Learn how to achieve financial freedom with our guide on creating multiple passive income streams to build long-term wealth effortlessly.

Understanding Passive Income

Passive income is often touted as the holy grail of personal finance, and for good reason. It represents the enticing idea of earning money without actively trading your time for it. But what exactly is passive income, and how does it differ from traditional employment?

In essence, passive income is money generated from assets you own or control, requiring minimal effort to maintain. It’s about putting in the work upfront to build or acquire an income-generating asset that continues to work for you, even while you sleep, travel, or pursue other endeavors.

Here are some key characteristics of passive income:

- Reduced Time Commitment: Unlike a traditional job, passive income streams often require minimal ongoing effort once established. This doesn’t mean they’re entirely “hands-off,” but the time investment is significantly less.

- Scalability: Passive income models often have the potential to scale. Once you have a successful model, you can replicate and expand it to generate increasing returns.

- Flexibility and Freedom: By generating income independent of your time, passive income can provide greater flexibility and freedom to pursue your passions, spend time with loved ones, or simply enjoy life on your own terms.

However, it’s crucial to understand that passive income isn’t about getting rich quick. It often requires upfront work, investment, and patience to build sustainable streams of income.

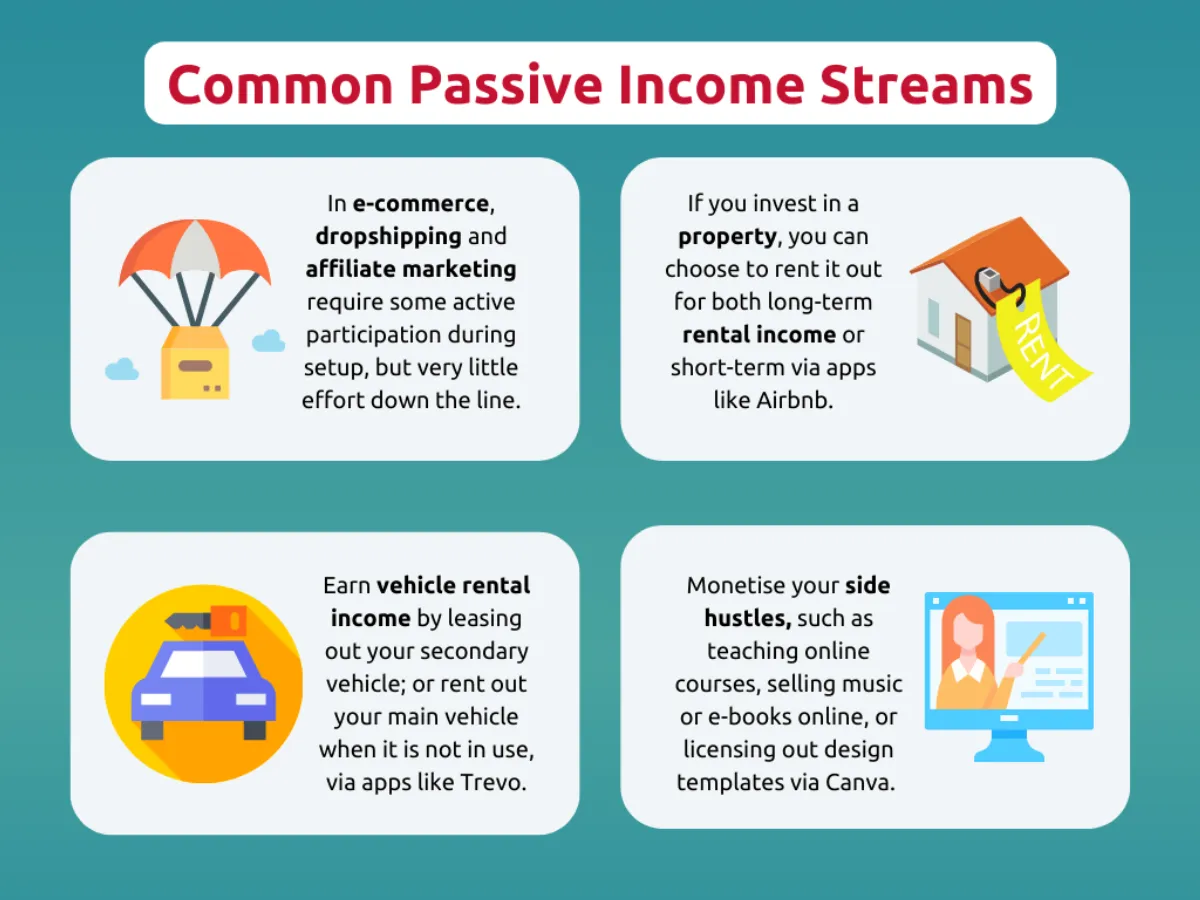

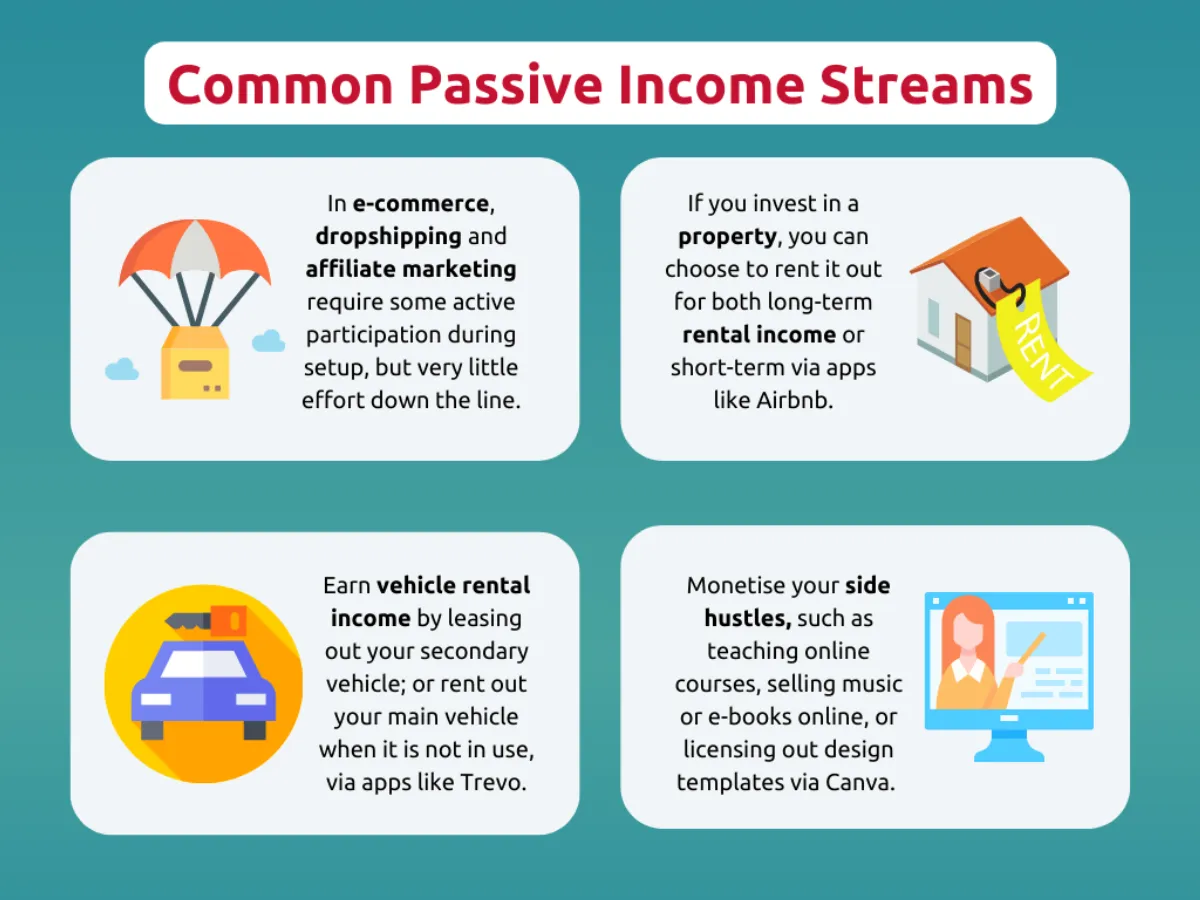

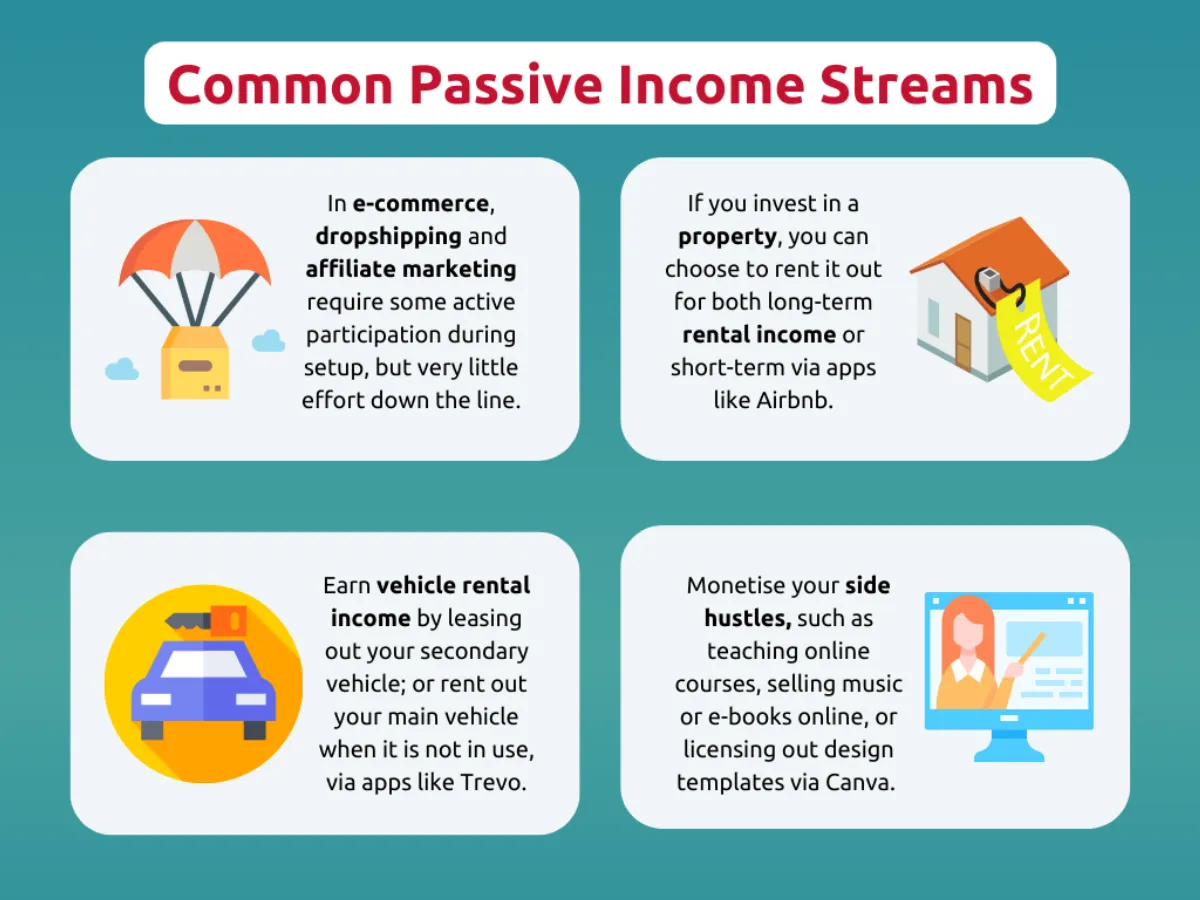

Types of Passive Income Streams

There are many different types of passive income streams, but some of the most popular include:

1. Dividend Income

When you buy stocks in a company that pays dividends, you’re essentially getting paid a portion of the company’s profits simply for being a shareholder. This can be a great way to generate passive income, as you’ll continue to receive payments as long as the company continues to pay dividends.

2. Rental Income

If you own property, you can rent it out to tenants and collect monthly rent payments. This can be a great way to generate passive income, as you’ll continue to receive payments as long as the property is occupied. However, it’s important to factor in the costs of owning and managing a rental property, such as mortgage payments, property taxes, and repairs.

3. Affiliate Marketing

Affiliate marketing is a performance-based marketing model in which a business rewards one or more affiliates for each visitor or customer brought about by the affiliate’s own marketing efforts. Essentially, you promote other people’s products or services and earn a commission on any sales that you generate.

4. Online Courses and Digital Products

If you have expertise in a particular area, you can create and sell online courses or digital products. This can be a great way to generate passive income, as you’ll continue to earn money every time someone purchases your product. The beauty of digital products is that once created, they can be sold repeatedly without incurring additional production costs.

5. Creating and Selling E-books

Similar to online courses, e-books allow you to share your knowledge or creative work with a potentially vast audience. Once the e-book is written, edited, and formatted, the sales process can be largely automated, making it a potential source of passive income.

Creating a Passive Income Plan

Building wealth through passive income requires a strategic approach. It’s not about stumbling upon a lucky opportunity but about crafting a plan that aligns with your financial goals and resources.

Here’s how to create a solid passive income plan:

1. Define Your Financial Goals

What are you hoping to achieve with passive income? Do you want to achieve financial independence, supplement your primary income, or save for a specific goal like retirement or a down payment? Clearly defined goals will guide your strategy and help you stay motivated.

2. Assess Your Resources

Passive income streams often require an initial investment of time, money, or both. Evaluate your current financial situation, available capital, and skills you can leverage. This analysis will help you identify suitable passive income opportunities.

3. Explore Passive Income Ideas

Research and explore various passive income streams that align with your interests, skills, and resources. Consider options like:

- Affiliate marketing

- Online courses and digital products

- Real estate investing (e.g., rental properties, REITs)

- Dividend-paying stocks

- Creating and selling digital assets (e.g., stock photos, templates)

4. Select Your Streams

Don’t feel pressured to pursue every passive income opportunity. Choose one or two streams to focus on initially. As you gain experience and resources, you can diversify your income streams further.

5. Create a Detailed Action Plan

Break down each chosen passive income stream into actionable steps. For example, if you’re pursuing affiliate marketing, your plan might include:

- Researching profitable niches

- Building a website or social media presence

- Choosing affiliate products to promote

- Creating high-quality content

- Driving traffic to your platform

6. Set Realistic Expectations

Building sustainable passive income takes time and effort, especially in the beginning. Be patient and consistent with your efforts. Don’t get discouraged if you don’t see immediate results.

7. Track Your Progress and Adjust

Regularly monitor the performance of your chosen passive income streams. Analyze what’s working, what’s not, and be willing to adjust your strategies as needed to optimize your results.

Investing in Real Estate

Real estate has long been considered a reliable avenue for building wealth, and it offers various opportunities to generate passive income. Here are a few popular approaches:

1. Rental Properties:

Owning and renting out residential or commercial properties can provide a consistent stream of passive income. As tenants pay rent, you collect a portion as profit after covering expenses like mortgages, property taxes, and maintenance.

2. REITs (Real Estate Investment Trusts):

REITs allow you to invest in real estate without directly owning properties. These companies own and manage income-generating real estate, such as shopping malls, apartments, or office buildings. By investing in REITs, you can earn dividends from the rental income generated by the properties.

3. Real Estate Crowdfunding:

Online platforms dedicated to real estate crowdfunding pool money from multiple investors to fund property projects. This approach offers a lower barrier to entry compared to traditional real estate investing and allows for diversification across different properties or locations.

4. House Hacking:

House hacking involves buying a multi-unit property and living in one unit while renting out the others. The rental income from the other units can help cover your mortgage payments and other expenses, potentially allowing you to live rent-free or even generate positive cash flow.

5. Short-Term Rentals:

Platforms like Airbnb have made it easier to generate income by renting out properties on a short-term basis. If you own a property in a desirable location, you can leverage this platform to earn higher rental income compared to traditional long-term rentals.

Important Considerations for Real Estate Investing:

- Market Research: Thoroughly research the real estate market, including property values, rental demand, and local regulations.

- Property Management: Consider the time and effort required for property management or explore hiring a property manager to handle tenant issues, maintenance, and rent collection.

- Financing Options: Understand different financing options available for real estate investments, including mortgages and loans.

- Risk Assessment: Real estate investments come with risks, such as market fluctuations, property damage, or non-paying tenants. Assess your risk tolerance and invest accordingly.

Generating Income from Investments

One of the most reliable ways to build passive income streams is through smart investing. By putting your money to work in various asset classes, you can generate a steady flow of income without actively trading your time for money. Here are some popular investment avenues to consider:

1. Dividend Stocks

Investing in dividend-paying stocks allows you to earn a portion of a company’s profits simply by holding shares. As companies grow and become more profitable, they often distribute dividends to shareholders, providing a consistent income stream. Look for established companies with a solid track record of dividend payments.

2. Real Estate Investment Trusts (REITs)

REITs are companies that own, operate, or finance income-generating real estate. By investing in REITs, you can gain exposure to the real estate market without directly owning properties. REITs typically distribute a significant portion of their rental income as dividends, making them an attractive option for passive income.

3. Bonds

Bonds are debt securities issued by corporations or governments. When you invest in bonds, you are essentially lending money to the issuer in exchange for regular interest payments and the return of your principal at maturity. Bonds offer a relatively stable income stream compared to stocks, making them suitable for risk-averse investors.

4. Peer-to-Peer (P2P) Lending

P2P lending platforms connect borrowers directly with individual investors, allowing you to earn interest by funding personal or business loans. While potentially offering higher returns than traditional investments, P2P lending carries a higher risk as you are exposed to the creditworthiness of individual borrowers.

5. Index Funds and ETFs

Investing in low-cost index funds and exchange-traded funds (ETFs) that track broad market indices, such as the S&P 500, can provide long-term growth and dividend income. These funds offer instant diversification and typically have lower expense ratios compared to actively managed mutual funds.

Monitoring and Growing Your Passive Income

Building wealth through passive income is not a “set it and forget it” endeavor. While the goal is to generate income with minimal effort, effectively growing your passive income streams requires ongoing monitoring and strategic adjustments.

Track Your Progress

Regularly track the performance of your passive income sources. Keep a detailed record of:

- Income generated from each stream.

- Expenses associated with maintaining each stream.

- Time invested in managing each stream.

This data will provide valuable insights into which streams are most profitable and identify areas for improvement.

Analyze and Optimize

Don’t be afraid to analyze your data and make changes as needed. Consider:

- Can you reduce expenses associated with a particular stream?

- Are there ways to improve the performance of an underperforming asset?

- Is it time to diversify into new passive income streams?

Reinvest Your Earnings

One of the most effective ways to grow your passive income is to reinvest your earnings. Use the profits generated from your existing streams to expand into new opportunities or scale up existing ones. This compounding effect can significantly accelerate your wealth-building journey.

Stay Informed

The world of passive income is constantly evolving. Stay informed about new opportunities, market trends, and potential challenges. Continuously learning and adapting your strategies will be crucial for long-term success in growing your passive income streams.

Conclusion

In conclusion, diversifying passive income streams is a key strategy to build sustainable wealth over time, providing financial security and freedom.