In times of economic downturns, making smart financial decisions is crucial. Learn how to navigate uncertainties, prioritize expenses, and build a resilient financial plan to secure your future.

Understanding Economic Downturns

Economic downturns are a natural part of the economic cycle, characterized by a period of decline in economic activity. While the specific causes can vary, common factors include:

- Recessions: Technically defined as two consecutive quarters of negative economic growth, recessions are marked by widespread job losses, reduced consumer spending, and decreased business investment.

- Inflation: A sustained increase in the general price level of goods and services can erode purchasing power and lead to economic uncertainty, prompting consumers and businesses to tighten their belts.

- External Shocks: Unforeseen events like pandemics, natural disasters, geopolitical crises, or sudden shifts in global markets can disrupt supply chains, impact consumer behavior, and trigger economic downturns.

During an economic downturn, you’ll likely observe several key indicators:

- High Unemployment: Businesses lay off workers due to decreased demand or financial constraints, making it harder to find new jobs.

- Declining Stock Market: Investor confidence wanes, leading to a decrease in stock prices and potentially impacting retirement savings.

- Reduced Consumer Spending: Households cut back on discretionary expenses due to job insecurity or concerns about the future.

Understanding the nature of economic downturns and recognizing their signs is crucial for making informed financial decisions that protect your financial well-being during challenging times.

Protecting Your Income

Economic downturns can be unsettling, especially when it comes to your income. Job security can feel uncertain, and you might be worried about potential pay cuts or even job loss. Here are some steps you can take to protect your income during these times:

1. Build an Emergency Fund:

Having 3-6 months’ worth of living expenses saved can be a lifesaver if you experience a job loss or reduction in income. This fund acts as a buffer to cover your essential expenses while you navigate the situation.

2. Reduce Unnecessary Spending:

Take a close look at your monthly expenses and identify areas where you can cut back. This might involve dining out less, finding more affordable entertainment options, or postponing large purchases.

3. Diversify Your Income Streams:

Consider exploring additional income sources to reduce your reliance on a single job. This could include freelancing, consulting, or starting a side business. Even a small amount of extra income can make a big difference.

4. Upskill and Enhance Your Value:

Invest in your professional development by acquiring new skills or certifications that are in demand. This can make you a more valuable asset to your current employer or increase your marketability in case you need to find a new job.

5. Network Strategically:

Stay connected with people in your industry and attend relevant events. Networking can provide valuable insights into job opportunities and industry trends. You never know when a connection might lead to a new opportunity.

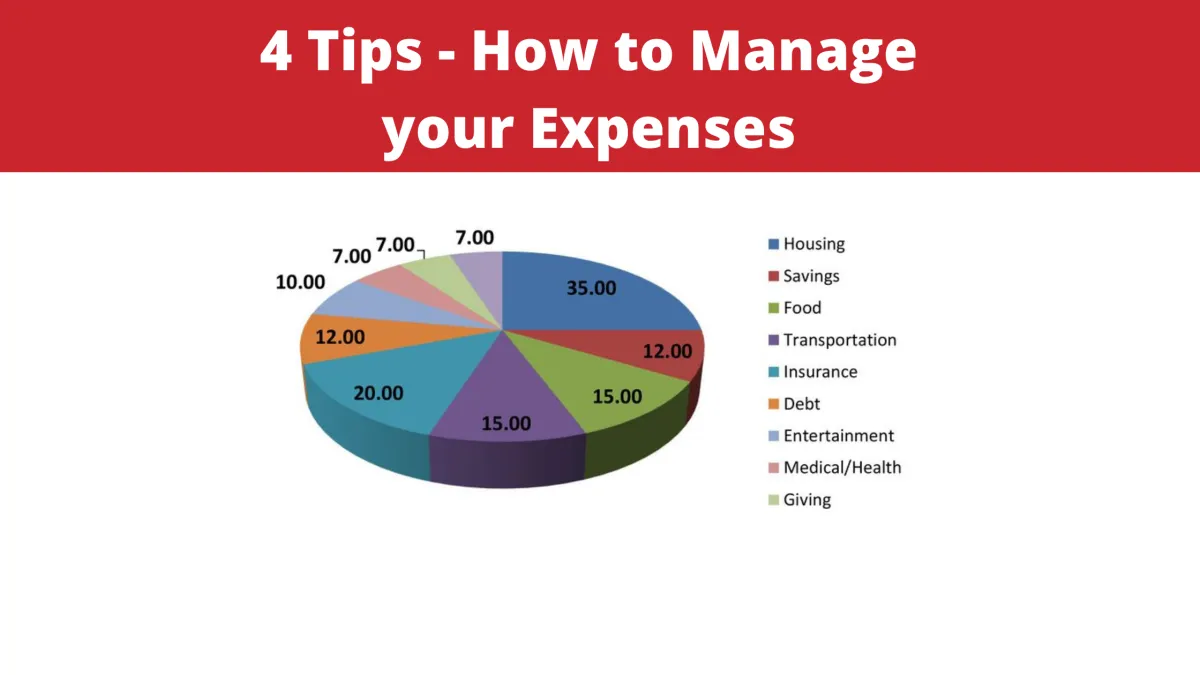

Managing Expenses

Economic downturns often mean tightening our belts and making conscious spending choices. Here’s how to effectively manage your expenses during these times:

1. Track Your Spending

Start by understanding where your money is going. Use budgeting apps, spreadsheets, or even a simple notebook to track every expense for a month. This will provide valuable insights into your spending habits.

2. Differentiate Needs vs. Wants

During uncertain economic times, it’s crucial to prioritize. Needs are essentials like housing, food, and utilities. Wants are non-essential items and services. Identify areas where you can reduce “wants” spending.

3. Explore Cost-Cutting Measures

- Negotiate Bills: Contact service providers (internet, phone, insurance) and explore options for lower rates or payment plans.

- Reduce Energy Consumption: Lower your utility bills by being mindful of electricity and water usage.

- Find Alternatives: Consider cheaper grocery stores, generic brands, and cooking at home more often.

- Review Subscriptions: Cancel or pause any non-essential subscriptions you don’t use regularly.

4. Build an Emergency Fund

If you haven’t already, focus on building an emergency fund. Having 3-6 months’ worth of living expenses saved can provide a safety net during tough times.

5. Seek Financial Advice

If you’re struggling to manage expenses, don’t hesitate to seek professional financial advice. A financial advisor can provide personalized guidance and help you navigate through the downturn.

Investing Wisely

While economic downturns can be unsettling, they can also present opportunities for savvy investors. Here’s how to approach investing during these times:

1. Don’t Panic Sell:

Seeing your portfolio value drop can be unnerving, but it’s crucial to avoid making impulsive decisions. Panic selling often leads to locking in losses and missing out on potential rebounds.

2. Consider Long-Term Goals:

Economic downturns are typically cyclical. Remind yourself of your long-term financial objectives and maintain a long-term perspective when making investment choices.

3. Look for Value Opportunities:

Market downturns often lead to undervalued assets. This can be a good time to research and invest in companies with strong fundamentals that may be temporarily priced below their intrinsic value.

4. Diversify Your Portfolio:

Diversification is key, especially during volatile periods. Ensure your portfolio is spread across different asset classes (stocks, bonds, real estate, etc.) to mitigate risk.

5. Consider Dollar-Cost Averaging:

Dollar-cost averaging involves investing a fixed amount of money at regular intervals, regardless of market fluctuations. This strategy helps to average out the purchase price over time and can be particularly beneficial during downturns.

6. Seek Professional Advice:

If you’re unsure about how to navigate the market during an economic downturn, consider consulting with a qualified financial advisor. They can provide personalized guidance based on your individual circumstances and risk tolerance.

Building an Emergency Fund

Economic downturns can be stressful, particularly when it comes to personal finances. One of the best ways to navigate uncertain times is to ensure you have a robust emergency fund in place. This fund acts as a financial cushion, providing peace of mind and practical support should you face unexpected challenges like job loss, medical emergencies, or unforeseen expenses.

Why is an Emergency Fund Crucial During a Downturn?

During an economic downturn, the risk of job loss or reduced income increases. Having an emergency fund can provide a financial bridge, allowing you to cover essential expenses while you search for new employment opportunities or adjust to a lower income. It can also prevent you from relying on high-interest credit cards or loans, which can exacerbate financial stress in the long run.

How Much Should You Save?

A good rule of thumb is to aim for 3-6 months’ worth of living expenses in your emergency fund. This means having enough saved to cover your essential expenses, such as rent or mortgage payments, utilities, groceries, and transportation, for 3-6 months should you lose your primary source of income.

Tips for Building Your Emergency Fund

- Create a Budget: Track your income and expenses to identify areas where you can cut back and free up extra cash flow for savings.

- Automate Savings: Set up automatic transfers from your checking account to your emergency fund each month. This “pay yourself first” strategy makes saving consistent and effortless.

- Start Small: Even small contributions add up over time. Start with a manageable amount you can consistently save each month and gradually increase it as your finances allow.

- Separate Your Funds: Keep your emergency fund in a separate savings account, ideally a high-yield savings account, to maximize interest earned and avoid accidentally dipping into it for non-emergency spending.

Planning for Recovery

While navigating an economic downturn requires a focus on stability and preservation, it’s equally crucial to plan for the eventual recovery. The decisions you make during challenging times can set the stage for a stronger financial future. Here’s how to approach recovery planning:

1. Reassess Your Financial Goals:

Economic downturns often shift priorities. Goals you set before the downturn might need adjustments. Revisit your short-term and long-term objectives. Are they still relevant? Do timelines need modification? This process allows for flexibility and ensures your efforts align with your current situation.

2. Rebuild Emergency Savings:

If you dipped into your emergency fund during the downturn, prioritize replenishing it. Aim to have 3-6 months’ worth of living expenses saved as a buffer against future uncertainties. A healthy emergency fund provides peace of mind and financial security.

3. Address Debt Strategically:

High-interest debts can hinder recovery. Explore options like balance transfers or consolidation to manage debt effectively. As the economy improves, consider accelerating debt repayment to reduce interest burdens and free up cash flow.

4. Explore Investment Opportunities:

Economic downturns can present investment opportunities. As markets recover, consider gradually increasing your investment contributions. Remember, a long-term perspective is key, and diversification remains crucial to mitigate risks.

5. Seek Professional Guidance:

Consulting a financial advisor can be invaluable during recovery planning. An advisor can provide personalized strategies tailored to your circumstances, helping you make informed decisions about debt management, investments, and overall financial well-being.

Conclusion

During economic downturns, making smart financial decisions is crucial. By prioritizing savings, staying informed, and seeking professional advice, individuals can navigate challenging times and secure their financial well-being.