As a freelancer, ensuring financial stability and growth requires strategic planning. Learn essential tips on managing finances effectively to achieve long-term success in your freelance career.

Creating a Freelance Budget

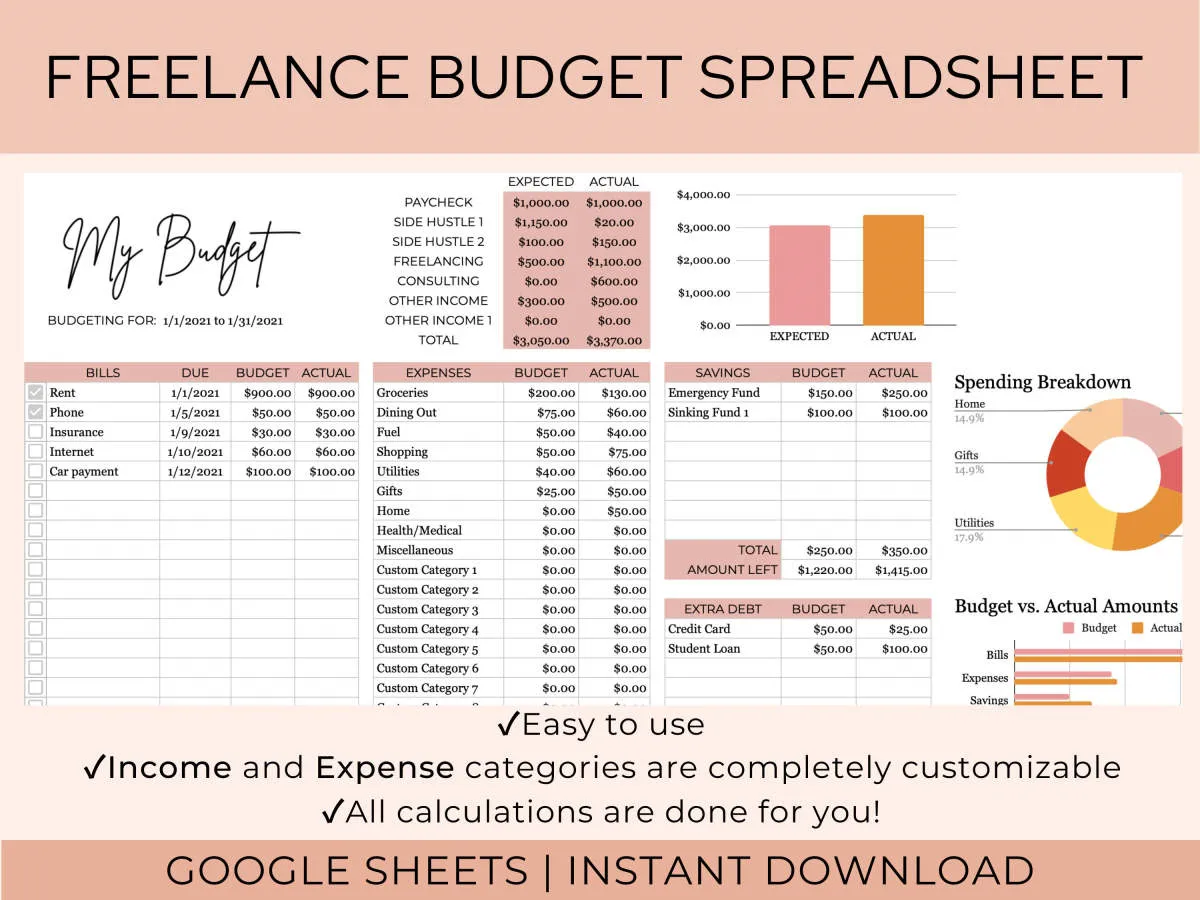

Creating a budget is a crucial first step in taking control of your freelance finances. It provides a clear picture of your income and expenses, enabling informed financial decisions. Here’s a step-by-step guide to building your freelance budget:

1. Track Your Income and Expenses

Start by monitoring your income and expenses diligently. Maintain a spreadsheet or utilize budgeting apps to record all sources of income and categorize your expenses. Track for a few months to get a realistic understanding of your financial inflows and outflows.

2. Differentiate Between Business and Personal Expenses

It’s essential to separate your business and personal expenses. This distinction helps in accurately assessing your freelance business’s profitability and simplifies tax filing. Maintain separate accounts or use clear labeling in your budgeting tools.

3. Identify Fixed and Variable Costs

Categorize your expenses into fixed and variable costs. Fixed costs remain relatively stable, such as rent or software subscriptions, while variable costs fluctuate, including travel or project-specific supplies. This categorization helps anticipate future expenses and adjust your budget accordingly.

4. Set Financial Goals

Define your short-term and long-term financial goals. Whether saving for taxes, investing, or planning for retirement, clear goals give your budget direction and motivate you to stick to it.

5. Determine Your Hourly Rate or Project Pricing

Based on your income needs and expense tracking, determine your hourly rate or project pricing. Ensure your rates align with your experience, industry standards, and allow for profit margins after deducting expenses.

6. Build Emergency Funds and Tax Savings

As a freelancer, prioritize saving for unpredictable circumstances. Aim to build an emergency fund covering 3-6 months of living expenses. Additionally, set aside money regularly for taxes as you’ll be responsible for paying self-employment and income taxes.

7. Review and Adjust Regularly

Your freelance budget is a dynamic tool. Review it regularly, ideally monthly or quarterly, and adjust based on changes in income, expenses, or financial goals. This consistent monitoring ensures your budget remains relevant and effective in supporting your freelance career.

Managing Irregular Income

One of the most significant challenges freelancers face is the irregularity of income. Unlike traditional employment with steady paychecks, your income can fluctuate significantly from month to month. This can make budgeting and financial planning seem daunting, but with the right strategies, you can achieve financial stability and even thrive.

1. Create a Realistic Budget:

Forget fixed monthly budgets. Embrace a flexible approach. Instead of budgeting for a specific income, budget for your essential expenses first. Determine your non-negotiable costs like rent/mortgage, utilities, groceries, and debt payments. This forms your “bare bones” budget. Any income exceeding this can be allocated to savings, discretionary spending, or irregular expenses.

2. Build an Emergency Fund:

An emergency fund is even more critical for freelancers. Aim for at least 3-6 months’ worth of living expenses in a readily accessible account. This cushion provides a safety net during lean months or unexpected events, like a medical emergency or a sudden dry spell in work.

3. Track Your Income and Expenses:

Diligently track every dollar coming in and going out. Numerous budgeting apps and spreadsheets can help you categorize and visualize your cash flow. Understanding your spending patterns is crucial for identifying areas where you can cut back during slower months and maximize savings during busier periods.

4. Smooth Out Income Fluctuations:

Consider setting aside a portion of your income during high-earning months into a separate “tax account” or a savings account specifically for taxes. This way, you won’t be caught off guard when tax season arrives. Additionally, explore setting up payment plans with clients to spread out larger payments over several months, creating a more consistent cash flow.

5. Diversify Your Income Streams:

Don’t put all your eggs in one basket. Explore different avenues to generate income. Perhaps you can offer additional services, take on freelance projects in different niches, or develop a passive income stream related to your skillset. Multiple income streams provide greater financial security.

Saving for Taxes

One of the most significant adjustments when transitioning to freelance work is managing your own taxes. Unlike traditional employment where taxes are automatically withheld from your paycheck, freelancers are responsible for setting aside money throughout the year to cover their tax obligations.

Estimate Your Tax Liability: Begin by understanding your potential tax liability. This can vary greatly depending on your income, location, and business expenses. Consult with a tax professional to get an accurate estimate of how much you should be saving.

Open a Separate Tax Savings Account: Resist the temptation to commingle business income with personal funds. Open a dedicated business bank account, and create a separate savings account specifically for taxes.

Set Aside a Percentage of Each Payment: A good rule of thumb is to set aside 25%-30% of each payment you receive into your tax savings account. This percentage might need to be adjusted based on your individual tax situation.

Make Quarterly Tax Payments: The IRS requires freelancers to make estimated tax payments quarterly. This helps you avoid penalties for underpayment and spreads your tax liability throughout the year. The IRS provides resources and forms for making estimated tax payments.

Track Business Expenses Diligently: Maintaining accurate records of your business expenses is crucial for reducing your tax burden. Legitimate business expenses are deductible, lowering your taxable income. Use accounting software or spreadsheets to track income and expenses meticulously.

Building an Emergency Fund

As a freelancer, income can be unpredictable. That’s why having a financial safety net is crucial. An emergency fund is a dedicated savings account specifically for unexpected expenses or income gaps. This fund acts as a buffer, preventing you from going into debt when unexpected situations arise.

Why is an Emergency Fund Important for Freelancers?

Freelancers often face income variability due to the nature of project-based work. An emergency fund can provide financial stability during:

- Unforeseen circumstances: Medical emergencies, car repairs, or unexpected home repairs.

- Fluctuations in workload: Periods with fewer projects or delayed payments.

- Pursuing new opportunities: Allowing you to confidently take risks, such as switching industries or starting a new venture.

How Much Should You Save?

Aim to save at least 3-6 months’ worth of living expenses in your emergency fund. This may seem daunting, but starting small and consistently contributing is key.

Tips for Building Your Emergency Fund:

- Create a budget: Track your income and expenses to identify areas where you can save.

- Automate your savings: Set up automatic transfers from your checking account to your emergency fund each month.

- Cut back on unnecessary expenses: Identify areas where you can reduce spending and redirect those funds to your savings.

- Find extra income opportunities: Explore side hustles or freelance gigs to supplement your income and accelerate your savings goals.

Investing for the Future

As a freelancer, building a secure financial future requires a proactive approach to investing. Without employer-sponsored retirement plans, it’s crucial to create your own investment strategy. Here’s what to consider:

1. Retirement Accounts:

Explore options specifically designed for self-employed individuals:

- Solo 401(k): Enjoy higher contribution limits than traditional IRAs, allowing you to save significantly for retirement.

- SEP IRA: A simplified option for small business owners and freelancers to contribute directly to a retirement account.

2. Diversification is Key:

Don’t put all your eggs in one basket. Diversify your investments across different asset classes:

- Stocks: Offer potential for high growth, but also come with higher risks.

- Bonds: Generally less volatile than stocks, providing a stable element to your portfolio.

- Real Estate: Can be a good long-term investment, but requires significant capital.

- Mutual Funds and ETFs: Provide instant diversification by investing in a basket of assets.

3. Risk Tolerance and Time Horizon:

Your investment strategy should align with your risk tolerance and time horizon. Younger investors with a longer time horizon might be more comfortable with higher-risk investments, while those closer to retirement may prefer a more conservative approach.

4. Regular Contributions:

Consistency is key. Establish a budget that allows for regular contributions to your investment accounts. Even small amounts, contributed consistently over time, can grow significantly thanks to the power of compounding.

5. Seek Professional Advice:

Navigating the world of investing can be complex. Consider consulting with a qualified financial advisor who understands the unique financial landscape for freelancers. They can help you create a personalized investment strategy that aligns with your financial goals and risk tolerance.

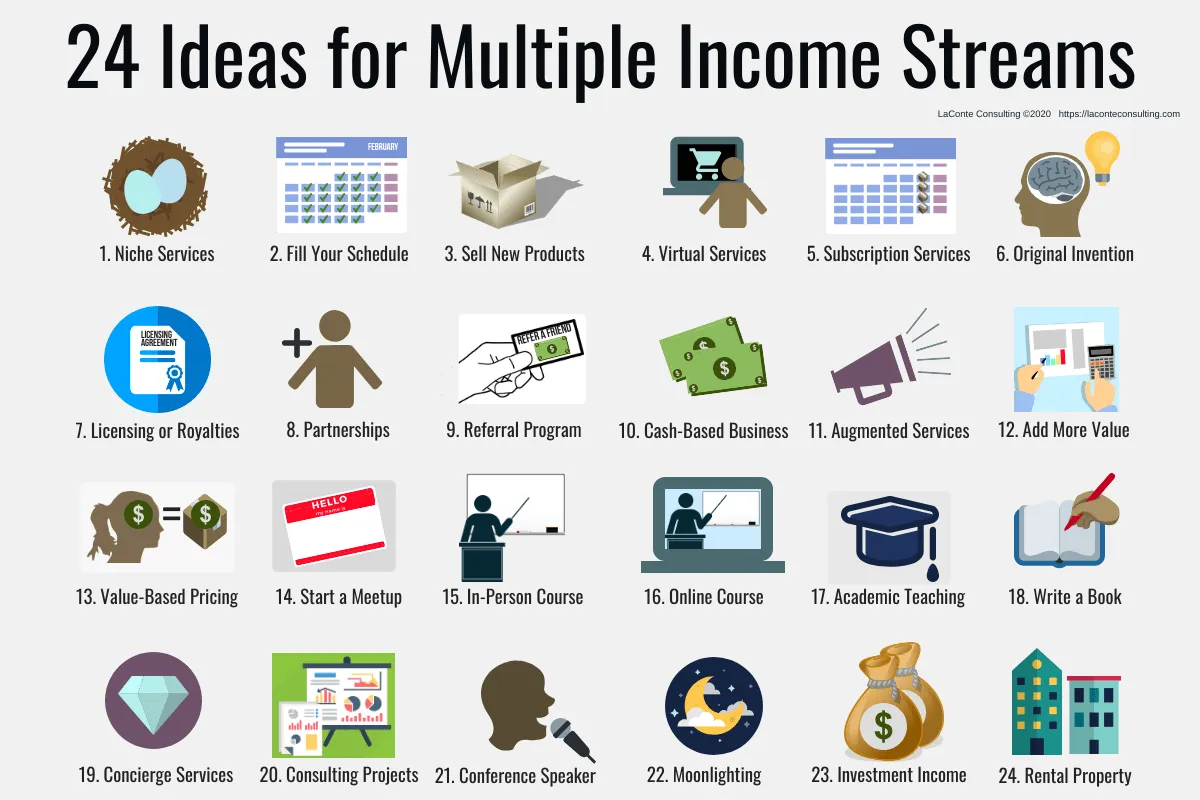

Finding Additional Income Streams

As a freelancer, diversifying your income is crucial for weathering the ups and downs of inconsistent work flow. Relying solely on one client or project puts you at risk. Exploring additional income streams provides financial cushioning and opens doors to new opportunities. Here are some avenues to consider:

1. Leverage Your Skills:

Think about how your existing skills can translate into other services. Can you offer workshops, consultations, or one-on-one coaching related to your field? Maybe you can create and sell digital products like templates, e-books, or online courses.

2. Passive Income Possibilities:

Generating passive income, even in small amounts, can add up. Explore options like:

- Affiliate Marketing: Partner with businesses and promote their products or services on your platforms. You earn a commission for each sale made through your unique referral link.

- Stock Photography or Digital Assets: If you have photography or design skills, consider selling your work on stock websites.

- Create and Sell Online Courses: Package your knowledge into valuable online courses and sell them through platforms like Udemy, Skillshare, or your website.

3. Explore Different Platforms:

Don’t limit yourself to one platform or marketplace. Branch out and offer your services on multiple platforms to reach a wider audience and attract new clients.

4. Monetize Your Expertise:

Establish yourself as a thought leader in your niche. Write guest posts for relevant blogs, create valuable content on LinkedIn, or participate in online communities. This exposure can lead to new clients and opportunities.

Conclusion

Effective financial planning is crucial for freelancers to ensure stability and growth in their careers. By budgeting, saving, and diversifying income streams, freelancers can build a secure financial future.