Discover the essential strategies for couples to effectively manage their finances together with our top financial tips. From creating shared goals to communicating openly about money, learn how to strengthen your financial partnership and achieve long-term stability.

Importance of Financial Communication

Open and honest communication about finances is paramount for couples. It’s not just about splitting bills—it’s about building trust, understanding each other’s financial goals and anxieties, and working as a team to achieve shared financial dreams.

Here’s why financial communication is essential:

- Prevents misunderstandings and conflicts. Money is a common source of arguments. Clearly communicating about spending habits, debts, and financial goals can help couples avoid misunderstandings and potential conflicts.

- Facilitates joint financial decisions. Whether it’s buying a home, saving for retirement, or planning a vacation, making sound financial decisions as a couple requires open communication and a shared understanding of your financial situation.

- Builds a stronger partnership. Talking openly about finances fosters a sense of teamwork and shared responsibility. It allows both partners to feel heard, understood, and empowered in managing their finances together.

- Uncovers and addresses financial anxieties. One partner might have anxieties or fears related to money that the other is unaware of. Communicating these concerns allows for support and finding solutions together.

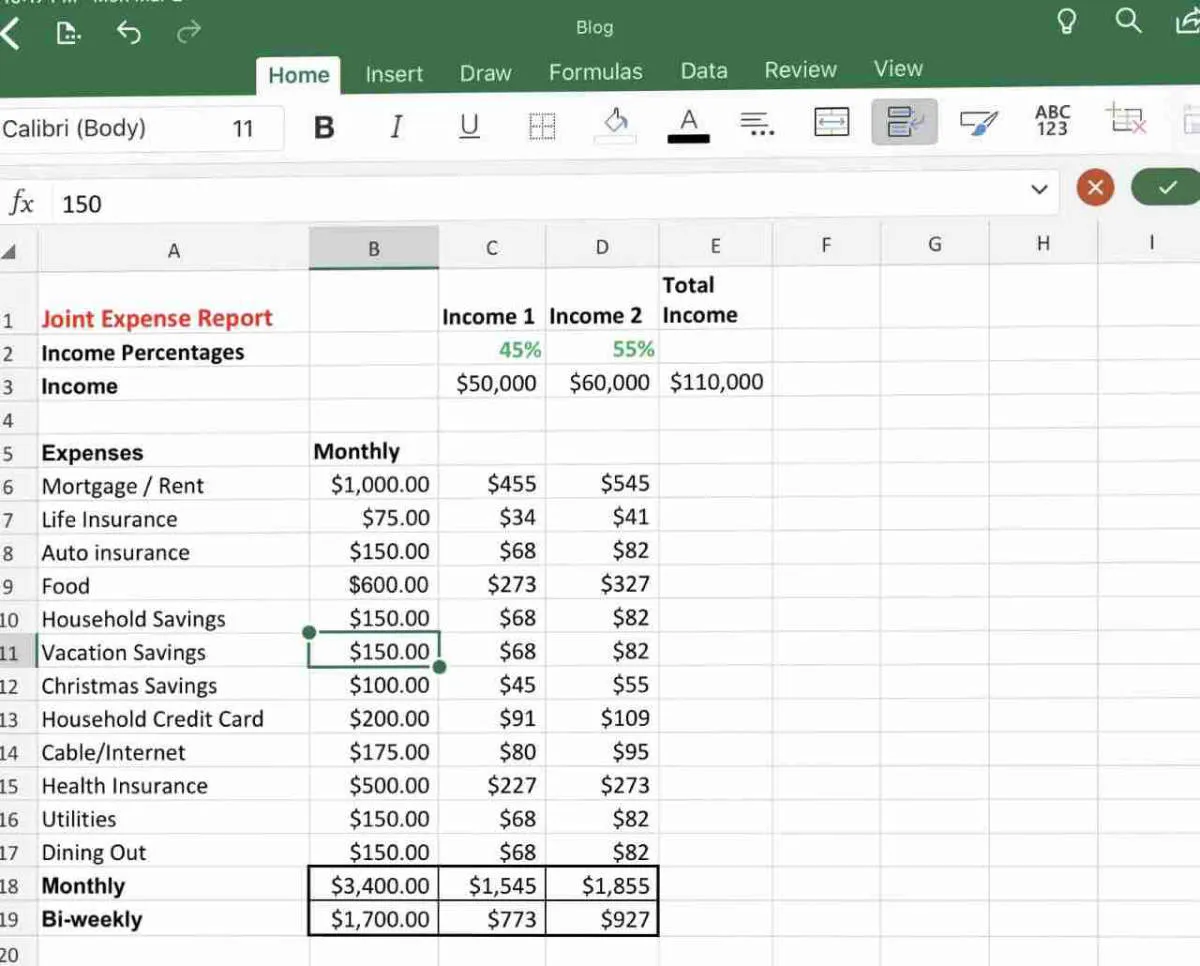

Creating a Joint Budget

One of the cornerstones of successful financial management as a couple is creating a joint budget. This involves both partners sitting down together and outlining their combined income and expenses. Here’s how to get started:

1. Track Your Spending:

Before you can budget, you need to understand where your money is going. Spend a month or two tracking all your expenses, individually and together.

2. Identify Your Income:

Determine your combined income after taxes. This includes salaries, wages, bonuses, investment income, and any other sources of regular income.

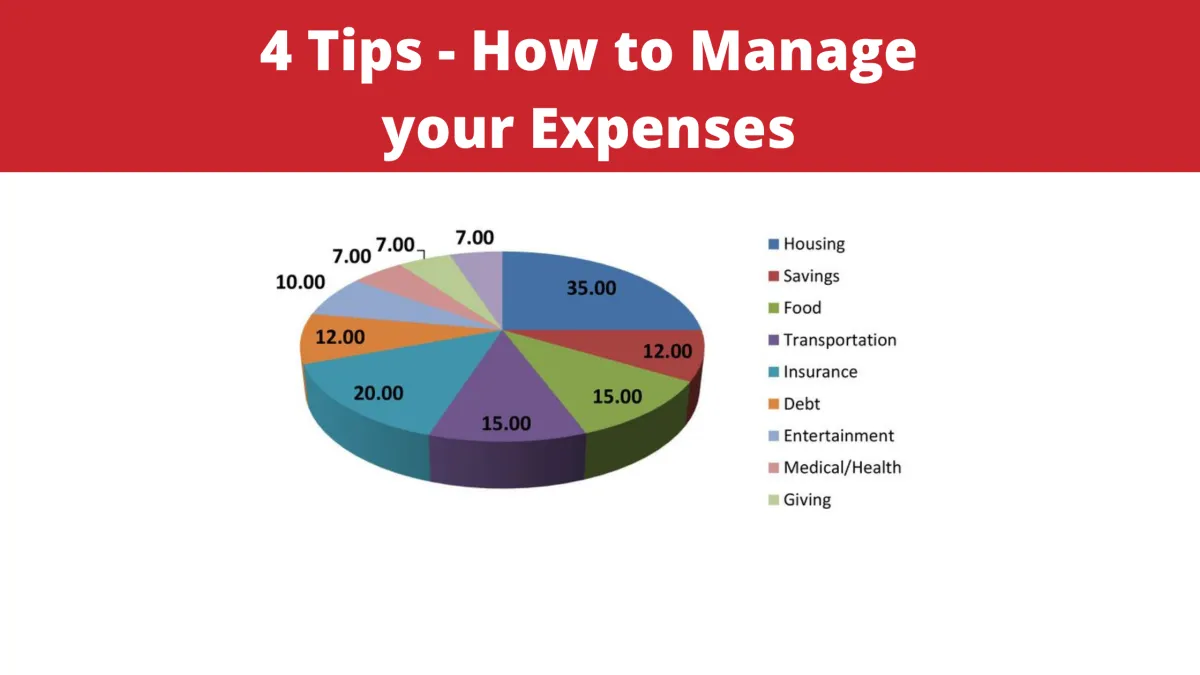

3. Categorize and Allocate:

Categorize your expenses (housing, transportation, food, entertainment, etc.). Then, decide how much you’ll allocate to each category based on your combined income and spending habits. Be realistic and honest with yourselves about your spending needs and wants.

4. Decide on a Budgeting Method:

There are various budgeting methods, such as the 50/30/20 rule, zero-based budgeting, or envelope system. Choose one that aligns with your financial goals and personalities.

5. Regularly Review and Adjust:

A budget is not static. Review your budget together monthly or quarterly, making adjustments as needed based on changes in income, expenses, or financial goals.

6. Tools and Resources:

Utilize budgeting apps or spreadsheets to streamline the process. Many online tools can help you track expenses, set financial goals, and manage your budget more effectively.

7. Communication is Key:

Open and honest communication is crucial throughout the budgeting process. Discuss your financial goals, priorities, and any concerns you have. Regular check-ins will help you stay on track and make adjustments as needed.

Setting Financial Goals Together

One of the most crucial aspects of successful money management as a couple is setting shared financial goals. These goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Start by having open and honest conversations about your individual aspirations and how they align with your life together.

What are your goals?

Consider short-term goals like building an emergency fund, paying off credit card debt, or saving for a down payment on a home. Long-term goals might include retirement planning, funding children’s education, or investments.

Prioritize and Compromise

You might have different priorities when it comes to finances. One person might prioritize saving for early retirement while the other is focused on homeownership. It’s essential to find common ground and be willing to compromise to create a financial plan that works for both of you.

Regular Check-ins

Regularly revisit your goals and make adjustments as needed. Life throws curveballs, and your financial goals should be flexible enough to accommodate unexpected expenses or changes in income.

Managing Shared Expenses

One of the most important aspects of managing money as a couple is figuring out how to handle shared expenses. This can be a source of tension if not approached thoughtfully. Here are a few strategies:

1. The Joint Account Method:

Open a joint account specifically for shared expenses like rent/mortgage, utilities, groceries, and joint entertainment. Both partners contribute a predetermined amount to this account each month. This approach simplifies bill paying and promotes transparency.

2. The Proportional Split Method:

If you have significantly different incomes, splitting expenses proportionally to income can feel fairer. For example, if one person earns 60% of the household income, they contribute 60% to shared expenses. This ensures both partners contribute proportionally to their means.

3. The Expense Tracking Method:

Use a budgeting app or spreadsheet to track who pays for what. This allows for flexibility and ensures no one feels burdened. At the end of each month, you can review expenses and settle any imbalances.

Important Considerations:

- Open Communication: Regularly discuss your financial goals and any concerns you have about shared expenses.

- Flexibility: Be willing to adjust your approach as needed. What works in one stage of life may not work in another.

- Respect: Respect each other’s financial habits and perspectives, even if they differ from your own.

Remember: Finding a system that works for both of you is key. Be open to trying different methods until you find the right fit for your relationship and financial situation.

Building an Emergency Fund

One of the most important things couples can do to secure their financial future is to build a robust emergency fund. This fund acts as a safety net during unexpected life events, such as job loss, medical emergencies, or urgent home repairs, preventing financial strain and potential debt.

How much to save? Aim for 3-6 months’ worth of living expenses. This may seem daunting, but even starting small helps.

Where to keep it? Choose a separate, easily accessible account like a high-yield savings account. This keeps the fund separate from daily spending and allows it to earn interest.

How to build it?

- Set a monthly savings goal and automate transfers.

- Explore opportunities to increase income, such as a side hustle, and direct the additional funds to the emergency fund.

- Make saving a habit by cutting down on unnecessary expenses and redirecting the money saved.

Planning for Long-Term Financial Goals

Building a solid financial future together requires setting and planning for long-term financial goals. These might include:

- Retirement planning: Determine how much you’ll need to live comfortably in retirement and start investing early to take advantage of compound interest.

- Homeownership: If buying a home is a shared dream, establish a savings plan for a down payment and closing costs. Research mortgage options and factor those costs into your budget.

- Investing: Explore different investment options together, considering your risk tolerance and time horizon. Diversifying your portfolio can help mitigate risks.

- Education Savings: If you plan to have children and want to support their education, explore options like 529 plans to save for future expenses.

- Estate Planning: Discuss and outline your wishes regarding wills, trusts, and beneficiaries to ensure a smooth transition of assets in the future.

Regularly review and adjust these goals as your life circumstances evolve. Having these conversations and plans in place ensures you’re both on the same page and working towards a secure financial future.

Conclusion

In conclusion, open communication, joint financial goals, and shared responsibility are key for couples to successfully manage money together.