Building and maintaining good credit is key to securing a strong financial future. Learn essential tips and strategies to establish a solid credit history for long-term financial success in our comprehensive guide on How to Build and Maintain Good Credit.

Importance of Good Credit

Good credit is much more than just a number – it’s a powerful financial tool that opens doors to numerous opportunities. Having good credit can significantly impact your financial well-being, both in the present and in the future. Here’s why:

Lower Interest Rates and Better Loan Terms

A strong credit history signals to lenders that you’re a responsible borrower. This translates to lower interest rates on loans such as mortgages, auto loans, and personal loans. Even a slight difference in interest rates can save you thousands of dollars over the life of a loan.

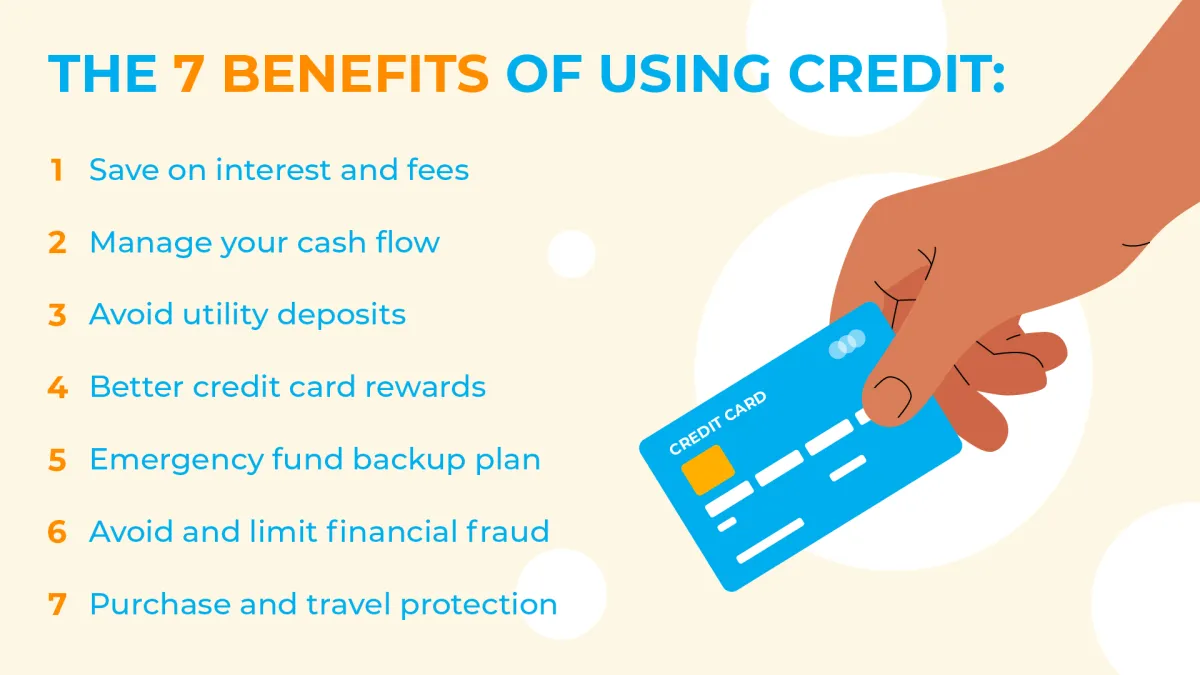

Access to Credit Cards and Higher Credit Limits

With good credit, you’re more likely to be approved for credit cards, often with more favorable terms and rewards programs. A higher credit limit provides increased purchasing power and can be helpful in emergencies.

Easier Apartment Rentals

Landlords frequently check credit reports to screen potential tenants. A good credit score increases your chances of securing your desired apartment, as it indicates financial responsibility and the ability to make timely rent payments.

Lower Insurance Premiums

In many states, insurance companies consider credit scores when calculating insurance premiums. Individuals with good credit often enjoy lower rates on auto, home, and even life insurance.

Increased Employment Opportunities

Some employers conduct credit checks as part of their background verification process, especially for positions that involve handling finances. A positive credit history can enhance your job prospects.

Building and maintaining good credit is an investment in your financial future. By demonstrating responsible financial behavior, you unlock a world of advantages that can lead to greater financial stability and success.

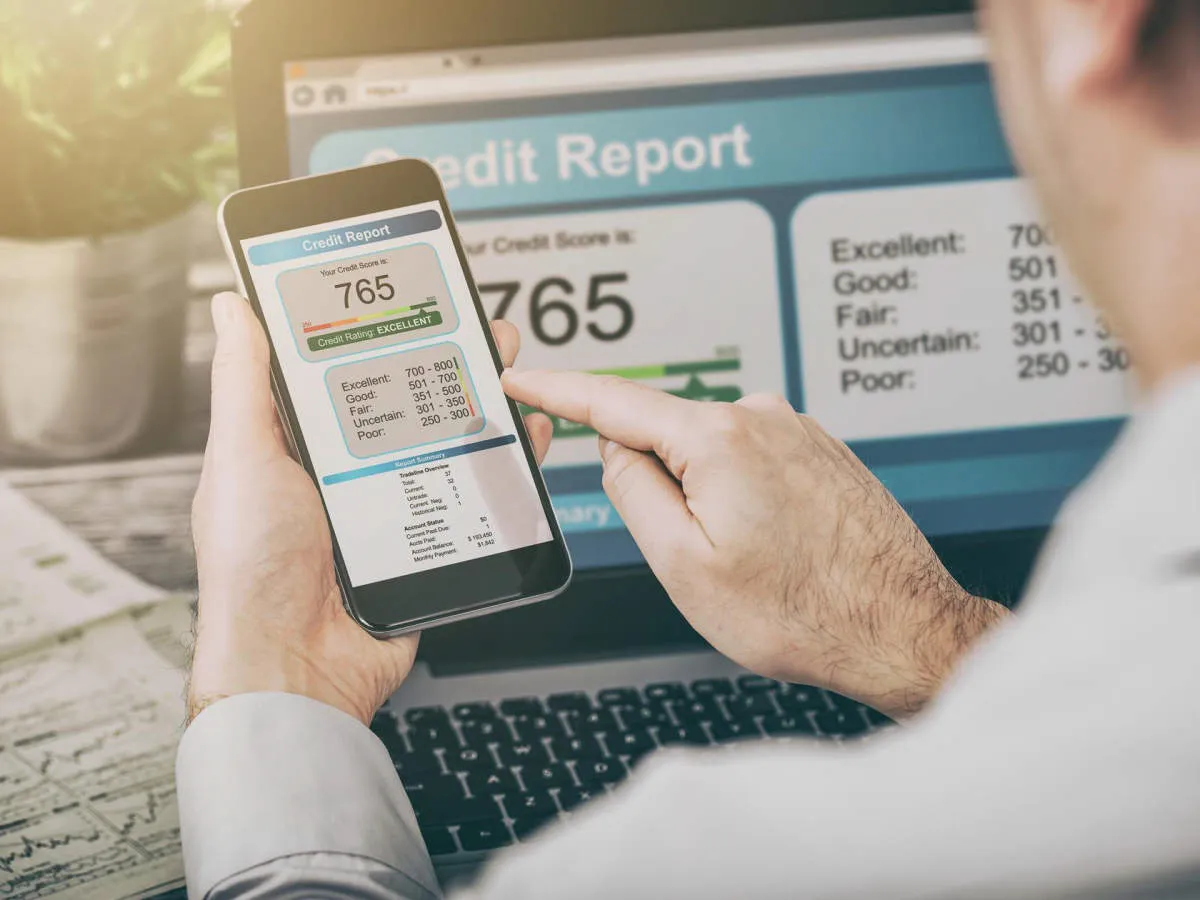

Understanding Credit Scores

Your credit score is a three-digit number that represents your creditworthiness, or how likely you are to repay borrowed money responsibly. It’s calculated based on information in your credit report, a detailed history of your credit activity.

Why are credit scores important? Lenders use your credit score to assess the risk of lending you money. A higher credit score suggests you’re a lower-risk borrower, which can lead to more favorable interest rates on loans and credit cards, better chances of approval for rental applications, and even lower insurance premiums.

How are credit scores calculated? Several factors contribute to your credit score calculation, with varying levels of impact:

- Payment History (35%): This is the most crucial factor, reflecting whether you pay your bills on time consistently.

- Amounts Owed (30%): This refers to your credit utilization ratio, which is the amount of credit you use compared to your total available credit limit. Keeping your utilization low is generally better for your score.

- Length of Credit History (15%): A longer credit history generally demonstrates a more established track record of responsible credit management.

- Credit Mix (10%): Having a mix of different types of credit, such as credit cards, installment loans, and mortgages, can positively impact your score.

- New Credit (10%): Applying for too much new credit within a short period can lower your score temporarily, as it signals potential risk to lenders.

Building Credit from Scratch

Starting with no credit history can feel like a Catch-22. Lenders want to see a history of responsible borrowing before offering you credit, but how can you build that history without getting credit in the first place? Fortunately, there are several strategies you can use to establish credit from the ground up:

1. Become an Authorized User:

Ask a trusted friend or family member with good credit to add you as an authorized user on their credit card account. This allows their positive credit history to be reported on your credit report, giving you a jumpstart. However, ensure they are responsible with their card as any negative marks will also affect your credit score.

2. Secured Credit Cards:

These cards require a security deposit, which typically becomes your credit limit. This minimizes the lender’s risk and allows you to demonstrate responsible credit card use. Make sure the issuer reports to all three major credit bureaus (Experian, Equifax, and TransUnion).

3. Credit Builder Loans:

These small loans are designed specifically for building credit. You make regular payments, and the lender reports your payment history to the credit bureaus. Once you’ve repaid the loan, you often receive the loan amount back, minus interest and fees.

4. Report Rent and Utility Payments:

While not all credit scoring models factor in these payments, some do. Look for services that report rent and utility payments to credit bureaus, which can help build positive credit history over time.

5. Monitor Your Credit Reports Regularly:

Sign up for free credit monitoring services to track your progress and identify any errors or discrepancies on your credit report. You can access your credit reports for free from each of the three major credit bureaus annually.

Remember, building credit takes time and consistent effort. By using these strategies responsibly, you can establish a positive credit history and set yourself up for future financial success.

Maintaining Good Credit Habits

Building good credit is a marathon, not a sprint. Once you’ve put in the hard work to establish a good credit score, the journey isn’t over. Maintaining good credit habits is crucial for preserving your financial health and ensuring access to favorable terms on loans, credit cards, and other financial products in the future.

Key Habits for Long-Term Credit Health:

- Consistent Payment History: The most crucial aspect of maintaining good credit is to pay all your bills, including credit card bills, loans, and utilities, on time. Set up automatic payments or reminders to avoid late payments.

- Keep Credit Utilization Low: Aim to keep your credit utilization rate, the percentage of available credit you’re using, below 30%. High utilization can signal credit risk to lenders.

- Monitor Your Credit Report Regularly: Check your credit report from all three major credit bureaus (Equifax, Experian, and TransUnion) at least annually. This allows you to identify and address any errors or signs of potential fraud.

- Avoid Unnecessary Credit Applications: Every hard inquiry on your credit report can slightly lower your score. Only apply for credit when you truly need it.

- Maintain a Healthy Credit Mix: Having a mix of credit types, such as credit cards and installment loans, can demonstrate responsible credit management. However, avoid taking on debt just to diversify your credit mix.

- Don’t Close Old Credit Cards: Older credit accounts with good history contribute positively to your credit age, a factor in your credit score.

- Use Credit Responsibly: Only charge what you can afford to pay back in full each month. Avoid overspending and accumulating unnecessary debt.

Repairing Damaged Credit

Having damaged credit can feel like an uphill battle, but it’s important to remember that it’s a fixable situation. With time and effort, you can improve your credit score and regain control of your financial well-being. Here’s how:

1. Review Your Credit Reports

Obtain copies of your credit reports from all three major credit bureaus (Equifax, Experian, and TransUnion). You can get free reports annually from AnnualCreditReport.com. Examine each report thoroughly for inaccuracies, outdated information, or any errors that might be negatively affecting your score.

2. Dispute Errors

If you find any errors on your credit reports, dispute them immediately with the respective credit bureau. Provide documentation to support your claim, and be persistent in following up on the dispute process.

3. Pay Bills On Time

Payment history is a crucial factor in credit score calculations. Make sure to pay all bills on time, including utilities, credit card bills, and loans. Set up reminders or consider automating payments to avoid late fees and negative marks on your credit report.

4. Reduce Credit Utilization

Your credit utilization ratio, the amount of credit you use compared to your total available credit, significantly impacts your score. Aim to keep your credit utilization below 30%. Pay down existing balances strategically and avoid opening new credit accounts unnecessarily.

5. Become an Authorized User

If possible, ask a trusted friend or family member with good credit to add you as an authorized user on one of their credit cards. This can positively impact your score by associating you with their responsible credit behavior. However, ensure the card has a low balance and is managed responsibly, as any negative activity will reflect on your report as well.

6. Seek Professional Guidance

If you’re overwhelmed by the process or need personalized advice, consider consulting a certified credit counselor. They can provide guidance on debt management, budgeting, and strategies for rebuilding your credit.

Monitoring Your Credit Report

Regularly monitoring your credit report is crucial for maintaining good credit health. It allows you to catch errors, identify potential fraud, and track your progress toward your financial goals.

Here’s why credit report monitoring is essential:

- Detect Errors: Credit reports are not immune to errors. Mistakes such as incorrect account balances, late payments that weren’t your fault, or even accounts that don’t belong to you can appear on your report. Monitoring allows you to identify and dispute these errors promptly, preventing them from harming your score.

- Prevent Fraud: In an age of increasing data breaches, identity theft is a real concern. By checking your credit report regularly, you can spot suspicious activity, such as accounts opened in your name without your knowledge. Early detection is key to mitigating the damage caused by fraud.

- Track Your Progress: Monitoring your credit report helps you track the progress you make in improving your score. As you pay down debt, maintain low balances, and demonstrate responsible credit behavior, you’ll see your score rise over time.

Conclusion

Building and maintaining good credit is essential for future financial success. By consistently making on-time payments, keeping credit card balances low, and monitoring your credit report, you can establish a strong credit history that will benefit you in the long run.