

Investing Wisely

Investing is a cornerstone of financial independence, allowing your money to grow over time and outpace inflation. However, it’s not just about throwing money at the stock market and hoping for the best. Investing wisely requires a strategic approach tailored to your financial goals, risk tolerance, and time horizon.

Define Your Investment Goals

What are you aiming to achieve through investing? Are you building a retirement nest egg, saving for a down payment on a house, or planning for your child’s education? Clearly defined goals will shape your investment strategy, dictating the appropriate level of risk and the types of investments you should consider.

Understand Your Risk Tolerance

Risk tolerance refers to your capacity and willingness to withstand potential losses in your investment portfolio. Generally, younger investors with a longer time horizon can afford to take on more risk, opting for higher-growth investments with potentially higher volatility. As you approach your financial goals, shifting towards a more conservative portfolio with lower-risk investments is often recommended.

Diversify Your Portfolio

Diversification is a fundamental principle of investing, emphasizing the importance of spreading your investments across different asset classes (e.g., stocks, bonds, real estate) and within those asset classes. This helps to mitigate risk; if one investment performs poorly, others can potentially offset those losses.

Consider Different Investment Vehicles

- Stocks: Represent ownership in publicly traded companies, offering potential for high growth but also carrying higher risk.

- Bonds: Essentially loans you make to governments or corporations, typically offering lower returns than stocks but considered less risky.

- Mutual Funds and ETFs: Provide instant diversification by investing in a basket of stocks, bonds, or other assets.

- Real Estate: Can provide rental income and potential for appreciation, but it often requires significant capital and ongoing management.

Do Your Research or Seek Professional Advice

Thoroughly research any investment before committing your hard-earned money. Understand the potential risks and rewards associated with different asset classes and specific investments. If you’re unsure where to start, consider seeking guidance from a qualified financial advisor who can provide personalized advice tailored to your circumstances.

Living Below Your Means

One of the cornerstones of financial independence is the often-heard, yet sometimes difficult-to-implement advice: live below your means. In essence, this means spending less than you earn, consistently. While it might sound simple, it requires a conscious shift in mindset and habits, especially in a world often geared towards consumerism.

Why is living below your means so crucial for financial independence? It allows you to:

- Build Savings: Having a surplus each month, no matter how small, allows you to build an emergency fund and start investing.

- Reduce Debt: The extra money can be directed towards paying down high-interest debt, freeing up more income in the future.

- Increase Financial Security: Knowing you can handle unexpected expenses without going into debt provides peace of mind.

- Reach Financial Goals Faster: Whether it’s buying a house, early retirement, or starting a business, living below your means accelerates your progress.

Living below your means doesn’t mean living a life devoid of enjoyment. It’s about making conscious choices, prioritizing needs over wants, and finding fulfillment outside of material possessions. It’s about creating a life where you have the freedom to pursue your passions and achieve your financial aspirations.

Maintaining Financial Independence

Achieving financial independence is a massive accomplishment, but the journey doesn’t end there. Maintaining it requires vigilance, adaptability, and a commitment to your financial well-being. Here’s how to ensure your hard-earned independence lasts a lifetime:

1. Budget and Track Expenses

Just because you’ve reached a comfortable financial position doesn’t mean you should abandon your budget. In fact, it’s even more critical now. Track your spending to ensure you stay within reasonable limits and identify any potential areas where you might be overspending. A well-managed budget is the cornerstone of long-term financial stability.

2. Review and Adjust Your Financial Plan Regularly

Life is full of changes – marriage, children, career shifts, and unexpected events. Regularly review and update your financial plan to reflect these changes and ensure your investments and strategies are still aligned with your goals. This could involve adjusting your asset allocation, retirement savings rate, or insurance coverage.

3. Invest Wisely and Manage Risk

Preserving your capital is as important as growing it. Diversify your investments across different asset classes to mitigate risk. As you approach retirement, consider adjusting your portfolio to a more conservative mix to safeguard your savings.

4. Generate Passive Income Streams

Explore opportunities to create passive income streams, such as rental income, dividend-paying stocks, or online businesses. These streams can provide a financial cushion and offer greater flexibility and security in the long run.

5. Guard Against Lifestyle Inflation

It’s easy to fall into the trap of lifestyle inflation – increasing spending as your income grows. Resist this urge and maintain a reasonable standard of living, even if your financial situation allows for more. This discipline will help your wealth last longer and provide greater peace of mind.

6. Stay Informed and Adapt

The financial landscape is constantly evolving. Stay informed about changes in tax laws, investment trends, and economic conditions. This knowledge will help you make informed decisions and adjust your strategies to maintain your financial advantage.

7. Seek Professional Guidance

Don’t hesitate to consult with a qualified financial advisor, especially when faced with major financial decisions or changes in your life. They can provide personalized advice, help you navigate complex financial situations, and hold you accountable for your financial goals.

Conclusion

Attaining and preserving financial independence requires diligent budgeting, astute investing, and consistent saving habits. By practicing financial discipline and setting achievable goals, individuals can secure their financial future and enjoy lasting independence.