Managing irregular income can be challenging, but with the right financial tips, you can navigate this uncertainty effectively. Learn how to budget wisely, build an emergency fund, and prioritize expenses in our article on Top Financial Tips for Managing Irregular Income.

Understanding Irregular Income

Irregular income, whether from freelance work, seasonal employment, or commission-based sales, presents unique challenges for financial management. Unlike a steady paycheck, income can fluctuate significantly from month to month, making it difficult to budget, save, and plan for the future.

Key characteristics of irregular income include:

- Unpredictable cash flow: You might experience periods of high earnings followed by stretches of little to no income.

- Variable paychecks: The amount you earn each pay period can differ drastically, making it hard to anticipate expenses.

- Lack of benefits: Irregular income often comes without employer-provided benefits like health insurance or retirement contributions, requiring you to secure and finance them independently.

Understanding the nature of irregular income is the first step toward effective financial management. By acknowledging the inherent unpredictability and variability, you can start implementing strategies to smooth out cash flow, build financial stability, and achieve your long-term financial goals.

Creating a Flexible Budget

Irregular income can make budgeting a real challenge. A traditional budget with fixed income and expenses might not cut it. Instead, you need a flexible budget that adapts to your income fluctuations.

Here’s how to create one:

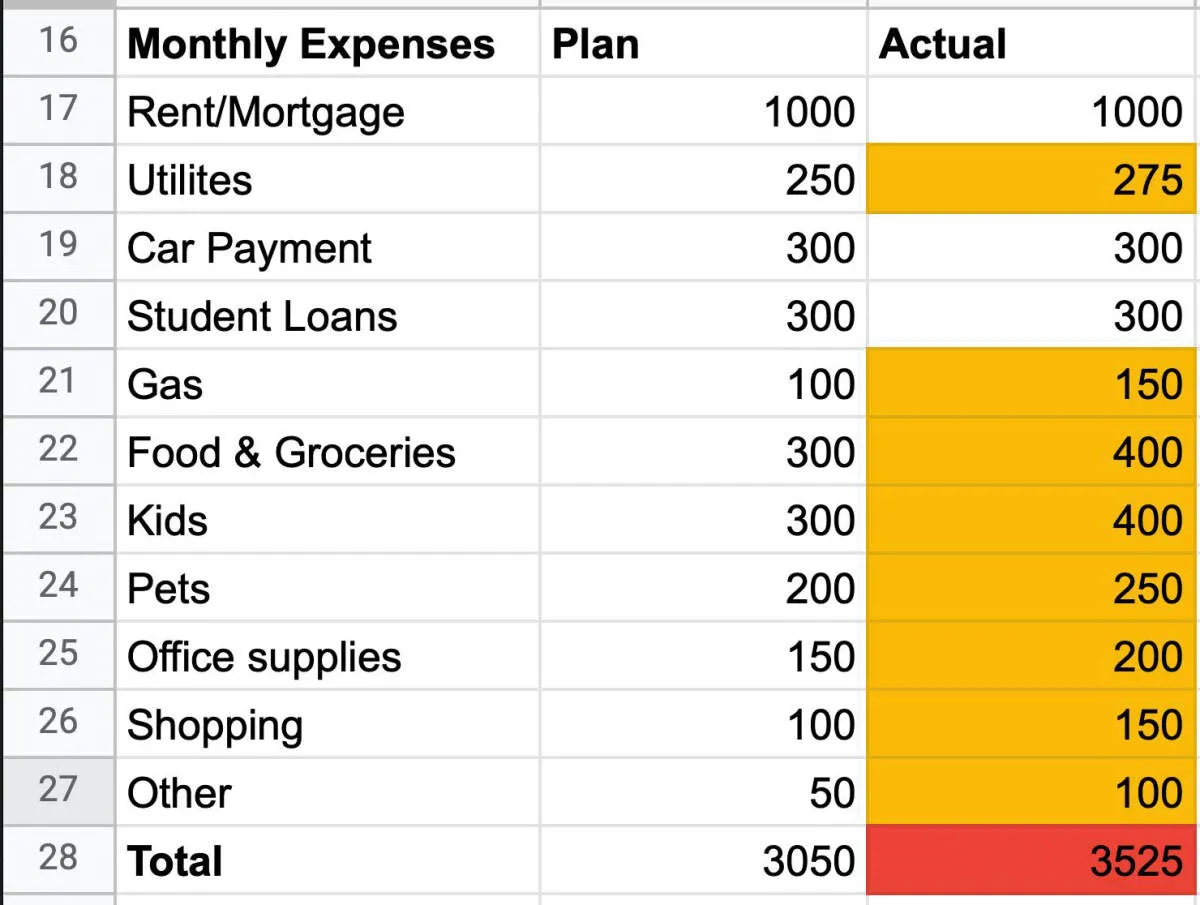

1. Identify Your Essential Expenses

Start by listing all your essential monthly expenses – housing, utilities, groceries, transportation, debt payments, and a minimum amount for savings. These are non-negotiable costs you need to cover every month.

2. Calculate Your Income Floor

Determine the minimum income you receive in any given month. This is your “income floor.” Your flexible budget should ensure that your essential expenses are always covered by this minimum income.

3. Categorize Remaining Expenses

After covering essential expenses, categorize your remaining spending into “wants” and “needs.” Needs might include things like clothing replacements or car maintenance, while wants are discretionary expenses like dining out, entertainment, or hobbies.

4. Prioritize Spending Based on Income

In months with higher income, you can allocate more towards your “needs” and even some “wants.” When income is lower, prioritize essential expenses and cut back on the “wants” category.

5. Track Your Income and Expenses

Use a budgeting app, spreadsheet, or even a simple notebook to diligently track where your money is going. This will help you adjust your spending in real-time based on your income fluctuations.

6. Build an Emergency Fund

Having an emergency fund is crucial when you have irregular income. Aim for 3-6 months’ worth of essential expenses. This safety net will provide peace of mind and financial security during lean months.

Building an Emergency Fund

When your income fluctuates, having a safety net is even more crucial. An emergency fund can be a lifesaver during dry spells, unexpected expenses, or income dips.

Here’s how to build one:

- Set a realistic savings goal: Aim for at least 3-6 months’ worth of living expenses. This may seem daunting, but start small and gradually increase your savings over time.

- Automate your savings: Set up automatic transfers from your checking account to your savings account each month, even if it’s a small amount.

- Supplement your income with side hustles: Utilize your skills for freelance work, gig economy opportunities, or part-time jobs to boost your savings.

- Cut back on non-essential expenses: Identify areas where you can reduce spending and redirect those funds to your emergency fund.

Planning for Tax Obligations

Irregular income can make tax planning feel like navigating a minefield, but with a little foresight, you can avoid nasty surprises come tax time. Here’s how:

1. Understand Your Tax Obligations

Freelancers, contractors, and those with multiple income streams often face different tax requirements than salaried employees. It’s crucial to understand:

- Your tax bracket: As your income fluctuates, so might your tax rate.

- Estimated taxes: You’ll likely need to make quarterly tax payments to avoid penalties.

- Deductible expenses: Keep meticulous records of business expenses to maximize deductions and lower your tax liability.

2. Set Aside Money for Taxes

Resist the temptation to spend all your income as it arrives. A good rule of thumb is to set aside 25-30% of each paycheck for taxes. This creates a safety net to cover your tax obligations, even during lean months.

3. Leverage Tax-Advantaged Accounts

Contribute to retirement accounts like IRAs and SEP-IRAs to reduce your taxable income and build a financial cushion for the future. These accounts offer tax benefits that can be particularly advantageous for those with unpredictable income.

4. Seek Professional Guidance

Tax laws can be complex and confusing. Consulting with a tax professional can provide personalized advice, ensure you’re taking advantage of all eligible deductions, and help you avoid costly mistakes.

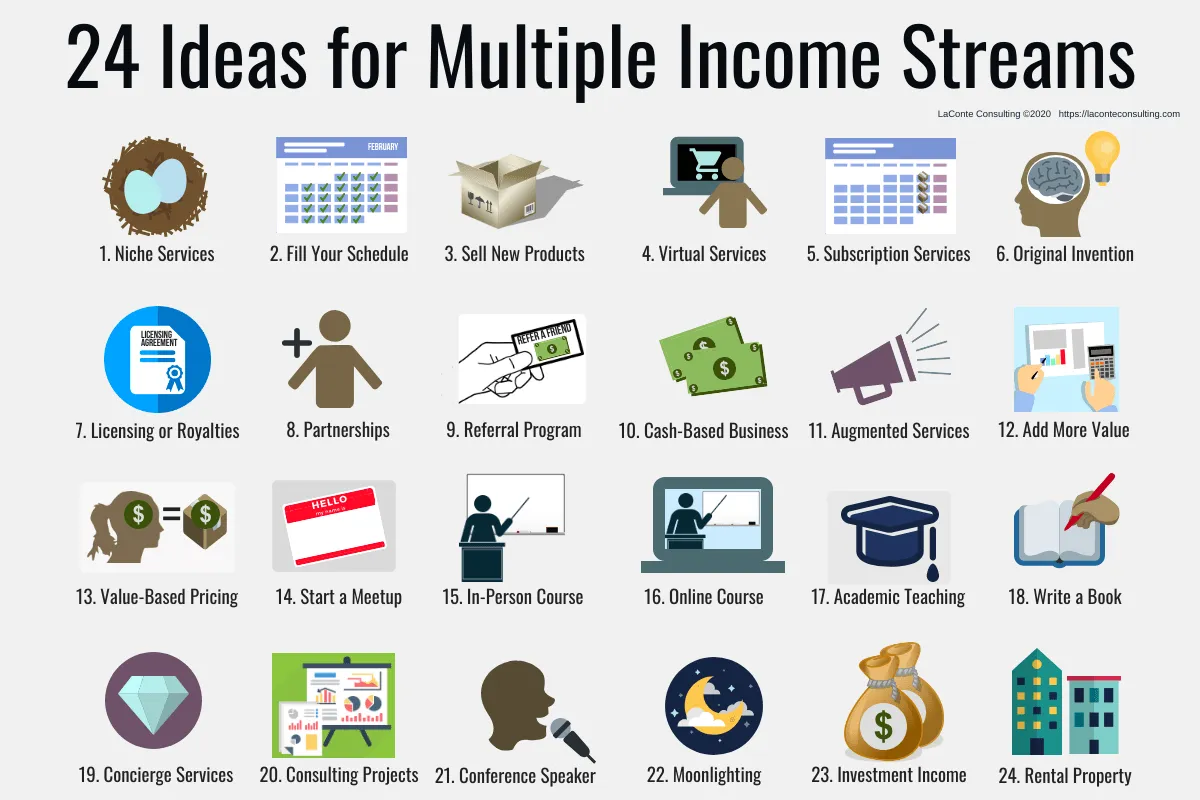

Finding Additional Income Streams

Irregular income can make budgeting and financial planning a challenge, but one way to mitigate this is by creating additional income streams. These don’t have to be full-time jobs; even small amounts can make a big difference. Here are some ideas:

Freelancing:

Offer your skills in writing, editing, graphic design, web development, virtual assistance, or any other area where you excel. Platforms like Upwork, Fiverr, and Guru connect freelancers with potential clients.

Gig Economy:

Consider joining the gig economy by driving for ride-sharing services, delivering food or groceries, or completing tasks through platforms like TaskRabbit.

Selling Goods Online:

If you create crafts, artwork, or other physical products, consider selling them through platforms like Etsy or Shopify. You can also sell unwanted items through platforms like eBay or Facebook Marketplace.

Teaching or Tutoring:

Share your knowledge and skills by offering online or in-person tutoring services. Platforms like TutorMe and Skooli connect tutors with students.

Renting Assets:

If you have a spare room, parking space, or even tools, consider renting them out for additional income. Platforms like Airbnb and Neighbor make it easy to find renters.

Reviewing and Adjusting Your Finances

Managing irregular income requires a keen eye on your finances and the ability to adapt to changing circumstances. Regularly reviewing and adjusting your budget is crucial to staying afloat and achieving your financial goals.

Track Your Income and Expenses

Start by meticulously tracking your income and expenses. Utilize budgeting apps, spreadsheets, or even a simple notebook to record all sources of income and every expense you incur. Categorize your spending to identify areas where you can potentially cut back.

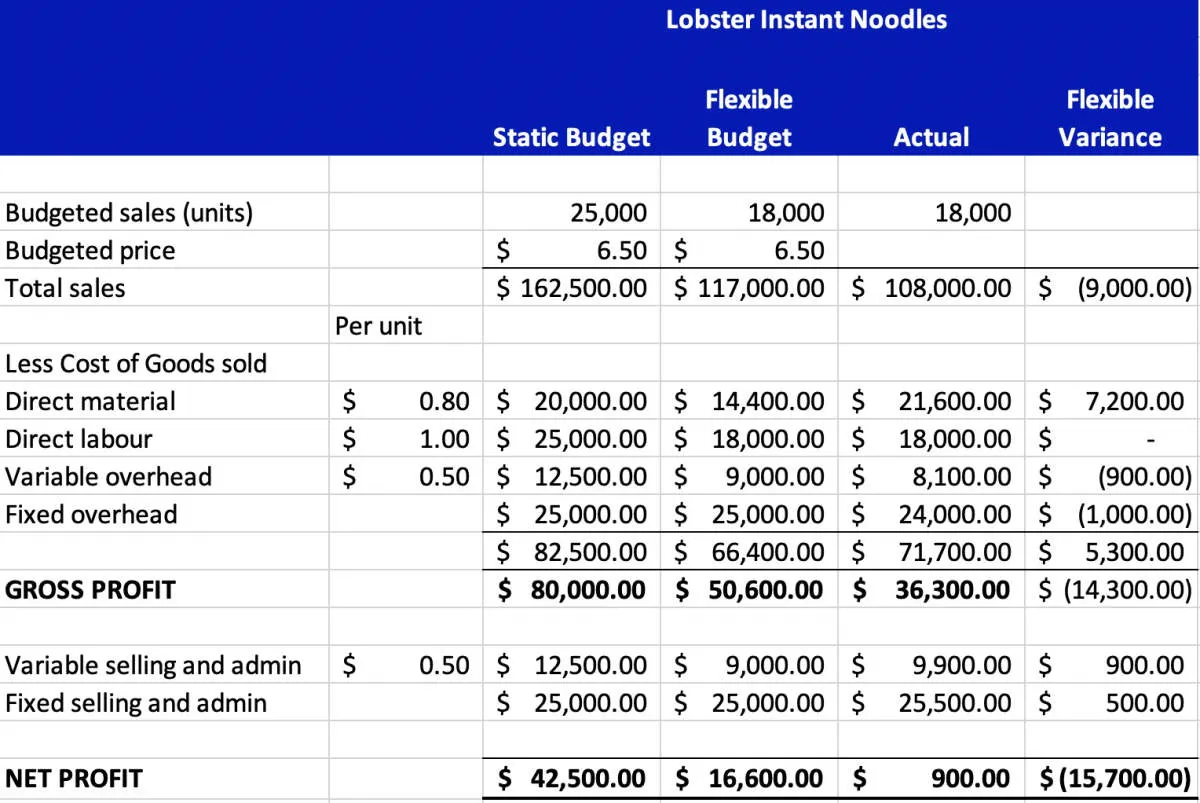

Create a Flexible Budget

Ditch the traditional static budget and embrace a more flexible approach. Instead of allocating fixed amounts to each category, determine a percentage-based budget. For example, allocate 50% of your income to necessities, 30% to discretionary spending, and 20% to savings and debt repayment. This way, your budget automatically adjusts based on your income fluctuations.

Prioritize Essential Expenses

When income is inconsistent, prioritize essential expenses such as housing, utilities, food, and transportation. Identify areas where you can reduce discretionary spending, such as dining out, entertainment, and non-essential shopping.

Build an Emergency Fund

An emergency fund is crucial for everyone, but it’s even more critical for individuals with irregular income. Aim to save at least 3-6 months’ worth of living expenses in a readily accessible account. This fund acts as a financial safety net during lean periods.

Explore Additional Income Streams

Consider diversifying your income by exploring additional income streams. This could involve freelancing, part-time work, or starting a side hustle. Multiple income sources can provide greater financial stability and peace of mind.

Regularly Review and Adjust

Don’t fall into the trap of creating a budget and forgetting about it. Make it a habit to review your finances at least monthly, or more frequently if needed. Analyze your income and expenses, identify any areas for improvement, and adjust your budget accordingly.

Conclusion

In conclusion, adapting a flexible budget, building an emergency fund, and diversifying income streams are key strategies for managing irregular income effectively.