In this article, we will delve into the essential steps on how to effectively create and manage a business budget to ensure financial stability and success. From setting clear goals to monitoring expenses, learn valuable strategies to optimize your company’s financial health.

Importance of a Business Budget

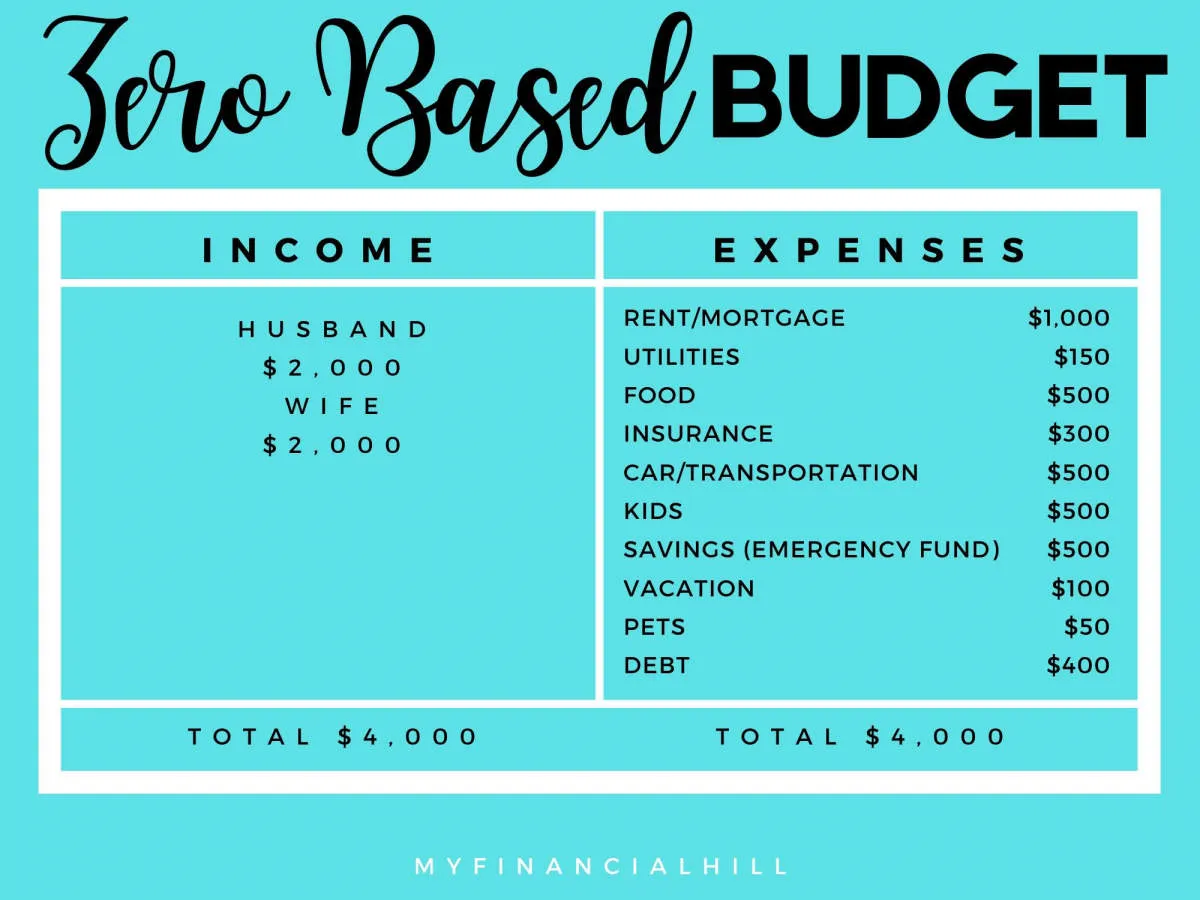

A business budget is a crucial tool for any business, regardless of size or industry. It acts as a financial roadmap, guiding your spending, resource allocation, and overall financial health. Here’s why a well-structured budget is vital for your business’s success:

1. Control and Track Spending

A budget allows you to actively manage your finances instead of merely reacting to them. By outlining expected income and expenses, you gain better control over cash flow and can identify potential areas for cost savings.

2. Set Realistic Goals

Without a budget, setting realistic financial goals becomes challenging. With a clear understanding of your income, expenses, and projected growth, you can establish attainable revenue targets, profit margins, and expansion plans.

3. Secure Funding

Whether seeking investments, loans, or grants, a comprehensive business budget is often a requirement. Lenders and investors need assurance that you have a clear financial plan and the ability to repay debts or generate returns.

4. Measure Performance

A budget provides a benchmark against which you can measure your business’s financial performance. By regularly comparing actual results to your budgeted figures, you can identify areas where you’re exceeding expectations and areas that require adjustments.

5. Improve Decision-Making

A well-structured budget provides valuable financial insights that can guide strategic decision-making. It helps you evaluate potential investments, expansion opportunities, and new product or service launches with a clearer understanding of their financial implications.

6. Enhance Communication

A business budget facilitates communication and alignment within your organization. By sharing budget information with relevant stakeholders, you ensure everyone is working towards the same financial goals and understands their role in achieving them.

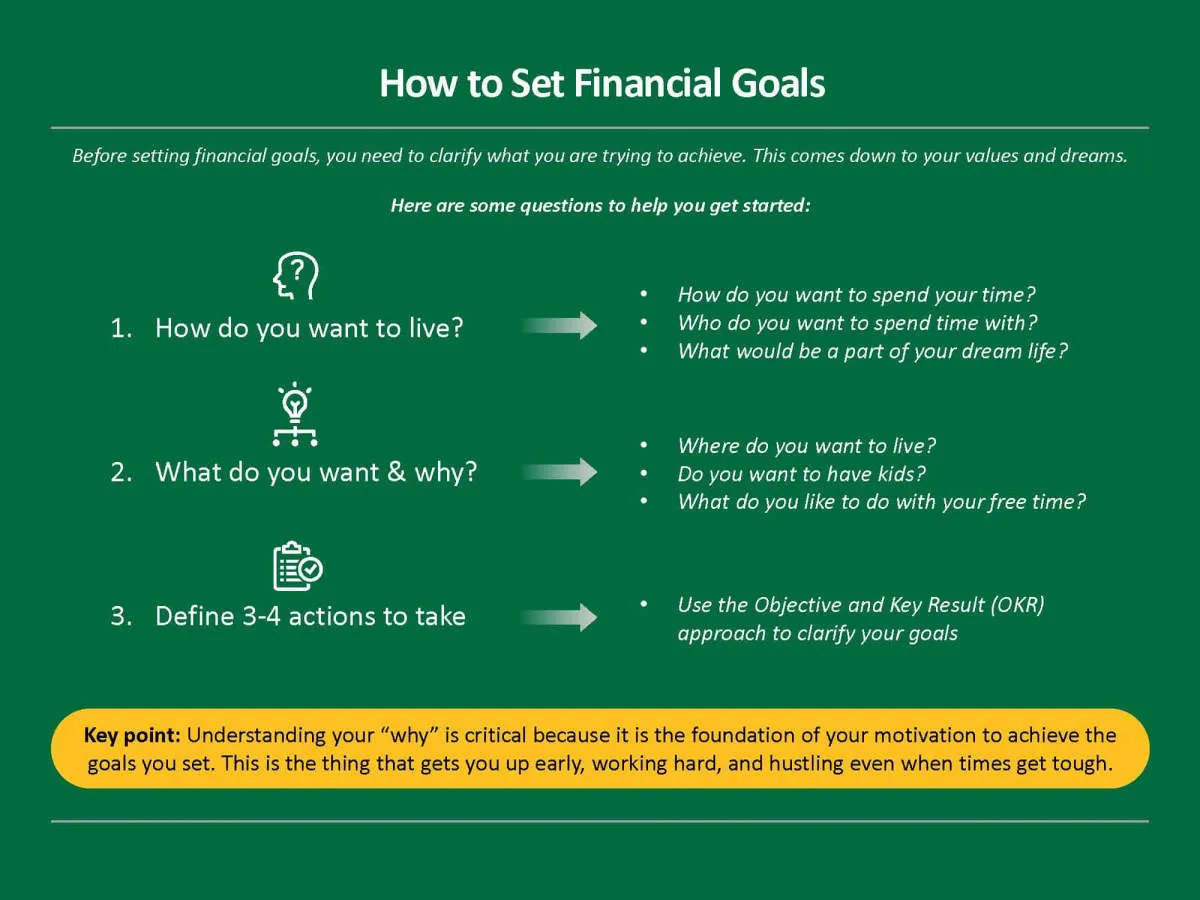

Setting Financial Goals

Before you even think about spreadsheets and expense reports, you need to define what you’re working towards. Setting clear financial goals is the bedrock of a successful business budget. These goals provide direction and motivation, ensuring every dollar you allocate serves a purpose.

Types of Financial Goals:

- Short-Term Goals: These are achievable within a year, like increasing monthly revenue by 10% or purchasing new equipment.

- Mid-Term Goals: Spanning one to three years, these could include expanding to a new location or hiring additional staff.

- Long-Term Goals: These are your big picture aspirations, such as achieving a certain market share or planning for an exit strategy, typically over three years or more.

Making Your Goals SMART:

Utilize the SMART method to ensure your goals are:

- Specific: Clearly define what you want to achieve. Instead of “increase sales,” aim for “increase online sales by 20%.”

- Measurable: Quantify your goals so you can track progress. Use metrics like revenue targets, profit margins, or debt reduction.

- Achievable: Set realistic goals based on your current situation and resources. While ambition is important, setting unattainable goals can be discouraging.

- Relevant: Align your financial goals with your overall business objectives. Ensure they contribute to the bigger picture of your company’s vision.

- Time-Bound: Set deadlines for each goal. This creates urgency and helps you stay on track.

Regularly Review and Adjust:

As your business grows and changes, so too should your financial goals. Schedule regular reviews – quarterly or annually – to assess your progress, adjust targets if needed, and ensure your goals remain aligned with your evolving business needs.

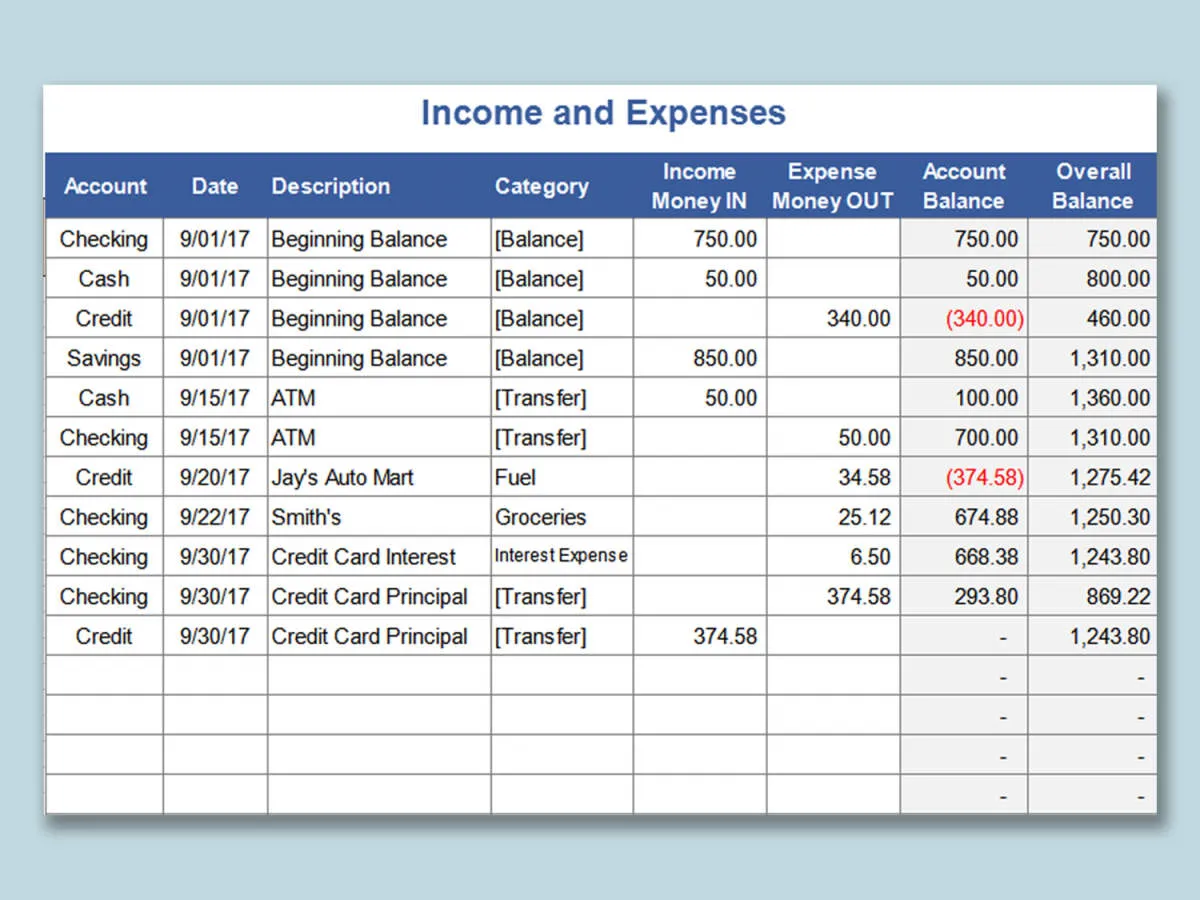

Tracking Income and Expenses

Keeping tabs on your income and expenses is the backbone of effective budget management. This involves diligently recording all sources of revenue and every dollar that flows out of your business. Here’s why it’s crucial and how to approach it:

Why It Matters:

- Identifies Profitability: By comparing income and expenses, you can quickly determine if your business is profitable or operating at a loss.

- Pinpoints Spending Habits: Tracking reveals where your money is going, highlighting areas of potential overspending or where you could cut back.

- Informs Decision Making: Accurate financial data is essential for making informed decisions about pricing, investments, hiring, and more.

- Supports Tax Preparation: Meticulous records make tax season less stressful and ensure you’re claiming all eligible deductions.

Methods for Tracking:

Choose a method that suits your business size and comfort level with technology:

- Spreadsheets: Simple and cost-effective for smaller businesses. You can use pre-made templates or create your own system.

- Accounting Software: (e.g., QuickBooks, Xero) Offers more features like automation, bank synchronization, and financial reporting, making it suitable for growing businesses.

Best Practices:

- Be Consistent: Set aside dedicated time each week or month to update your records. The more frequently you do it, the less overwhelming it becomes.

- Categorize Everything: Assign categories to both income and expenses (e.g., “Rent,” “Marketing,” “Sales”). This makes it easier to analyze spending patterns.

- Reconcile Regularly: Compare your records with bank statements and credit card bills to catch any errors or discrepancies promptly.

- Save Receipts: Keep digital or physical copies of all receipts as proof of purchase, especially for tax purposes.

Cutting Unnecessary Costs

Once you have a clear picture of your income and expenses, you can start identifying areas where you can cut back. This is where the real savings happen. Here are some strategies to consider:

Review Subscriptions and Memberships

Do you really use all those software subscriptions? Are you making the most of your gym membership? Cancel or renegotiate any subscriptions and memberships that you don’t use regularly or that don’t provide significant value.

Negotiate with Suppliers

Don’t be afraid to negotiate with your suppliers for better rates, especially if you’ve been a loyal customer. You might be surprised at how much you can save by simply asking.

Reduce Utility Consumption

Simple changes like turning off lights when leaving a room, using energy-efficient appliances, and minimizing water usage can lead to significant savings on your utility bills.

Explore Outsourcing Options

For tasks that aren’t core to your business, consider outsourcing to freelancers or contractors. This can be a cost-effective way to get things done without the overhead of hiring full-time employees.

Go Paperless

Not only is it environmentally friendly, but going paperless can also save you money on printing, postage, and storage. Switch to digital invoicing, document sharing, and communication whenever possible.

Take Advantage of Free or Low-Cost Marketing

There are plenty of free or low-cost marketing options available to businesses, such as social media marketing, email marketing, and content marketing. Get creative and explore ways to promote your business without breaking the bank.

Planning for Future Expenses

Creating a solid business budget isn’t just about tracking current income and expenses. It’s also about anticipating and preparing for future financial obligations. This forward-thinking approach helps you avoid potential cash flow issues and ensures the long-term sustainability of your business. Here’s how to effectively plan for future expenses:

1. Identify Potential Future Expenses:

Begin by brainstorming potential expenses that might arise. Consider:

- Industry trends: Are there emerging technologies or regulations that might require investment?

- Seasonality: Does your business experience seasonal fluctuations? Plan for higher expenses during peak seasons.

- Growth plans: Will you be hiring more staff, expanding your product line, or moving to a larger space?

- Equipment upgrades: Do you anticipate needing to replace or upgrade any equipment or machinery?

- Taxes: Set aside funds throughout the year to cover your estimated tax liability.

2. Estimate Costs:

Once you’ve identified potential expenses, research and estimate their costs as accurately as possible. Request quotes from vendors, consider historical data, and factor in inflation when making your estimations.

3. Create a Timeline:

Determine when these expenses are likely to occur. This will help you prioritize savings and allocate funds accordingly. For instance, if you know you’ll need new computers in a year, start setting aside a small amount each month to spread out the cost.

4. Establish a Contingency Fund:

Unexpected expenses are inevitable in business. Establish a contingency fund specifically for unforeseen circumstances, like emergency repairs or sudden economic downturns. Having a financial cushion provides a safety net and prevents minor setbacks from derailing your entire budget.

5. Regularly Review and Adjust:

Don’t treat your future expense plan as static. Review it quarterly or annually, and adjust it based on your business’s performance, market changes, and any new information or insights you’ve gained.

Reviewing and Adjusting Your Budget

Creating a business budget isn’t a “set it and forget it” task. Regular review and adjustment are crucial to ensure your budget remains relevant and effective. Here’s how to approach this ongoing process:

Set a Review Schedule

Don’t wait until the end of the fiscal year to look at your budget. Aim for regular reviews, whether that’s monthly, quarterly, or at least semi-annually. This frequency allows you to identify and address discrepancies early on.

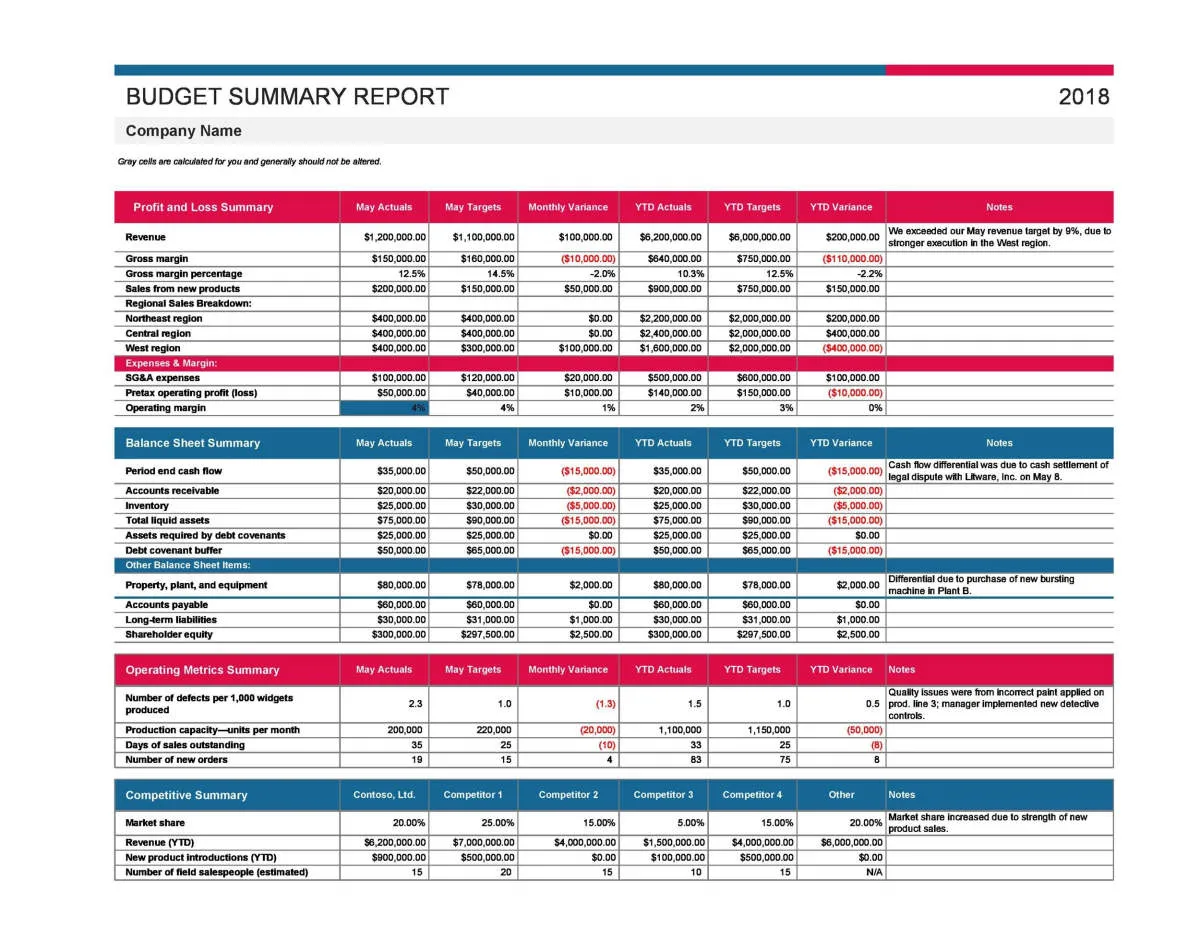

Compare Actuals to Projections

The core of budget review is comparing your planned expenses and income to what actually transpired. Use accounting software or spreadsheets to track your income and expenses meticulously.

Analyze Variances

When you identify differences between your budget and reality, it’s time to analyze why. Are certain expenses consistently higher than projected? Is revenue falling short? Understanding these variances is key to making informed adjustments.

Identify Internal and External Factors

Variances often stem from internal or external influences. Internal factors might include operational inefficiencies or changes in pricing strategies. External factors could involve market shifts, economic downturns, or new competitor activity.

Make Strategic Adjustments

Based on your analysis, adjust your budget strategically. This might involve:

- Expense Reduction: Can you cut unnecessary costs or find more favorable vendor agreements?

- Revenue Growth Strategies: Are there opportunities to increase sales, introduce new products, or adjust pricing?

- Contingency Planning: Can you build in a buffer to absorb unexpected expenses or revenue shortfalls in the future?

Flexibility is Key: Business environments are dynamic. Don’t be afraid to revise your budget throughout the year to reflect new information, opportunities, or challenges.

Conclusion

In conclusion, creating and managing a business budget is essential for financial stability and growth, helping businesses make informed decisions and achieve long-term success.