Discover effective strategies to successfully expand your business and achieve growth in our comprehensive guide on Business Expansion.

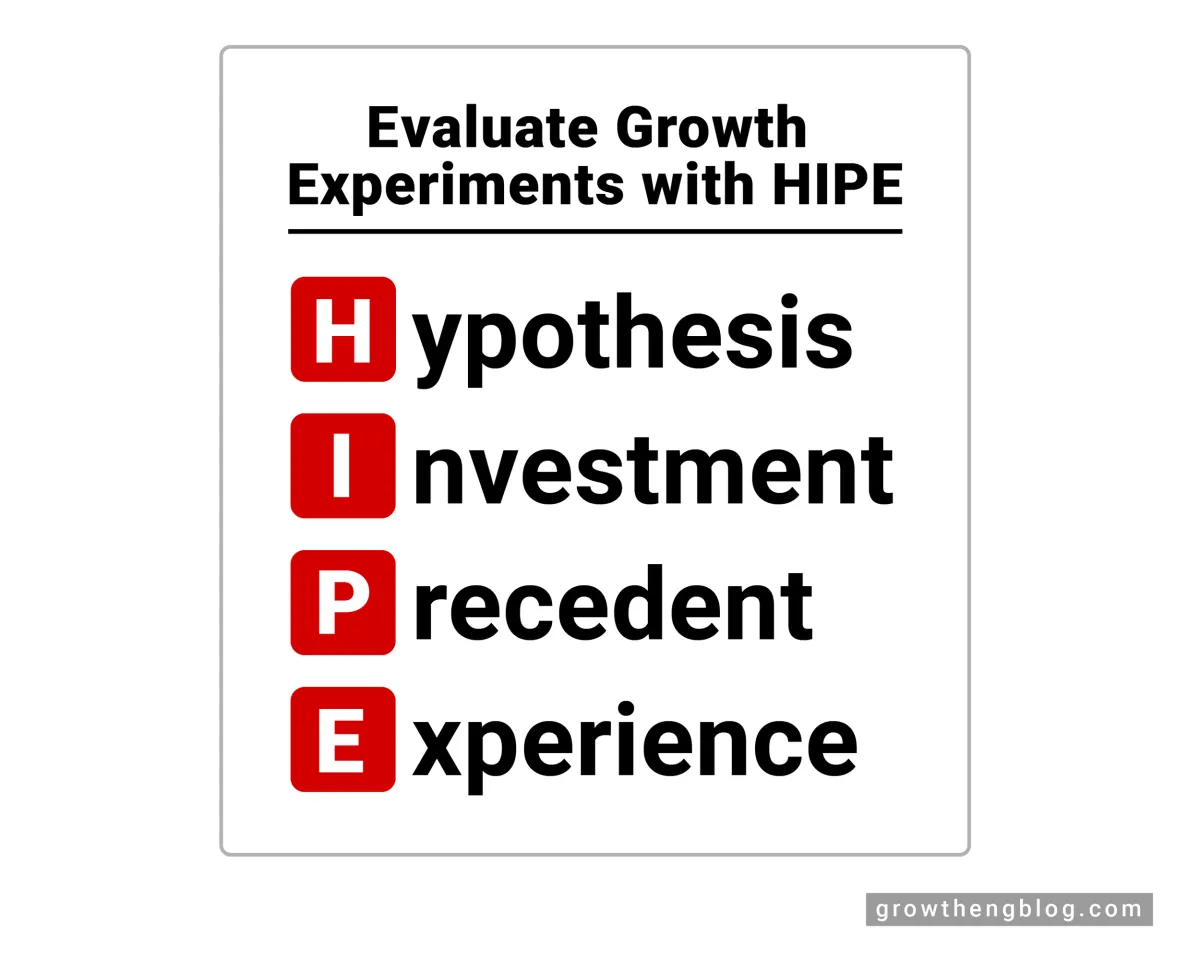

Evaluating Growth Opportunities

Once you’ve established a strong foundation for your business, it’s time to explore avenues for expansion. However, not all growth opportunities are created equal. It’s crucial to carefully evaluate potential avenues to ensure they align with your overall business goals and have a high likelihood of success. Here’s a breakdown of key factors to consider:

1. Market Analysis

Before diving into any expansion strategy, a thorough understanding of your target market is essential. Consider the following:

- Market Size and Growth Potential: Is the market you’re considering large enough to support your expansion goals? Is it a growing market, or is it saturated?

- Competition: Who are your main competitors in this new market? What are their strengths and weaknesses? How will you differentiate yourself?

- Target Audience: Does your target audience in this new market differ from your existing customer base? If so, how will you tailor your products or services to meet their needs?

2. Internal Analysis

While analyzing the external market is critical, evaluating your internal capabilities is equally important. Consider these factors:

- Resources and Capabilities: Do you have the financial resources, human capital, and infrastructure to support expansion? Will you need to invest in new equipment, technology, or talent?

- Operational Efficiency: Can your current operations handle increased demand? Are there processes you need to streamline or automate to ensure a smooth expansion?

- Risk Tolerance: How much risk are you willing to take on? Some growth opportunities might be riskier than others. Assess your comfort level with potential downsides.

3. Financial Projections and ROI

Any growth strategy should be backed by solid financial projections. Consider these aspects:

- Cost of Expansion: What are the upfront costs associated with this opportunity (e.g., marketing, new staff, inventory)?

- Revenue Projections: Realistically, how much revenue do you expect to generate from this expansion, and over what timeframe?

- Return on Investment (ROI): What is the expected ROI for this opportunity? Compare it to other potential investments to prioritize your efforts.

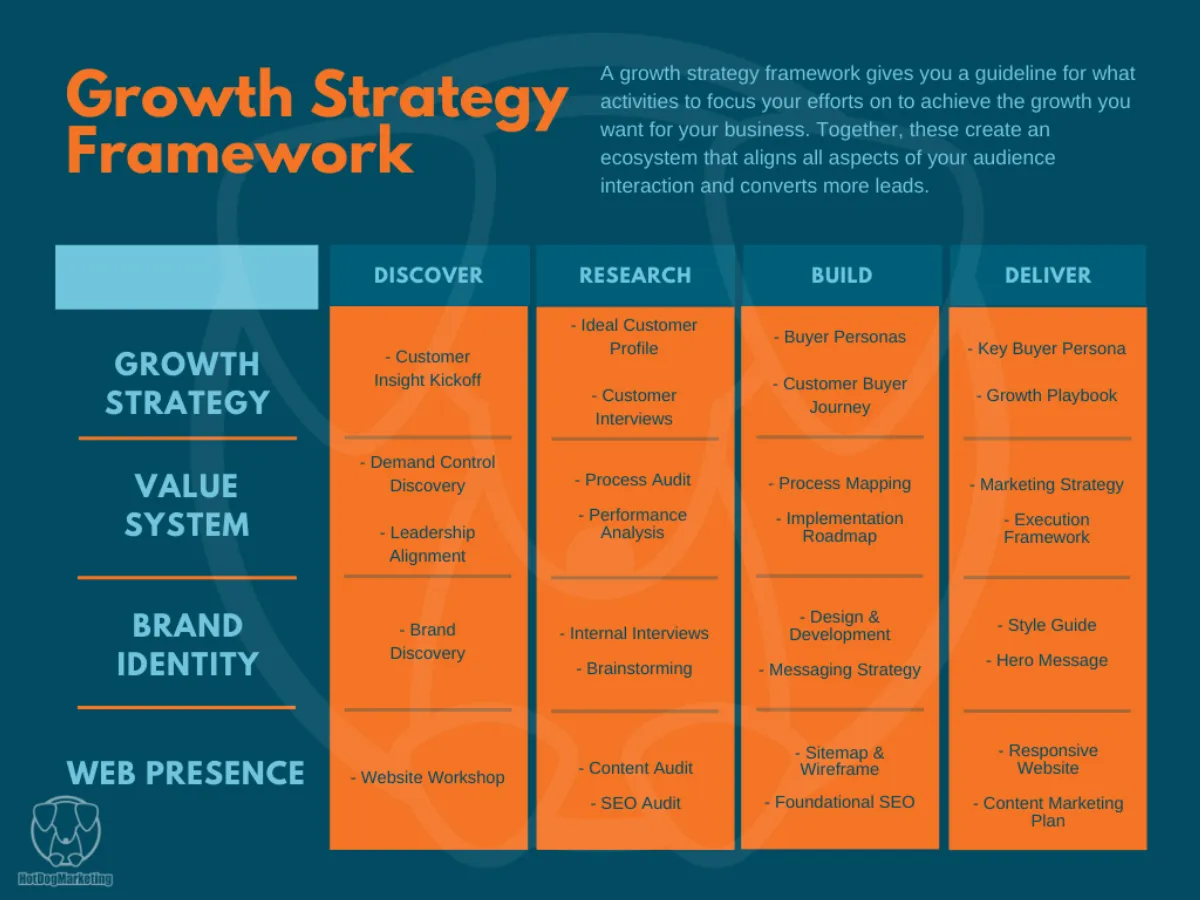

Creating a Growth Plan

A well-defined growth plan is the roadmap to successfully scaling your business. It provides direction and focus, ensuring everyone is aligned on the goals and the steps to achieve them. Here’s how to develop a robust growth plan:

1. Conduct a SWOT Analysis

Begin by understanding your current position. A SWOT analysis helps identify your business’s Strengths, Weaknesses, Opportunities, and Threats. This analysis provides a clear picture of your competitive landscape and areas for potential growth.

2. Set SMART Goals

Define where you want to be. Establish Specific, Measurable, Achievable, Relevant, and Time-bound (SMART) goals. This could include increasing market share, expanding into new markets, or launching new products or services.

3. Identify Growth Strategies

Explore different avenues for achieving your goals. This could include:

- Market Penetration: Increasing sales of existing products to existing markets.

- Market Development: Expanding into new markets with existing products.

- Product Development: Developing new products for existing markets.

- Diversification: Entering new markets with new products.

4. Allocate Resources Effectively

Determine the resources required to execute your chosen strategies. This includes financial resources, human capital, technology, and marketing budget. Prioritize resource allocation based on the potential ROI of each strategy.

5. Develop an Action Plan

Break down each strategy into actionable steps with clear deadlines. Assign responsibilities to specific individuals or teams to ensure accountability.

6. Monitor, Evaluate, and Adapt

Regularly track your progress against the established metrics. Analyze the effectiveness of your strategies and make necessary adjustments based on performance and market changes.

Securing Funding for Expansion

Expanding your business often requires an injection of capital. Identifying and securing the right funding is crucial to supporting your growth plans without crippling your financial stability.

Here are several avenues for securing funding for expansion:

Internal Funding:

- Bootstrapping: Funding expansion through retained profits. Requires careful financial planning and may slow the expansion process.

- Selling Assets: Liquidating unused assets can provide quick capital but needs to be assessed for long-term impact.

External Funding:

- Bank Loans: Traditional lending institutions offer term loans or lines of credit. Requires strong credit history and a solid business plan.

- Small Business Administration (SBA) Loans: Government-backed loans with potentially favorable terms for eligible businesses.

- Equity Financing: Exchanging a share of company ownership for capital from angel investors or venture capitalists.

- Crowdfunding: Raising smaller amounts from a large pool of individuals, often through online platforms. Suitable for specific projects or products.

- Grants: Non-repayable funding awarded by government agencies or organizations for specific purposes. Highly competitive and often require detailed proposals.

Key Considerations When Seeking Funding:

- Creditworthiness: Lenders and investors assess credit history and financial health.

- Business Plan: A comprehensive plan outlining expansion strategies, financial projections, and expected returns is crucial.

- Equity vs. Debt: Understand the implications of each funding option on ownership, control, and financial obligations.

- Funding Amount & Repayment Terms: Secure funding that aligns with your needs and repayment capacity to avoid financial strain.

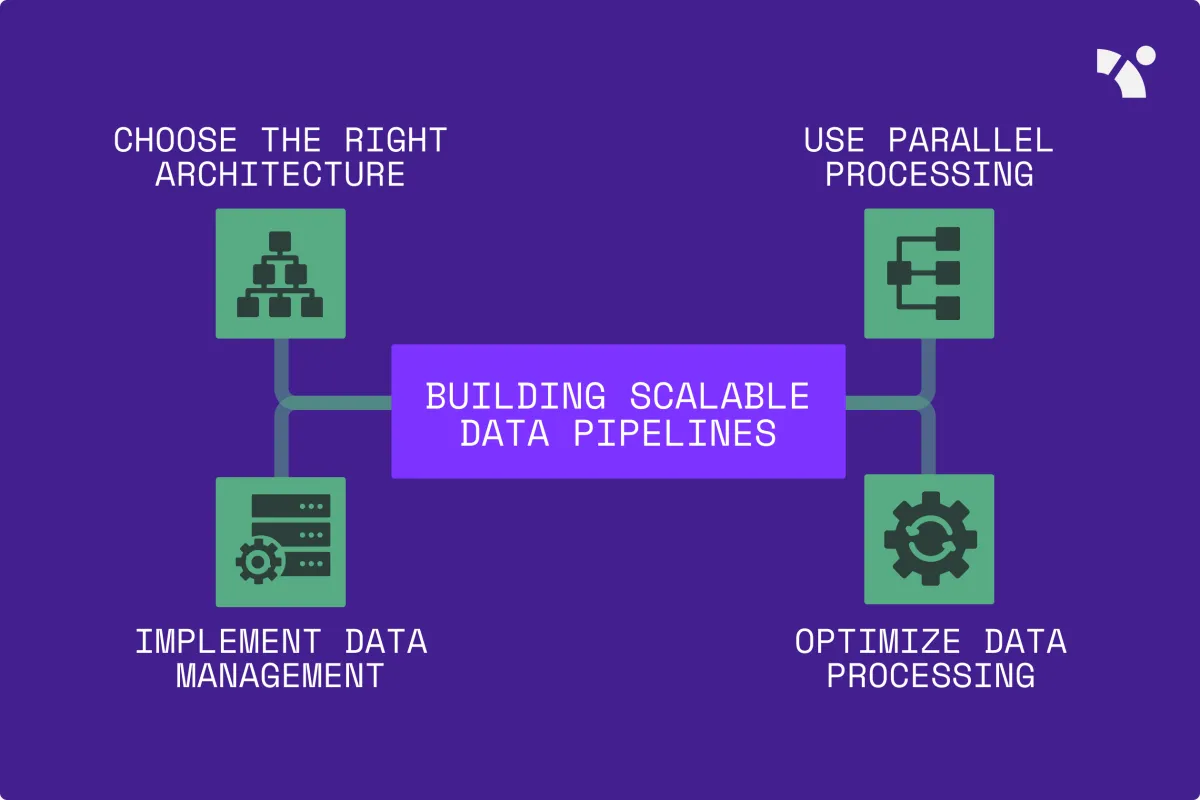

Building a Scalable Infrastructure

As your business expands, it’s crucial that your infrastructure can keep pace. Building a scalable infrastructure means creating systems and processes that can handle increased demand without sacrificing efficiency or performance. This is essential for accommodating growing customer bases, data volumes, and operational complexities.

Here are key aspects to consider:

1. Cloud Computing

Leveraging cloud-based solutions offers unparalleled scalability. Instead of being limited by physical servers, cloud platforms allow you to easily adjust resources as needed. This flexibility means you can scale up or down based on real-time demands, optimizing costs and ensuring consistent performance during peak periods.

2. Automation

Automation is key to managing increased workload without proportional increases in manpower. By automating repetitive tasks like data entry, customer onboarding, or marketing campaigns, you free up your team to focus on strategic initiatives that drive growth.

3. Data Management

With growth comes a surge in data. Implementing robust data management systems is vital for storing, organizing, and analyzing this information effectively. A well-designed data infrastructure provides valuable insights to inform business decisions, optimize operations, and personalize customer experiences.

4. Flexible Technology Stack

Avoid getting locked into rigid technology solutions. Instead, opt for a flexible technology stack that can adapt to your evolving needs. Choose software and tools that integrate well with each other and offer the potential for customization and expansion as your business grows.

Entering New Markets

Expanding your business into new markets can be an exciting and lucrative endeavor. However, it also comes with its own set of challenges and risks. To increase your chances of success, a well-planned and executed market entry strategy is crucial. Here are some key considerations:

1. Market Research and Selection:

Thorough market research is paramount. Identify potential markets that align with your products or services. Consider factors like:

- Market size and growth potential

- Target audience demographics and needs

- Competitive landscape

- Economic and political stability

- Legal and regulatory environment

2. Entry Mode:

Determine the most suitable entry mode based on your resources, risk tolerance, and the specific market. Common options include:

- Exporting: Selling products directly to the new market.

- Licensing or Franchising: Granting rights to a local entity to use your brand and business model.

- Joint Venture: Partnering with a local company to share resources and expertise.

- Foreign Direct Investment (FDI): Establishing a wholly owned subsidiary or acquiring a local company in the new market.

3. Marketing and Sales Strategy:

Adapt your marketing and sales efforts to resonate with the local culture and consumer behavior. Consider:

- Language localization

- Cultural nuances and preferences

- Effective marketing channels

- Pricing strategies

- Building relationships with local partners and distributors

4. Operations and Logistics:

Establish efficient operational processes to support your expansion. This includes:

- Sourcing and supply chain management

- Distribution and logistics networks

- Customer service and support

5. Legal and Regulatory Compliance:

Navigate the legal and regulatory landscape of the new market. This includes:

- Incorporating your business

- Obtaining necessary permits and licenses

- Complying with tax laws

- Understanding labor regulations

Monitoring and Adjusting Your Strategy

Creating a comprehensive business expansion strategy is a crucial first step, but it’s not enough to guarantee success. The business landscape is constantly evolving, and your strategy needs to adapt along with it. Regular monitoring and adjustment are essential to keep your expansion on track and maximize your chances of achieving your growth objectives.

Key Performance Indicators (KPIs)

Identifying and tracking the right KPIs is paramount to effective monitoring. These metrics provide insights into the performance of your expansion efforts. Select KPIs that align directly with your expansion goals, whether it’s increased market share, revenue growth in new markets, or successful product line diversification. Some examples of relevant KPIs include:

- Revenue growth in new markets

- Customer acquisition cost in new demographics

- Market share percentage in the expanded area

- Customer satisfaction ratings from new markets

- Return on investment (ROI) for expansion initiatives

Regular Review and Analysis

Establish a regular schedule for reviewing your KPIs. This frequency depends on the nature of your business and the pace of your expansion, but monthly or quarterly reviews are often suitable. Analyze the data to identify trends, both positive and negative. Are you hitting your projected targets? If not, where are the discrepancies, and what factors might be contributing to them?

Flexibility and Adaptation

Don’t be afraid to adjust your strategy based on the insights gained during monitoring. Business environments are dynamic, and what worked initially might need modification. Flexibility is key to navigating unforeseen challenges and capitalizing on emerging opportunities. This might involve:

- Adjusting your marketing strategies for new demographics.

- Revising your pricing strategy based on competitor analysis.

- Refining your product or service offerings for the new market.

- Modifying your expansion timeline based on market conditions.

Seeking External Input

Consider seeking external feedback on your strategy. This could involve consultants, industry experts, or even feedback from customers in your new market. An outsider’s perspective can provide valuable insights and identify blind spots in your approach.

By embracing monitoring and adjustment as ongoing processes, you can ensure your business expansion strategy remains relevant, responsive, and ultimately successful in achieving your desired growth.

Conclusion

In conclusion, implementing effective strategies and proper planning are crucial for successful business expansion. By focusing on market research, financial stability, and customer satisfaction, companies can achieve sustainable growth and stay competitive in the market.