Discover effective strategies for managing personal finances and optimizing savings in our comprehensive guide. Learn how to budget wisely, invest smartly, and reach your financial goals with confidence.

Introduction to Personal Finance

Personal finance encompasses all aspects of managing your money. It’s about making informed decisions about your income, expenses, savings, investments, and debt. Whether you’re just starting out or looking to improve your financial well-being, understanding the basics of personal finance is crucial.

Why is Personal Finance Important?

Effective personal finance management empowers you to:

- Achieve financial goals, such as buying a home, saving for retirement, or funding your children’s education.

- Build a safety net to navigate unexpected expenses or financial emergencies.

- Reduce financial stress and gain peace of mind.

- Make informed decisions about your money and avoid debt traps.

- Grow your wealth over time through savings and investments.

Key Areas of Personal Finance:

Personal finance can be broken down into several key areas:

- Budgeting: Tracking your income and expenses to understand your cash flow and identify areas for savings.

- Saving: Setting aside money regularly for emergencies, short-term goals, and long-term financial security.

- Debt Management: Strategizing to pay off debt efficiently, minimizing interest charges, and avoiding excessive borrowing.

- Investing: Growing your money over time by putting it to work in assets like stocks, bonds, or real estate.

- Retirement Planning: Saving and investing specifically for your retirement years to ensure financial independence.

- Insurance: Protecting yourself and your assets from financial risks, such as illness, accidents, or property damage.

Creating a Budget That Works

A budget is the cornerstone of healthy financial management. It’s not about restriction, but rather about awareness and control over your money. A well-structured budget empowers you to allocate funds wisely, meet financial goals, and achieve peace of mind.

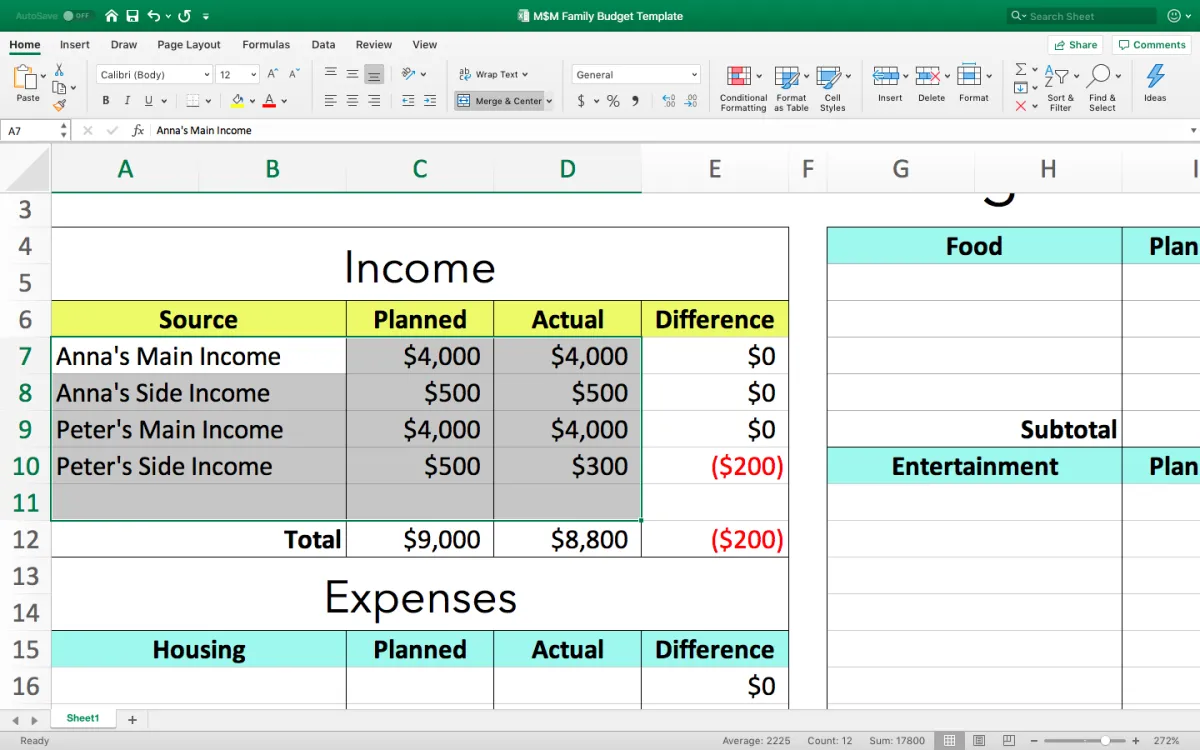

1. Track Your Income and Expenses

Begin by diligently monitoring where your money comes from and where it goes. Utilize budgeting apps, spreadsheets, or even a simple notebook to record all income sources and every expense for a month. This exercise unveils spending patterns and highlights areas for potential savings.

2. Categorize and Analyze

Categorize your expenses (e.g., housing, transportation, groceries, entertainment). Analyze each category’s proportion of your overall spending. Identify areas of overspending and opportunities for reduction.

3. Set Realistic Financial Goals

Define your short-term and long-term financial goals. Whether it’s saving for a down payment, paying off debt, or investing, having clear objectives provides direction for your budget.

4. The 50/30/20 Rule (or Similar)

Consider budgeting frameworks like the 50/30/20 rule as a starting point. Allocate:

- 50% of your income to needs: Essential expenses like housing, utilities, groceries, and transportation.

- 30% to wants: Discretionary spending like dining out, entertainment, hobbies, and shopping.

- 20% to savings and debt repayment: Building an emergency fund, investing, and tackling any existing debt.

Adjust these percentages based on your individual circumstances and priorities.

5. Automate Your Savings

Treat savings like a non-negotiable expense. Set up automatic transfers from your checking account to savings or investment accounts each month. This “pay yourself first” approach ensures consistent progress towards your goals.

6. Regularly Review and Adjust

Your financial situation and goals evolve. Revisit your budget monthly, especially in the initial stages, to make necessary adjustments. Life throws unexpected expenses, and your budget should be flexible enough to accommodate them without derailing your overall plan.

Smart Saving Strategies

Saving money is crucial for achieving financial stability and reaching your financial goals. Whether you’re aiming to buy a home, invest for retirement, or simply build a safety net, employing smart saving strategies can significantly impact your progress. Here are some effective techniques to maximize your savings:

1. Set Realistic Savings Goals

Start by defining clear and achievable savings goals. Determine how much you want to save each month or year and break down your goals into smaller, manageable milestones. This approach makes saving less daunting and allows you to track your progress effectively.

2. Create a Budget

A budget is essential for understanding your income, expenses, and identifying areas where you can save. Track your spending for a few months to get a clear picture of your financial habits. Categorize your expenses and identify non-essential items that can be reduced or eliminated to free up more money for savings.

3. Automate Your Savings

Make saving automatic by setting up regular transfers from your checking account to your savings account. Treat your savings like a bill that needs to be paid consistently. Automating the process removes the temptation to spend the money and ensures that you’re regularly contributing to your savings goals.

4. Explore High-Yield Savings Options

Don’t settle for traditional savings accounts that offer minimal interest rates. Research and compare high-yield savings accounts, money market accounts, and certificates of deposit (CDs) to find options that can help your money grow faster.

5. Cut Down on Unnecessary Expenses

Identify areas where you can reduce spending without drastically impacting your lifestyle. Consider dining out less frequently, brewing your own coffee, finding more affordable entertainment options, or negotiating better rates for services like insurance or cable.

Investing for Beginners

Investing might seem daunting at first, but it’s a crucial step towards building wealth and achieving your financial goals. Here’s a beginner’s guide to get you started:

1. Define Your Financial Goals

What are you saving for? A down payment on a house? Retirement? Identifying your goals will help determine your investment timeline and risk tolerance.

2. Start with a Budget

Before investing, understand your cash flow. Create a budget to track income and expenses. This will reveal how much you can realistically invest each month.

3. Build an Emergency Fund

Before investing, ensure you have 3-6 months of living expenses saved in an easily accessible account. This protects you from unexpected financial emergencies.

4. Consider Your Risk Tolerance

Investments come with varying levels of risk. Generally, higher returns come with higher risk. Your risk tolerance will depend on your age, financial situation, and comfort level with market fluctuations.

5. Explore Different Investment Options

There are numerous investment options available:

- Stocks: Represent ownership in publicly traded companies. They offer potential for high growth but also come with higher volatility.

- Bonds: Represent loans you make to governments or corporations. They offer lower returns than stocks but are generally less risky.

- Mutual Funds and ETFs: These are baskets of stocks or bonds, offering instant diversification for your portfolio.

- Real Estate: Investing in property can be profitable but often requires significant upfront capital.

6. Start Small and Diversify

You don’t need a lot of money to start investing. Begin with small, regular investments and diversify your portfolio across different asset classes to minimize risk.

7. Educate Yourself

Investing requires continuous learning. Take advantage of online resources, books, and financial education workshops to enhance your knowledge.

8. Seek Professional Advice

If you’re unsure where to start or need personalized guidance, consider consulting a certified financial advisor. They can help create a tailored investment plan based on your specific needs and goals.

Debt Management Tips

Effectively managing debt is crucial for achieving financial stability and maximizing savings. Here are some valuable tips to help you gain control of your debts:

1. Create a Debt Inventory

Start by listing all your debts, including credit cards, loans, and any outstanding balances. Note down the interest rates, minimum payments, and total amounts owed. This comprehensive overview will provide clarity on your current debt situation.

2. Prioritize Debt Repayment

Focus on paying down high-interest debts first, such as credit card balances. Consider using the debt snowball or debt avalanche method to prioritize repayment based on interest rates or outstanding balances. Allocate extra funds towards these debts to accelerate progress.

3. Explore Debt Consolidation

If you have multiple debts with varying interest rates, consider debt consolidation. This involves combining multiple debts into a single loan with a lower interest rate. This can simplify repayment and potentially save money on interest charges.

4. Negotiate with Creditors

Don’t hesitate to negotiate with creditors for better terms. Contact your credit card companies or loan providers and explore options such as lower interest rates, waived fees, or modified payment plans. They may be willing to work with you, especially if you’re facing financial hardship.

5. Track Your Progress and Stay Motivated

Regularly monitor your debt repayment progress to stay motivated. Track your payments, observe declining balances, and celebrate milestones. Visualizing your progress can provide a sense of accomplishment and encourage you to stay committed to your debt management goals.

Conclusion

In conclusion, adopting effective budgeting, investing wisely, and setting financial goals are key strategies for managing personal finances and maximizing savings.