Explore the best investment strategies tailored to diverse life stages, from early adulthood to retirement. Learn how to optimize your financial decisions and secure your future at every milestone.

Investing in Your 20s

Your 20s are a time of significant change and growth, both personally and financially. It’s the decade where you start laying the foundation for your future financial well-being. While you might be juggling student loan payments, building your career, and navigating the complexities of adulting, it’s crucial not to underestimate the power of early investing.

Why Start Investing in Your 20s?

Here’s why investing in your 20s is one of the smartest financial moves you can make:

- Time is on Your Side: Time is your biggest asset in investing. The magic of compound interest means your money has more time to grow exponentially. Starting early allows you to maximize the benefits of compounding.

- Ride Out Market Fluctuations: The market will inevitably experience ups and downs. Starting early gives your portfolio more time to recover from potential market downturns.

- Start Small, Grow Big: You don’t need a fortune to start investing. Even small, consistent contributions can add up to a significant nest egg over time.

- Develop Good Habits: Investing in your 20s ingrains responsible financial habits that will benefit you throughout your life.

Investment Strategies for 20-Somethings

Here are some investment strategies tailored for those in their 20s:

1. Prioritize Retirement Accounts:

Contribute to employer-sponsored retirement plans like 401(k)s, especially if your employer offers a matching contribution. It’s free money! If you don’t have access to a 401(k), consider opening an Individual Retirement Account (IRA).

2. Explore Low-Cost Index Funds:

Index funds are a great option for beginners as they offer diversification by tracking a specific market index, such as the S&P 500. They also tend to have lower fees compared to actively managed funds.

3. Consider a Roth IRA:

With a Roth IRA, you contribute after-tax dollars, but your withdrawals in retirement are tax-free. This can be advantageous for young adults who anticipate being in a higher tax bracket later in life.

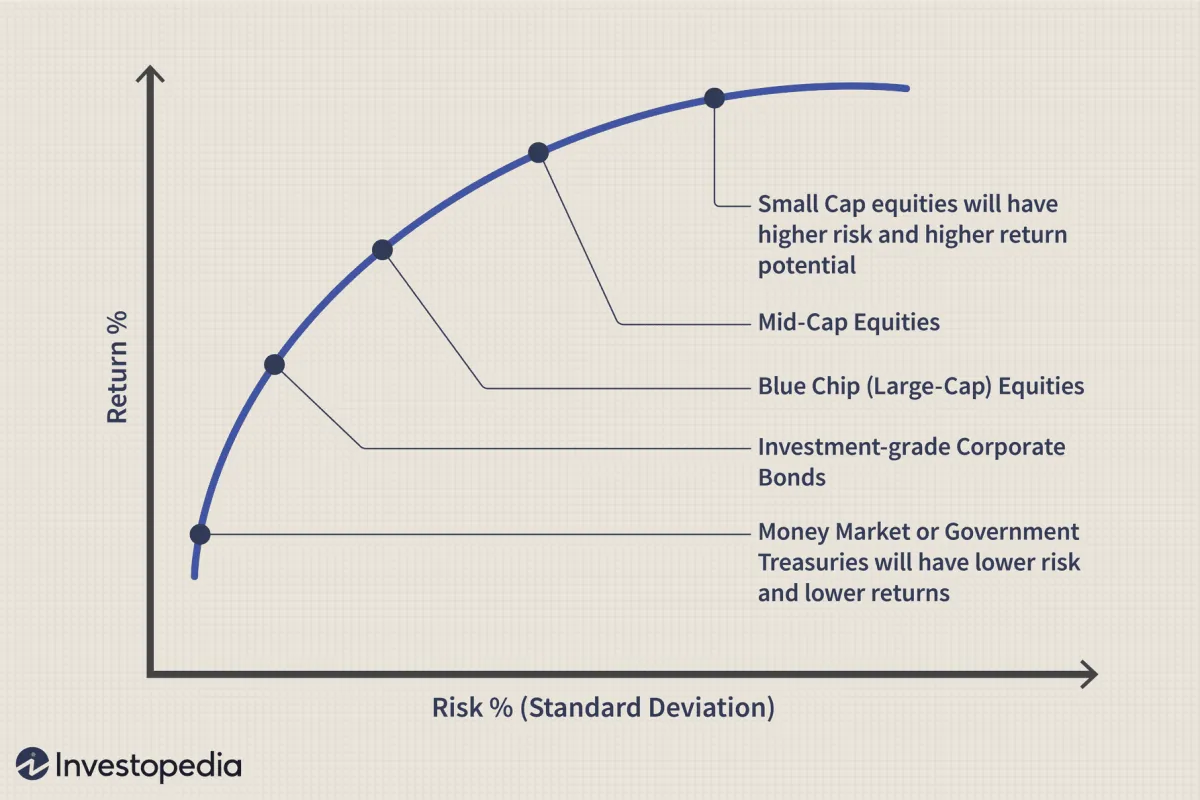

4. Don’t Shy Away from Risk:

In your 20s, you have a longer time horizon to recover from investment losses. Consider allocating a portion of your portfolio to higher-risk investments with potentially higher returns, such as stocks or growth-oriented mutual funds.

5. Automate Your Investments:

Set up automatic transfers from your checking account to your investment accounts. This “set it and forget it” approach ensures consistent investing and helps you avoid impulsive spending.

Investing in Your 30s

Your 30s are often a time of significant life changes – careers are solidifying, families might be growing, and homeownership may be on the horizon. These changes also signal a shift in financial priorities and investment strategies.

Time Horizon: You’re likely a couple of decades away from retirement, which means your investment time horizon is still relatively long. This allows you to take on more risk and focus on long-term growth.

Key Investment Considerations:

- Retirement Planning: While retirement might seem far off, your 30s are crucial for building a solid foundation. Increase retirement contributions if possible and consider diversifying your portfolio beyond employer-sponsored plans.

- Homeownership: Saving for a down payment on a home is a major financial goal for many in their 30s. Consider lower-risk investment options for these shorter-term savings goals.

- Education Fund: If you’re starting a family, saving for your children’s education becomes increasingly important. Explore tax-advantaged options like 529 plans.

- Investment Mix: Maintain a diversified portfolio with a focus on growth investments like stocks. However, balance this with more conservative options like bonds to mitigate risk.

Tips for Success:

- Emergency Fund: Ensure you have a robust emergency fund to cover 3-6 months of living expenses, especially as family responsibilities increase.

- Debt Management: Aggressively pay down high-interest debts like credit cards, as this can significantly impact your ability to save and invest.

- Regularly Review & Adjust: Your financial situation and goals are likely to evolve throughout your 30s. Regularly review your investments (at least annually) and make adjustments as needed to stay on track.

Investing in Your 40s

Your 40s are a time of significant financial transition. Careers are often well-established, you might have a family to support, and retirement is no longer a distant concept. This means your investment strategies should adapt to reflect these changes.

Key Considerations:

- Risk Tolerance: While you may still have a long time horizon until retirement, it’s generally wise to start shifting towards a more moderate risk tolerance. This doesn’t mean eliminating risk entirely, but rather finding a balance between growth potential and capital preservation.

- Retirement Savings: By your 40s, you should be aggressively saving for retirement. Take advantage of any employer-sponsored retirement plans and consider maximizing contributions to IRAs.

- Debt Management: Focus on paying down high-interest debts like credit cards. If you have a mortgage, consider making extra payments to shorten the loan term and save on interest.

- College Savings: If you have children and anticipate higher education expenses, explore options like 529 plans to save specifically for those costs.

Investment Options to Consider:

At this stage, a diversified portfolio remains crucial. Here are some specific investment avenues to consider:

- Growth and Income Stocks: Look for well-established companies with a history of dividend payments for a combination of growth and income potential.

- Real Estate: Whether it’s investing in rental properties or REITs (Real Estate Investment Trusts), real estate can provide diversification and potential long-term appreciation.

- Bonds: As you become more risk-averse, a portion of your portfolio should be allocated to bonds for their stability and income generation.

Investing in Your 50s and Beyond

As you enter your 50s and beyond, your investment strategies may need to shift. Retirement is no longer a distant concept, it’s fast approaching. Here’s what you need to consider:

Prioritizing Growth and Preservation

While still aiming for growth, your portfolio should also focus heavily on preserving the wealth you’ve accumulated. This means:

- Reducing Risk: Gradually shift towards a more conservative asset allocation. This might involve decreasing exposure to volatile assets like stocks and increasing allocations to more stable assets like bonds.

- Diversification is Key: Don’t put all your eggs in one basket. Diversify across different asset classes, sectors, and geographical regions to mitigate risk.

Retirement Planning Considerations

Retirement planning becomes paramount in this stage:

- Maximize Retirement Contributions: Take advantage of catch-up contributions allowed in many retirement plans if you haven’t already maximized annual limits.

- Estimate Retirement Expenses: Create a realistic budget for your retirement years, factoring in healthcare costs, travel, and lifestyle choices.

- Withdrawal Strategies: Consider consulting a financial advisor to develop a tax-efficient withdrawal plan for your retirement funds.

Estate Planning

Planning for the future also involves ensuring your estate is in order:

- Update Your Will: Make sure your will reflects your current wishes and is updated to include any life changes like marriage, divorce, or new children.

- Beneficiary Designations: Review and update beneficiary designations on your retirement accounts, insurance policies, and other financial products.

- Consider Long-Term Care: Investigate long-term care insurance options to protect your assets from potential future healthcare expenses.

Adjusting Your Portfolio Over Time

Building an investment portfolio isn’t a “set it and forget it” endeavor. As you navigate through life, your financial goals, risk tolerance, and time horizon will inevitably shift. What worked for you in your 20s might not be suitable in your 50s. Here’s why regularly adjusting your portfolio is crucial:

1. Changing Time Horizon:

Time is one of the most powerful factors in investing. When you’re younger and further from retirement, you have a longer time horizon to recover from market downturns. This allows you to take on more risk, potentially leading to higher returns over the long term. As you approach retirement, your time horizon shrinks, and preserving capital becomes a higher priority.

2. Shifting Risk Tolerance:

Your risk tolerance, or your comfort level with investment fluctuations, can change throughout your life. Major life events like job changes, home purchases, or starting a family can all influence your risk appetite. Regularly assessing your risk tolerance and making necessary portfolio adjustments ensures your investments remain aligned with your comfort level.

3. Evolving Financial Goals:

Your investment goals are not static. Early in your career, you might focus on growing wealth for a down payment or funding a child’s education. As you progress, your goals might shift towards retirement planning or leaving a legacy. Your portfolio should be structured to support the achievement of these evolving goals.

4. Market Fluctuations and Economic Conditions:

Market cycles are a reality of investing. Economic conditions, geopolitical events, and interest rate changes can all impact market performance. By staying informed and making periodic adjustments, you can position your portfolio to potentially benefit from favorable conditions and mitigate losses during downturns.

5. Rebalancing:

Over time, certain asset classes within your portfolio may outperform others, causing your original asset allocation to drift. Rebalancing involves selling a portion of your overperforming assets and reinvesting in underperforming ones. This disciplined approach helps you maintain your target asset allocation and manage risk.

Common Investment Pitfalls

Navigating the world of investing can be daunting, and even seasoned investors fall prey to common pitfalls. Understanding these pitfalls can help you make more informed decisions and avoid costly mistakes:

1. Lack of Diversification

Putting all your eggs in one basket, or concentrating your investments in a single asset or sector, significantly increases your risk. Diversifying your portfolio across different asset classes (stocks, bonds, real estate, etc.), sectors, and geographies can help mitigate losses and create a more resilient portfolio.

2. Emotional Investing

Letting fear or greed dictate your investment decisions can lead to impulsive buying or selling at the worst possible times. Market fluctuations are inevitable, and reacting emotionally can derail your long-term investment strategy. It’s important to make rational decisions based on your financial goals, risk tolerance, and thorough research.

3. Chasing Returns

Trying to chase the latest hot stock or investment trend can be tempting, but it often leads to buying high and selling low. Past performance is not indicative of future results, and chasing returns often results in buying into overvalued assets.

4. Ignoring Fees & Expenses

Investment fees and expenses, while seemingly small, can significantly erode your returns over time. Be mindful of expense ratios on mutual funds and ETFs, trading commissions, and advisory fees. It’s essential to compare costs and understand their impact on your overall investment growth.

5. Not Having a Plan

Investing without a clear plan is like setting sail without a destination. Defining your financial goals, risk tolerance, and investment timeline is crucial to developing a roadmap for your investments. A well-defined plan will guide your decisions and keep you focused on your long-term objectives.

Conclusion

Adapting investment strategies to different life stages is crucial for financial success. Whether starting out, raising a family, or planning retirement, diversification and risk tolerance should guide your approach to wealth building.