Learn how to effectively manage your family finances with these smart budgeting tips to save money without sacrificing your lifestyle.

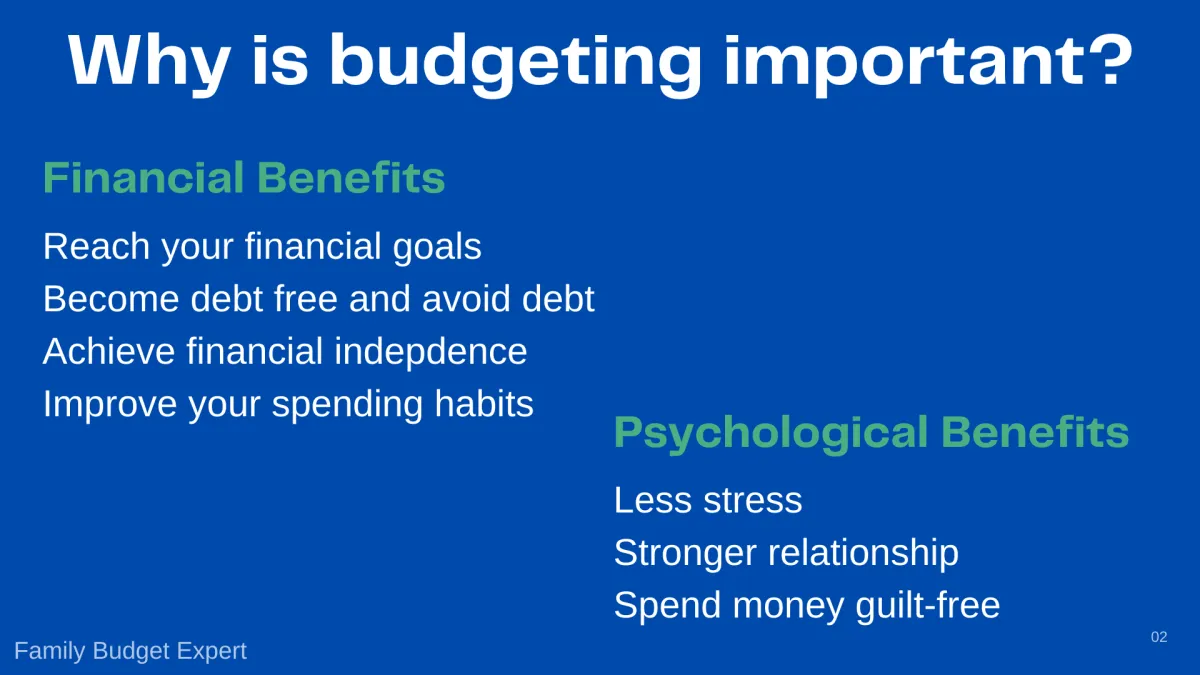

Why Budgeting is Important

Budgeting often gets put in the “too hard” basket, but family budgeting is essential for financial stability and achieving your financial goals. It provides a clear picture of your income and expenses, allowing you to make informed decisions about your money. Here’s why budgeting is crucial for families:

1. Track Income and Expenses

A budget helps you track where your money is coming from and where it’s going. This awareness is essential for identifying areas where you can cut costs and save more.

2. Achieve Financial Goals

Whether it’s saving for a down payment on a house, a family vacation, or your children’s education, a budget helps you allocate funds strategically to reach your goals faster.

3. Avoid Debt

Budgeting helps you live within your means and avoid overspending. By allocating funds for necessities and tracking spending, you’re less likely to rely on credit cards and accumulate debt.

4. Make Informed Financial Decisions

With a clear understanding of your financial situation, you can make informed decisions about major purchases, investments, and other financial commitments. This leads to better long-term financial well-being.

5. Reduced Financial Stress

Perhaps most importantly, budgeting brings peace of mind. Knowing where your money is going and having a plan to achieve your financial goals significantly reduces stress and anxiety related to finances. It empowers you to take control of your money and your future.

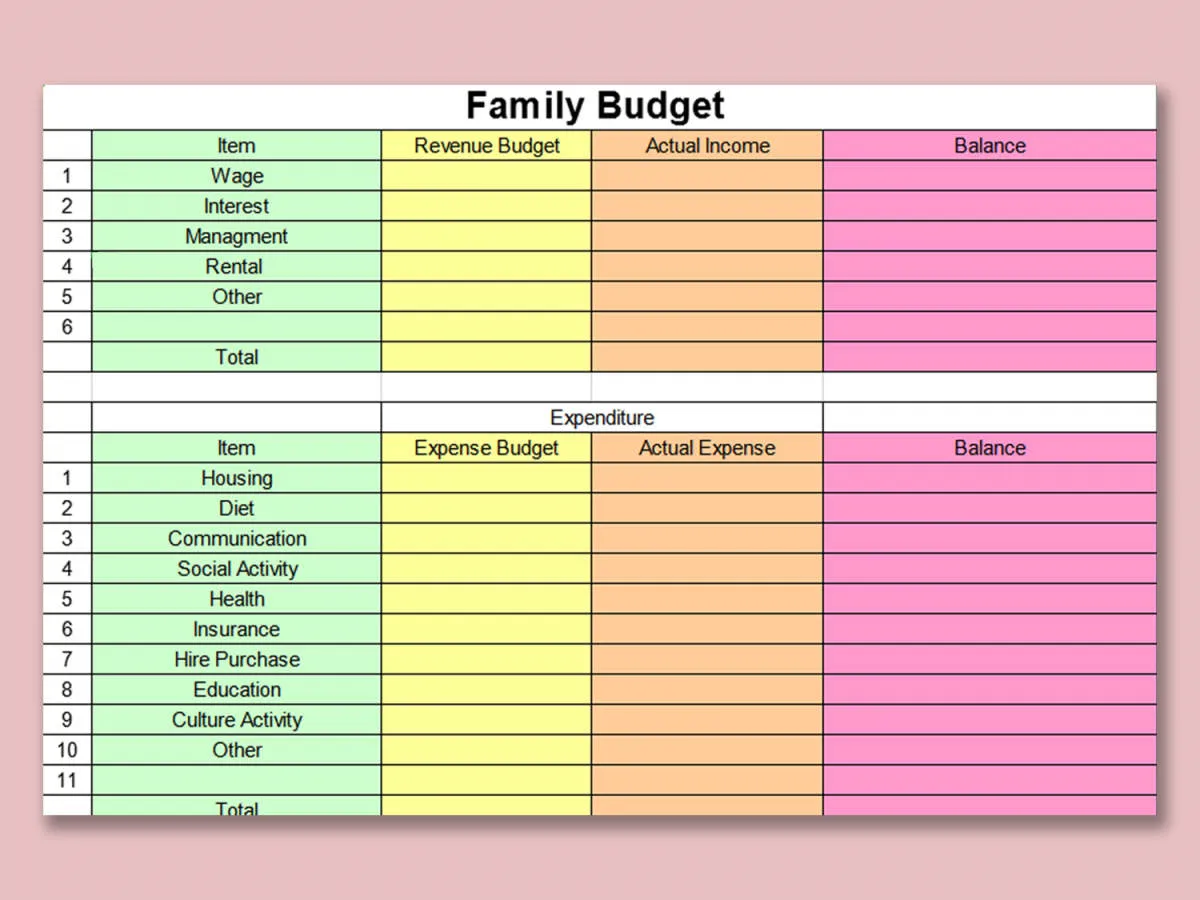

Creating a Family Budget

A family budget acts as a financial roadmap, guiding your income towards expenses and savings goals. It provides a clear picture of your financial inflows and outflows, enabling informed decisions about spending and saving.

Steps to Create a Family Budget:

- Track Income and Expenses: Note down all sources of income and meticulously list all your expenses. Use budgeting apps, spreadsheets, or a notebook to record every dollar coming in and going out.

- Categorize Spending: Divide expenses into categories like housing, groceries, transportation, entertainment, etc. This allows you to pinpoint areas of overspending and identify potential savings.

- Set Realistic Goals: Define your short-term and long-term financial goals, whether it’s a family vacation, a down payment on a house, or saving for college. Having concrete goals adds purpose to your budget.

- Determine Fixed and Variable Expenses: Differentiate between fixed expenses (like rent/mortgage payments) and variable expenses (like groceries or entertainment). This distinction helps in understanding where you have more flexibility to adjust spending.

- Implement the 50/30/20 Rule (Optional): This popular budgeting method allocates 50% of your income to needs, 30% to wants, and 20% to savings and debt repayment. It’s a helpful framework, but you can adjust these percentages based on your family’s specific situation.

- Review and Adjust Regularly: A family budget is not static. Review it monthly or quarterly, making necessary adjustments based on changes in income, expenses, or financial goals. Life is fluid, and so should your budget be.

Cutting Unnecessary Expenses

Trimming the fat from your budget is a crucial step in saving money. It’s amazing how small expenses add up over time. Here are some areas to consider:

Entertainment:

- Rethink cable TV and streaming services: Can you live without one or two? Consider cheaper alternatives or rotate subscriptions.

- Limit dining out: Make eating at home the rule and restaurant meals the exception. Explore affordable recipes and pack lunches.

- Explore free entertainment options: Parks, museums with free days, community events, and libraries offer fun without emptying your wallet.

Shopping Habits:

- Plan your meals and grocery shop with a list: Avoid impulse buys and stick to what you need.

- Compare prices: Use apps, browser extensions, or simply check different stores for the best deals.

- Embrace second-hand: Clothing, toys, and furniture can be found in excellent condition at thrift stores, consignment shops, and online marketplaces.

Lifestyle Choices:

- Cut down on energy consumption: Turn off lights, unplug devices, and explore energy-efficient options for your home.

- Reduce water usage: Fix leaks promptly, take shorter showers, and be mindful of water consumption.

- Find free alternatives to paid services: Utilize free Wi-Fi, borrow books from the library, and explore free exercise options like walking or running outdoors.

Saving on Groceries and Utilities

Groceries and utilities are two areas where families often spend a significant portion of their budget. However, there are several strategies you can implement to cut costs without sacrificing your family’s needs:

Grocery Shopping on a Budget:

- Plan Your Meals: Create a weekly meal plan and make a detailed grocery list based on your plan. This prevents impulse purchases and reduces food waste.

- Cook at Home: Eating out frequently can quickly drain your finances. Opt for home-cooked meals as much as possible. It’s healthier and more budget-friendly.

- Take Advantage of Sales and Coupons: Browse grocery store flyers, use coupon apps, and sign up for loyalty programs to maximize savings. Stock up on non-perishable items when they’re on sale.

- Buy in Bulk (When It Makes Sense): Purchase frequently used items in bulk, especially if they have a long shelf life. However, ensure you have enough storage space.

- Reduce Food Waste: Get creative with leftovers, freeze excess produce before it spoils, and compost food scraps to minimize waste.

Lowering Utility Bills:

- Conserve Energy: Turn off lights when leaving a room, unplug electronics not in use, and use natural light whenever possible. Consider energy-efficient appliances and light bulbs.

- Adjust Your Thermostat: Lower your thermostat a few degrees in the winter and raise it a few degrees in the summer. Use fans for better air circulation and reduce reliance on heating and cooling systems.

- Conserve Water: Fix any leaks promptly, take shorter showers, and run the dishwasher and washing machine only when full.

- Negotiate with Providers: Contact your utility providers to inquire about discounts, plans, or promotions that could lower your monthly bills.

- Insulate Your Home: Proper insulation can significantly reduce energy loss. Seal any drafts around windows and doors to keep your home comfortable year-round.

Planning for Future Expenses

Creating a budget that addresses both your current needs and future aspirations is crucial for long-term financial stability. This involves anticipating significant expenses and systematically saving toward them. Here’s a breakdown of how to effectively plan for future expenses:

1. Identify Your Family’s Future Needs:

Start by listing down major expenses you anticipate in the coming years. This could include:

- Education: College funds for your children

- Housing: Down payment for a new home, renovations

- Vehicles: Purchasing a car or maintenance costs

- Healthcare: Growing medical expenses, insurance premiums

- Retirement: Building a comfortable retirement nest egg

- Family Vacations: Saving for memorable trips

2. Estimate Costs and Timelines:

Research the potential costs of each anticipated expense. Factor in inflation to ensure your estimates are realistic. Determine how far in the future you’ll need the money, as this will influence your saving strategy.

3. Set Realistic Saving Goals:

Break down your larger financial goals into smaller, manageable monthly or annual savings targets. This makes the saving process less daunting and allows you to track your progress.

4. Explore Savings and Investment Options:

Consider different savings vehicles based on your time horizon and risk tolerance.

- High-yield savings accounts: Suitable for short-term goals

- Certificates of Deposit (CDs): Offer fixed interest rates for a set period

- 529 Plans: Specifically designed for education savings

- Retirement accounts (401(k), IRA): Offer tax advantages for retirement savings

- Mutual funds or ETFs: Provide diversification for long-term growth potential

5. Automate Your Savings:

Set up automatic transfers from your checking account to your designated savings or investment accounts. This ensures consistent saving without requiring constant effort.

Fun and Affordable Family Activities

Sticking to a budget doesn’t mean sacrificing family fun! There are plenty of ways to enjoy quality time together without breaking the bank. Here are some ideas for fun and affordable family activities:

Explore the Great Outdoors:

- Visit a local park: Pack a picnic lunch and enjoy the playground, walking trails, or open spaces.

- Go hiking or biking: Explore nearby trails and enjoy the fresh air and scenery.

- Have a beach or lake day: Build sandcastles, swim, or simply relax by the water.

- Go stargazing: Find a spot with minimal light pollution and marvel at the night sky.

Embrace Your Inner Homebody:

- Have a family game night: Dust off the board games or card games and enjoy some friendly competition.

- Movie night at home: Pop some popcorn and enjoy a cozy movie night in your living room.

- Get creative with crafts: Engage in DIY projects, painting, drawing, or other creative endeavors.

- Cook or bake together: Choose a new recipe to try as a family and enjoy the delicious results.

Take Advantage of Free Community Events:

- Check local listings: Many communities offer free concerts, festivals, and other events throughout the year.

- Visit museums and art galleries on free admission days: Take advantage of discounted or free admission opportunities.

- Attend library events: Libraries often host free workshops, story times, and other family-friendly activities.

Conclusion

In conclusion, implementing smart budgeting strategies can help families effectively save money and achieve their financial goals.