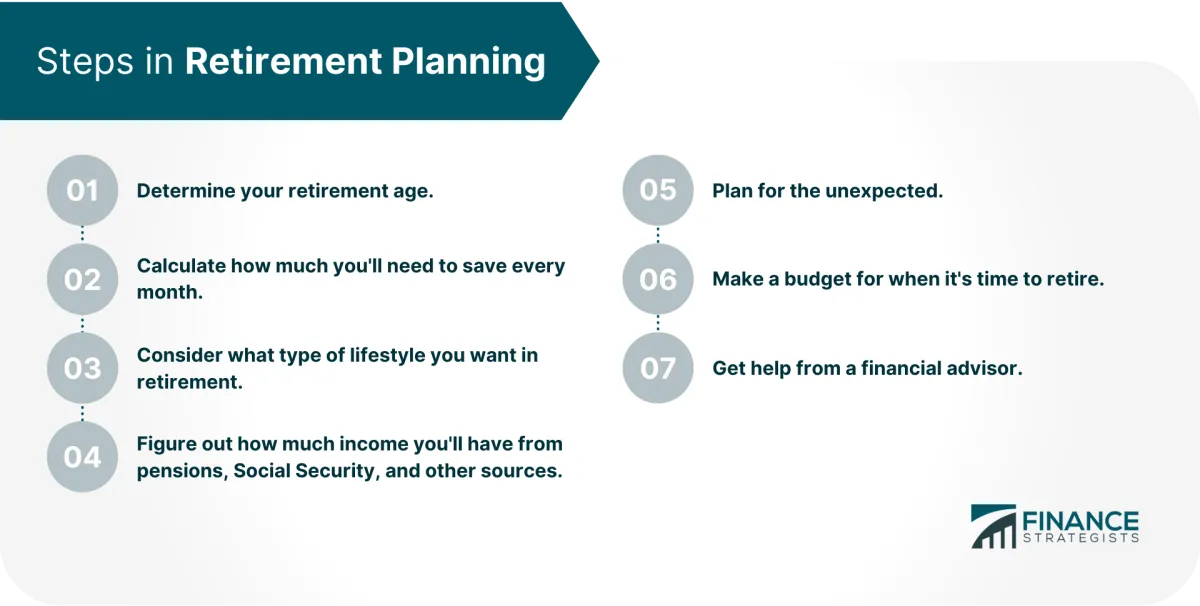

Planning for retirement is crucial for ensuring a secure financial future. This article will guide you through the essential steps to take in order to effectively plan and prepare for your retirement years.

Why Retirement Planning is Important

Retirement planning might seem like a distant concern, especially when you’re in the prime of your career. However, securing a comfortable and financially stable future requires early and consistent planning. Here’s why:

Financial Security:

Retirement often means a significant decrease or complete loss of active income. Without a well-structured retirement plan, maintaining your lifestyle and covering essential expenses like healthcare, housing, and daily living can become challenging. Retirement planning allows you to accumulate the necessary funds to support yourself financially after you stop working.

Inflation Protection:

The cost of living tends to increase over time due to inflation. What a dollar can buy today won’t be the same in 10, 20, or 30 years. Retirement planning helps you factor in inflation and ensures your savings retain their purchasing power, allowing you to maintain your standard of living even as prices rise.

Healthcare Costs:

Medical expenses can become a significant burden as you age. Retirement planning helps you prepare for potential healthcare costs, including insurance premiums, long-term care, and unexpected medical bills. Having a financial cushion dedicated to healthcare ensures you can access quality care when you need it most.

Pursuing Your Passions:

Retirement shouldn’t feel like an end but rather a new beginning. Whether it’s traveling, pursuing hobbies, or spending time with loved ones, retirement planning empowers you to live life on your terms. By securing your financial future, you gain the freedom to enjoy your retirement years to the fullest.

Peace of Mind:

Perhaps most importantly, retirement planning provides invaluable peace of mind. Knowing you have a solid financial plan in place alleviates stress and allows you to approach your later years with confidence and security. You can focus on enjoying your life knowing that you’ve taken the necessary steps to secure your future.

Setting Retirement Goals

Retirement might seem far off, but planning for it should start sooner rather than later. The cornerstone of a successful retirement plan is setting clear and achievable goals. This clarity will guide your saving and investment strategies and paint a picture of the future you’re working towards.

What Does Retirement Look Like for You?

Envisioning your ideal retirement is the first step. Ask yourself some key questions:

- When do you want to retire? Choosing an age (or a range) gives you a timeline to work with.

- Where do you want to live? Staying put, downsizing, or relocating all come with different financial implications.

- How do you want to spend your time? Travel, hobbies, volunteering, or part-time work all factor into your retirement budget.

Translating Dreams into Numbers

Once you have a vision, it’s time to get specific. Consider these factors:

- Estimated Expenses: Research the potential costs associated with your desired lifestyle. Don’t forget about healthcare, which can be a significant expense in retirement.

- Sources of Income: Determine what income you’ll have in retirement, such as Social Security benefits, pensions, or rental income.

- Inflation: Factor in inflation when calculating your retirement needs. What costs $10,000 today might cost significantly more in 20 years.

By setting specific and realistic retirement goals, you’ll have a roadmap for creating a financial plan that can help you achieve the retirement you desire.

Calculating Retirement Needs

Determining how much money you’ll need for retirement is a crucial first step in financial planning. This calculation involves several factors and considers your desired lifestyle during retirement.

Factors to Consider:

- Years in Retirement: Estimate how many years you expect to spend in retirement based on your health and family history.

- Retirement Lifestyle: Do you envision a comfortable retirement with travel and leisure activities, or a more modest one? Your lifestyle choices significantly impact your expenses.

- Current Expenses: Analyze your current spending habits. While some costs may decrease or disappear in retirement (like work-related expenses), others might increase (like healthcare costs).

- Inflation: Factor in the rising cost of living. Inflation erodes the purchasing power of your savings over time.

- Sources of Income: Account for any potential income sources during retirement, such as Social Security benefits, pensions, or part-time work.

Methods and Tools:

Several methods and online calculators can help you estimate your retirement needs. These tools often consider the factors mentioned above and can provide you with a projected savings goal. It’s advisable to consult with a financial advisor to receive personalized guidance based on your specific circumstances.

Regular Review and Adjustment:

Remember that your retirement needs are not static. It’s essential to review and adjust your calculations periodically, especially as you approach retirement age or experience significant life changes.

Investment Options for Retirement

Planning for a financially secure retirement requires careful consideration of your investment options. Choosing the right investments is crucial for growing your retirement savings and ensuring you have enough income to support your desired lifestyle after you stop working. Here are some popular investment options to consider:

Retirement Accounts

These accounts offer tax advantages specifically designed for retirement savings:

- 401(k) or 403(b): Employer-sponsored plans that allow pre-tax contributions, and potential employer matching contributions.

- Traditional IRA: Individual Retirement Accounts offer tax-deductible contributions and tax-deferred growth.

- Roth IRA: Contributions aren’t tax-deductible, but withdrawals in retirement are tax-free.

Stocks

Investing in stocks means owning a share of a publicly traded company. Stocks offer potential for high returns but also come with higher volatility and risk.

Bonds

Bonds are considered a more conservative investment than stocks. When you invest in bonds, you are essentially loaning money to a government entity or corporation. They offer lower potential returns than stocks but can provide more stability and consistent income.

Mutual Funds and Exchange-Traded Funds (ETFs)

These investment vehicles pool money from multiple investors to invest in a diversified portfolio of assets, such as stocks, bonds, or real estate. Mutual funds and ETFs offer diversification and professional management.

Real Estate

Investing in real estate can provide rental income and potential property appreciation. This option can require significant capital and comes with its own set of risks and responsibilities.

Annuities

Annuities are contracts with insurance companies that provide guaranteed income payments in retirement. They can be a good option for those seeking a predictable income stream.

Managing Retirement Accounts

Managing your retirement accounts is crucial for ensuring your financial security during your golden years. Here’s what you need to know:

Types of Retirement Accounts:

Familiarize yourself with the different types of retirement accounts available:

- 401(k)s and 403(b)s: Employer-sponsored plans that offer tax advantages and often include employer matching contributions.

- Traditional IRA: Contributions may be tax-deductible, and earnings grow tax-deferred until retirement.

- Roth IRA: Contributions are not tax-deductible, but qualified withdrawals in retirement are tax-free.

- SEP IRA: Designed for self-employed individuals and small business owners.

Contribution Strategies:

Maximize your contributions to your retirement accounts. Consider the following:

- Contribute early and consistently. The power of compounding can significantly grow your savings over time.

- Take advantage of employer matching contributions. It’s essentially free money!

- Increase contributions annually. Aim to increase your contributions as your income grows.

- Consider catch-up contributions. If you’re 50 or older, you can make additional catch-up contributions.

Investment Allocation:

Your investment allocation should align with your risk tolerance and time horizon. Consider a diversified portfolio that includes:

- Stocks: Offer potential for growth but also come with higher risk.

- Bonds: Generally less volatile than stocks and provide income.

- Mutual funds and ETFs: Offer diversification across different asset classes.

Regularly Review and Rebalance:

It’s important to review your retirement accounts at least annually and rebalance your portfolio as needed. This ensures that your investments stay aligned with your goals and risk tolerance.

Seek Professional Advice:

Consider consulting with a qualified financial advisor who can provide personalized guidance tailored to your specific financial situation and retirement goals.

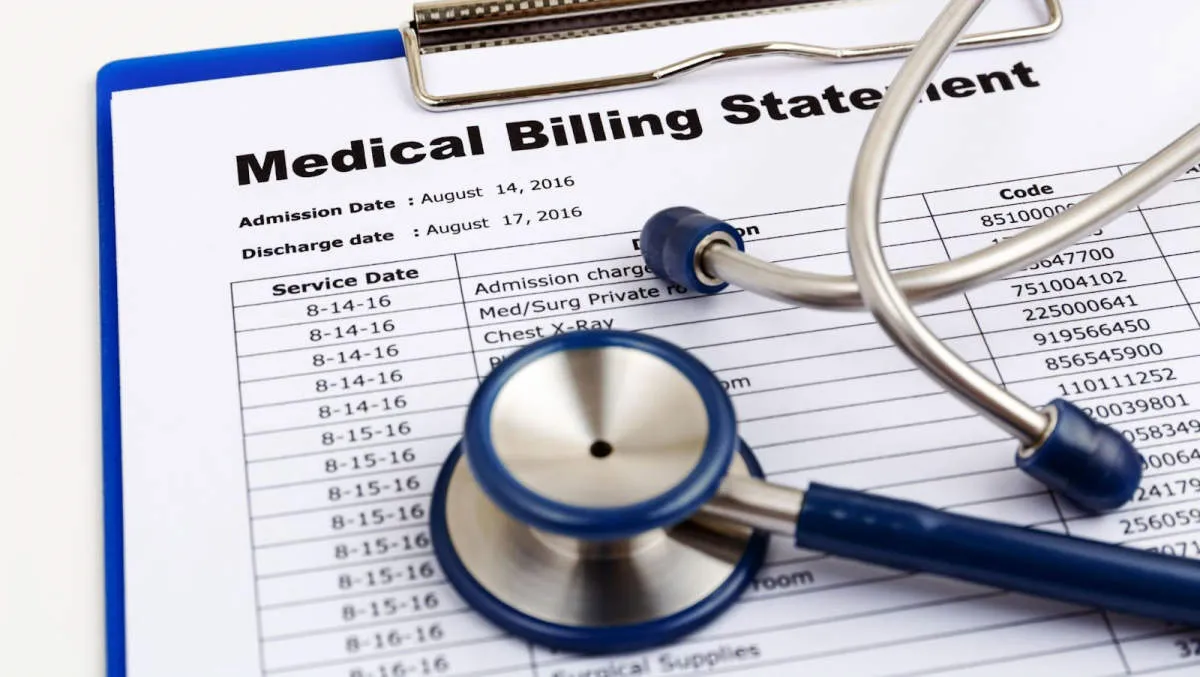

Planning for Healthcare Costs

Retirement often brings a shift in healthcare needs and expenses. While Medicare provides valuable coverage for those 65 and older, it doesn’t cover everything. Planning for potential healthcare costs in retirement is crucial for financial security.

Estimate Future Healthcare Expenses: Consider factors like your health history, family medical history, and potential long-term care needs. Online tools and financial advisors can help you estimate these costs.

Explore Medicare and Supplemental Options: Familiarize yourself with Medicare Part A (hospital insurance), Part B (medical insurance), and Part D (prescription drug coverage). Evaluate if supplemental insurance like Medigap or Medicare Advantage plans would better suit your needs and budget.

Factor in Long-Term Care: Long-term care, including nursing homes or in-home care, can be very expensive. Consider long-term care insurance options or dedicate a portion of your retirement savings to potentially cover these costs.

Health Savings Accounts (HSAs): If eligible, contributing to an HSA while working can provide tax-advantaged savings specifically for healthcare costs in retirement.

Conclusion

In conclusion, proper financial planning is essential to ensure a secure retirement. By taking steps like setting goals, creating a budget, and investing wisely, you can build a stable financial future for your retirement.