Are you new to the world of investing and interested in renewable energy? This guide for beginners will explore the numerous investment opportunities available in the growing sector of renewable energy.

Importance of Renewable Energy

Renewable energy, often referred to as clean energy, harnesses the power of naturally replenishing sources like sunlight, wind, water, and geothermal heat. Unlike fossil fuels, these resources are virtually inexhaustible and their utilization carries profound environmental and economic benefits.

Environmental Advantages

The most compelling reason to embrace renewable energy lies in its potential to mitigate the pressing issue of climate change. Burning fossil fuels releases greenhouse gases into the atmosphere, trapping heat and driving global warming. Renewable energy sources, on the other hand, produce little to no greenhouse gas emissions during operation, making them a cornerstone of global efforts to combat climate change.

Furthermore, renewable energy technologies generally have a much smaller environmental footprint compared to conventional power plants. They require less water for cooling, produce no air pollutants, and contribute less to land degradation associated with mining and extraction activities.

Economic Benefits

Beyond the environmental advantages, renewable energy offers significant economic opportunities. The transition to a clean energy economy is creating jobs in manufacturing, installation, maintenance, and research and development. As renewable energy technologies mature, they become increasingly cost-competitive with fossil fuels, offering consumers and businesses a stable and often more affordable source of power.

Investing in renewable energy also enhances energy security and reduces dependence on volatile global fossil fuel markets. By diversifying energy sources and promoting domestic renewable energy production, countries can strengthen their energy independence and resilience.

Types of Renewable Energy Investments

Investing in renewable energy doesn’t mean putting all your eggs in one basket. There are various avenues to explore, each with its own risk profile and potential returns. Here are some key types of renewable energy investments:

1. Direct Investments

This involves buying physical assets like solar panels for your home or investing in the development of a wind farm. Direct investments require more upfront capital and often involve a longer time horizon, but they can offer significant control and potentially higher returns.

a. Residential Renewable Energy Systems

Investing in solar panels, wind turbines, or geothermal heat pumps for your own home can reduce your energy bills and offer a solid return on investment over time.

b. Commercial and Utility-Scale Projects

Investing in larger-scale renewable energy projects, like solar or wind farms, can provide substantial returns. This often involves partnering with developers or investing in specialized funds.

2. Indirect Investments

If you’re looking for more diversified exposure to renewable energy, indirect investments offer a good option. These often require less capital and can be more liquid.

a. Renewable Energy Stocks

Investing in companies that manufacture renewable energy equipment (like solar panel manufacturers) or companies that operate renewable energy projects is a popular option.

b. Renewable Energy Funds

Mutual funds and ETFs focused on renewable energy companies provide a diversified way to invest in the sector. These funds pool money from multiple investors to invest in a basket of renewable energy stocks.

c. Green Bonds

These fixed-income securities finance specific renewable energy projects. Investors lend money to a project developer in exchange for regular interest payments and the return of their principal investment at maturity.

3. Community-Based Investments

Community-owned renewable energy projects allow individuals to invest in local initiatives and have a direct impact on their community’s transition to cleaner energy sources.

Benefits of Investing in Renewable Energy

Investing in renewable energy is no longer just an ethical choice, it’s a smart financial one. As the world transitions to a more sustainable future, the renewable energy sector presents a wealth of compelling benefits for investors of all levels:

1. High Growth Potential

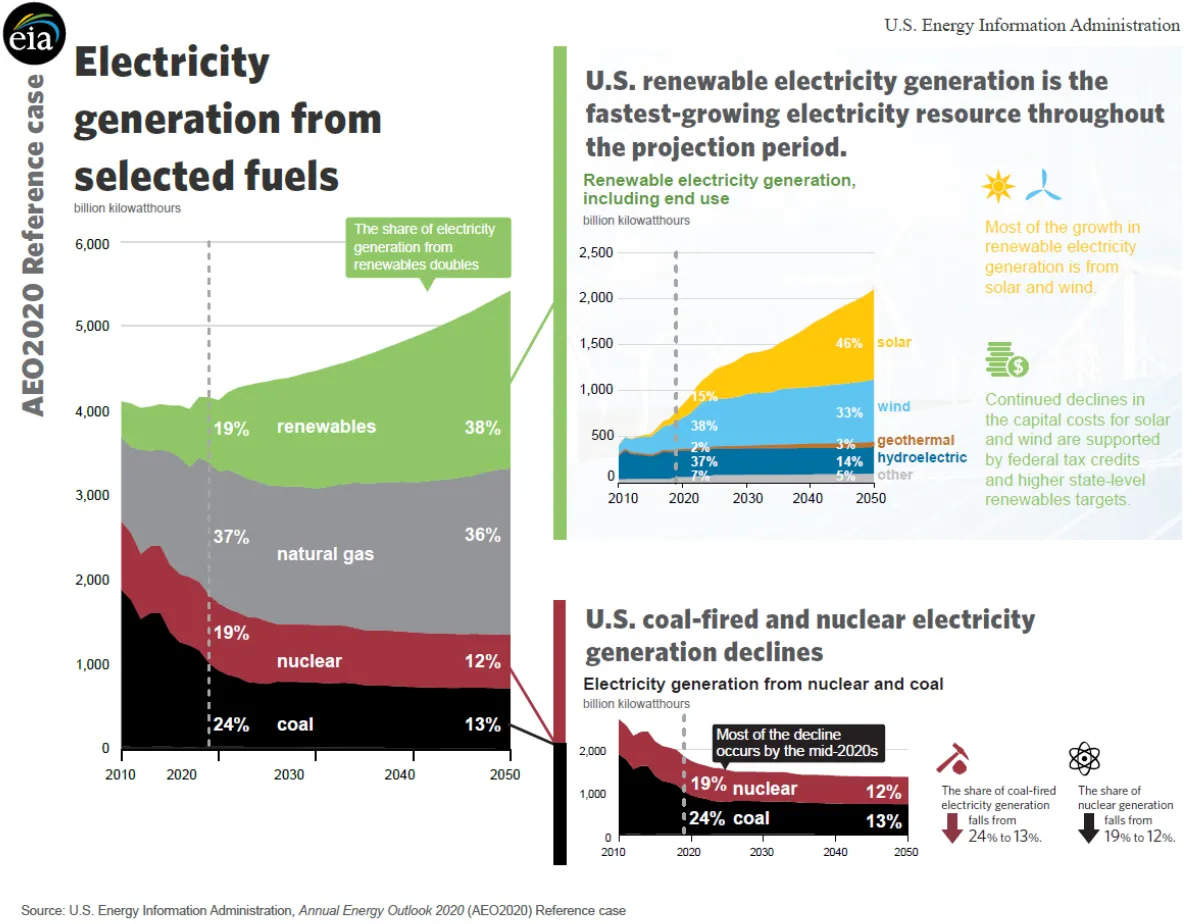

The renewable energy market is experiencing exponential growth. Driven by government incentives, declining technology costs, and increasing demand, this sector offers substantial potential for high returns. Early investors stand to benefit significantly from this upward trajectory.

2. Stable, Long-Term Returns

Unlike fossil fuels, which are subject to price volatility, renewable energy sources like solar and wind are virtually free after the initial investment. This predictable cost structure translates into stable, long-term returns for investors, providing a secure income stream for years to come.

3. Diversification and Portfolio Stability

Adding renewable energy investments to your portfolio can reduce overall risk. As a distinct asset class, renewable energy often performs independently of traditional markets, offering a hedge against volatility and enhancing the stability of your investment portfolio.

4. Environmental Impact

Investing in renewable energy directly supports the fight against climate change. By supporting companies and projects that reduce carbon emissions and promote sustainability, you can align your investments with your values and contribute to a greener future.

5. Energy Independence

Renewable energy sources are domestically abundant. Investing in these technologies reduces dependence on foreign energy sources, bolstering energy security and supporting local economies.

Assessing Risks and Rewards

Investing in renewable energy, like any investment, requires a careful evaluation of potential risks and rewards. While the sector presents promising opportunities, it’s crucial to understand both sides of the coin before making informed decisions.

Risks to Consider:

- Policy and Regulation Changes: Government incentives and regulations play a significant role in renewable energy profitability. Changes to these policies can impact returns on investment.

- Technology Risk: The renewable energy sector is constantly evolving. New technologies might emerge and potentially outpace existing ones, affecting the long-term viability of certain investments.

- Project Development and Execution Risks: Renewable energy projects, particularly large-scale ones, can face delays and cost overruns due to permitting, construction, or grid connection challenges.

- Competition and Market Volatility: As the renewable energy sector expands, competition among companies increases. Fluctuations in energy prices and demand can also influence profitability.

Potential Rewards:

- Long-Term Growth Potential: The global shift towards sustainable energy solutions signals a significant long-term growth trajectory for the renewable energy sector.

- Stable Returns: Once operational, many renewable energy projects generate predictable cash flows through long-term power purchase agreements, offering relatively stable returns compared to other investment assets.

- Environmental and Social Impact: Investing in renewable energy contributes to environmental sustainability by reducing carbon emissions and promoting a cleaner future.

- Portfolio Diversification: Including renewable energy assets in an investment portfolio can offer diversification benefits, potentially reducing overall portfolio risk.

Finding Investment Opportunities

Now that you understand the basics of renewable energy investing, where do you actually find these opportunities? There are a few main avenues:

1. Public Markets

You can invest in renewable energy companies just like any other publicly traded company, through:

- Individual Stocks: Research and purchase shares of companies specializing in renewable energy technology, project development, or operation.

- Exchange-Traded Funds (ETFs): These diversified funds track a basket of renewable energy stocks, offering broader exposure to the sector.

- Mutual Funds: Similar to ETFs, mutual funds pool investor money to invest in a portfolio of renewable energy companies.

2. Private Markets

These investments typically require larger sums and may have less liquidity, but also offer potentially higher returns:

- Private Equity Funds: These funds pool capital from accredited investors to invest directly in private renewable energy companies or projects.

- Venture Capital Funds: Focus on early-stage, high-growth renewable energy technology startups.

- Direct Investment: Invest directly in a renewable energy project, like a solar farm or wind turbine, potentially through a partnership or by providing debt financing.

3. Other Options

- Green Bonds: Fixed-income securities specifically used to finance climate-friendly projects, including renewable energy.

- Crowdfunding Platforms: Some platforms connect investors with smaller-scale renewable energy projects seeking funding.

- Community Solar Projects: Subscribe to a shared solar installation and receive credits on your electricity bill.

Research and Due Diligence

Regardless of your chosen investment path, thorough research is crucial. Consider the company’s financials, management team, technology, regulatory environment, and the overall market outlook for the specific renewable energy sub-sector. Consulting with a financial advisor experienced in renewable energy investments is highly recommended.

Long-Term Outlook for Renewable Energy

The future is bright for renewable energy. As concerns about climate change and energy security grow, the global shift towards sustainable energy sources continues to accelerate. This transition is driven by several key factors that paint a positive long-term outlook for the renewable energy sector:

Declining Costs:

Technological advancements and economies of scale have drastically reduced the cost of renewable energy technologies like solar and wind power. In many parts of the world, they are now cost-competitive with or even cheaper than fossil fuels, making them an increasingly attractive investment.

Government Support and Policies:

Governments worldwide are implementing supportive policies, including financial incentives, tax breaks, and renewable energy targets, to encourage the development and adoption of clean energy solutions. This policy landscape provides a favorable environment for long-term investment in the sector.

Increasing Demand:

As populations grow and developing economies expand, global energy demand is expected to rise significantly. Renewable energy sources are well-positioned to meet this growing demand, offering a sustainable and scalable solution to future energy needs.

Technological Advancements:

Ongoing innovation in renewable energy technologies, such as energy storage solutions and smart grid systems, is further enhancing the efficiency, reliability, and affordability of these energy sources. These advancements will continue to drive growth and unlock new opportunities in the renewable energy sector.

Corporate Sustainability Commitments:

Many leading companies are making ambitious commitments to reduce their carbon footprint and transition to renewable energy sources. This corporate demand for clean energy is creating a significant market for renewable energy investments and further accelerating the shift towards a sustainable future.

Conclusion

Investing in renewable energy offers sustainable growth potential for beginners seeking ethical and profitable opportunities in the evolving energy sector.