In “Creating a Financial Safety Net: Steps to Protect Your Wealth,” we explore essential strategies for safeguarding your assets and securing a stable financial future.

Understanding Financial Safety Nets

A financial safety net refers to the resources and strategies in place to protect you from unexpected financial hardship. It acts as a buffer against life’s uncertainties, allowing you to navigate difficult times without derailing your long-term financial goals. This safety net isn’t about getting rich quickly; it’s about creating a foundation of stability and resilience.

Think of it like this: Imagine a tightrope walker. Their skill and balance are essential, but equally important is the safety net below. It doesn’t guarantee they won’t stumble, but it provides a crucial safety measure should they fall. Similarly, a financial safety net won’t prevent financial challenges but will cushion the impact and help you get back on your feet faster.

Key elements of a financial safety net typically include:

- Emergency Fund: A readily accessible cash reserve specifically designed to cover unexpected expenses like medical bills, car repairs, or job loss.

- Insurance Coverage: Health, life, disability, and property insurance policies provide financial protection against major unforeseen events.

- Debt Management: Having a handle on your debts—credit cards, loans, mortgages—is crucial. Minimizing high-interest debt reduces financial vulnerability.

- Savings and Investments: Beyond your emergency fund, building savings and investment accounts helps achieve long-term financial goals and can provide additional resources in times of need.

Understanding the importance of a financial safety net is the first step toward building a more secure future. By taking proactive steps to establish these elements, you gain greater control over your finances and empower yourself to face life’s challenges with greater confidence.

Building an Emergency Fund

An emergency fund is a crucial part of any solid financial plan. It acts as a buffer against unexpected expenses, protecting you from financial hardship when life throws curveballs. Imagine facing a sudden job loss, medical emergency, or major car repair without any financial cushion. These events can be stressful enough without the added burden of financial instability.

How much should you save? A good rule of thumb is to have three to six months’ worth of living expenses saved in your emergency fund. This means enough to cover essential costs like rent/mortgage payments, utilities, groceries, and transportation for that period. If you have dependents or work in a volatile industry, consider saving closer to the higher end of the range.

Where should you keep it? Your emergency fund should be easily accessible when you need it. A high-yield savings account or money market account at a reputable bank or credit union is generally a good option. Avoid investing these funds in the stock market, as their value can fluctuate and you don’t want to be forced to withdraw at a loss during an emergency.

How do you build it? Start by setting a realistic savings goal and then break it down into smaller, manageable chunks. Automate your savings by setting up regular transfers from your checking account to your emergency fund. Even small contributions add up over time. Consider cutting back on non-essential expenses and redirecting those funds to your emergency savings. Every little bit helps!

Insurance Coverage

Insurance is a cornerstone of a strong financial safety net. It acts as a buffer, protecting your wealth from unexpected events that could otherwise derail your financial goals. Here’s a breakdown of key insurance types to consider:

Health Insurance

Medical expenses can be financially devastating. Health insurance helps mitigate these costs, covering expenses like doctor’s visits, hospital stays, and prescription drugs.

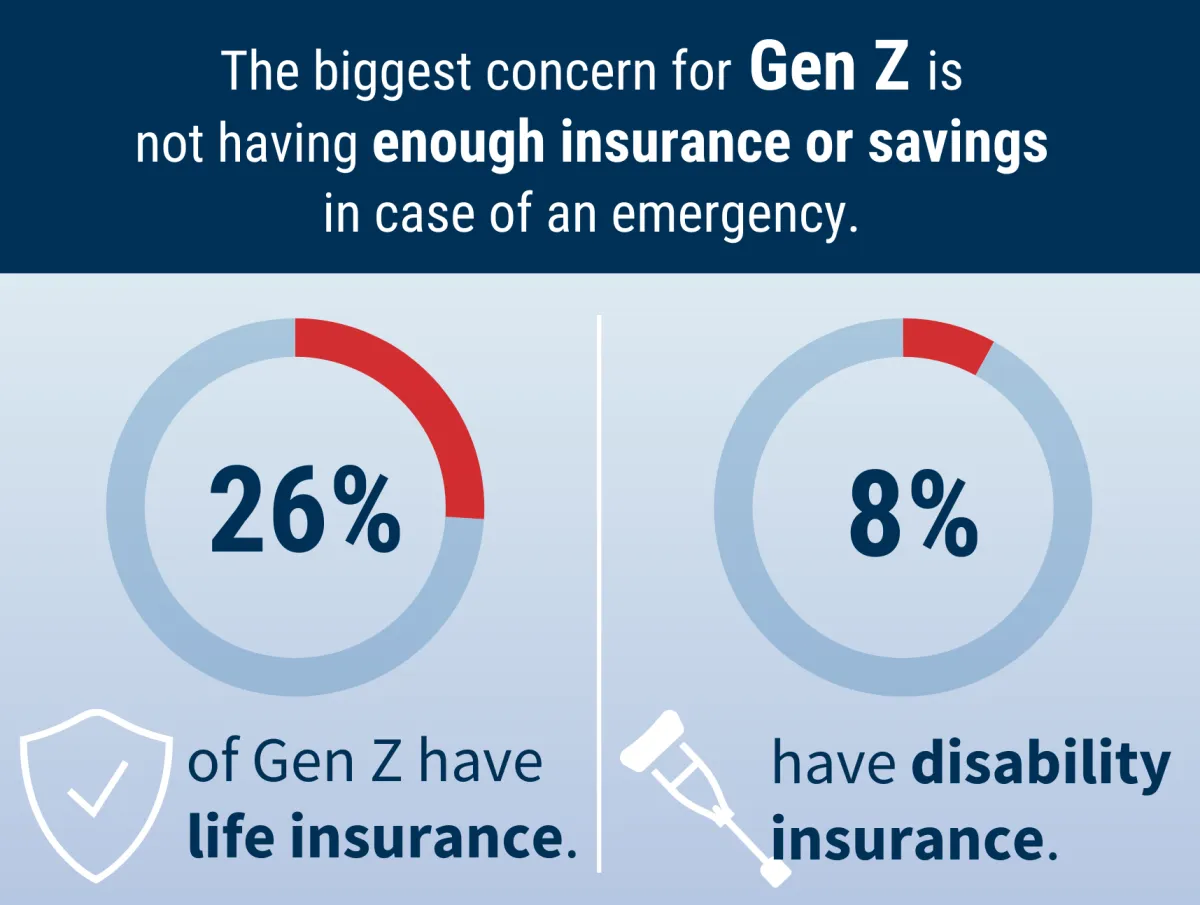

Life Insurance

If you have dependents relying on your income, life insurance is crucial. It provides a financial safety net for your loved ones in the event of your passing, helping cover living expenses, education costs, and outstanding debts.

Disability Insurance

Your ability to earn an income is a valuable asset. Disability insurance replaces a portion of your income if you become unable to work due to illness or injury, ensuring you can still meet your financial obligations.

Property Insurance

Whether you own a home or rent, property insurance protects your belongings and living space. Homeowners insurance covers damage from fire, theft, natural disasters, and liability claims, while renters insurance protects your personal property and provides liability coverage within your rental unit.

Auto Insurance

Auto insurance is essential for all drivers. It protects you financially in case of an accident, covering costs associated with vehicle damage, medical bills, and legal liabilities.

Evaluate your needs, research different insurance providers, and compare quotes to find the coverage that aligns best with your circumstances and budget.

Diversifying Your Investments

Diversification is a key principle in building a strong financial safety net. It involves spreading your investments across a range of asset classes, such as:

- Stocks: Represent ownership in publicly traded companies. They offer potential for high growth but also come with higher volatility.

- Bonds: Essentially loans to governments or corporations. They typically offer lower returns than stocks but are generally less volatile.

- Real Estate: Can include residential or commercial properties. It can provide rental income and potential for appreciation.

- Commodities: Raw materials like oil, gold, and agricultural products. Their prices can fluctuate significantly based on supply and demand.

By diversifying, you reduce the risk of significant losses from any single investment. If one asset class performs poorly, others may perform well, helping to cushion the impact on your overall portfolio.

Determining Your Asset Allocation

The right asset allocation for you depends on factors like your:

- Risk tolerance

- Time horizon

- Financial goals

A younger investor with a longer time horizon might choose a more aggressive allocation with a higher percentage of stocks. While an older investor approaching retirement might prefer a more conservative approach with a larger portion in bonds.

Regular Portfolio Review

It’s essential to review your investment portfolio regularly and rebalance as needed. Market fluctuations can shift your asset allocation over time. Rebalancing ensures your portfolio stays aligned with your risk tolerance and financial goals.

Estate Planning

Estate planning is often overlooked but is a crucial aspect of financial security, ensuring your wealth is managed and distributed according to your wishes, even when you’re no longer able to do so yourself. It provides peace of mind, knowing your loved ones will be taken care of and your assets will be handled responsibly.

Here’s what you should consider:

- Will: A will is a legal document that outlines how you want your assets distributed after your death. Without one, the distribution will be determined by state law, which may not align with your wishes.

- Trusts: Trusts can be used to manage assets for beneficiaries, potentially reducing estate taxes and avoiding probate court. They offer greater control over how and when assets are distributed.

- Power of Attorney: A power of attorney grants someone you trust the authority to make financial and legal decisions on your behalf if you become incapacitated. This ensures your affairs are managed according to your wishes, even if you’re unable to make decisions yourself.

- Healthcare Directive: Also known as a living will, this document outlines your wishes for medical treatment if you’re unable to communicate them. It ensures your healthcare decisions are respected and alleviates the burden of decision-making from your loved ones during a challenging time.

- Beneficiary Designations: Regularly review and update beneficiary designations on retirement accounts, life insurance policies, and other financial products. This ensures the right people receive these assets directly, often bypassing probate.

Consulting with an estate planning attorney is essential. They can help you create a comprehensive plan tailored to your specific circumstances and ensure your assets are protected for future generations.

Reviewing and Adjusting Your Financial Safety Net

Building a financial safety net is not a “set it and forget it” endeavor. Just like your life changes over time, so do your financial needs and goals. Regularly reviewing and adjusting your plan is essential to ensure it remains relevant and effective in safeguarding your wealth.

Factors Triggering a Review

Several life events and circumstances warrant a closer look at your financial safety net:

- Significant income changes: A raise, job loss, or starting a business all impact your financial landscape.

- Major expenses: Planning a wedding, buying a home, or funding a child’s education require adjustments to your safety net.

- Changes in family structure: Marriage, divorce, birth, or adoption necessitate revisiting your financial plan.

- Economic shifts: Inflation, recession, or changes in interest rates impact your savings and investments.

- Achieving milestones: Reaching significant financial goals like paying off debt requires realigning your plan.

Key Areas for Review and Adjustment

During your review, focus on these key areas of your financial safety net:

- Emergency Fund: Evaluate if the amount set aside is still sufficient to cover 3-6 months of living expenses, especially given any changes in your lifestyle or expenses.

- Debt Management: Review your progress on debt repayment and explore strategies to optimize interest rates and minimize the burden.

- Insurance Coverage: Assess if your current coverage (health, life, disability, etc.) adequately protects you and your loved ones against potential risks.

- Investment Strategy: Revisit your risk tolerance, time horizon, and investment goals, making adjustments to your portfolio allocation as needed.

Conclusion

Building an emergency fund, investing wisely, and obtaining insurance are essential steps to secure your financial future and safeguard your wealth.