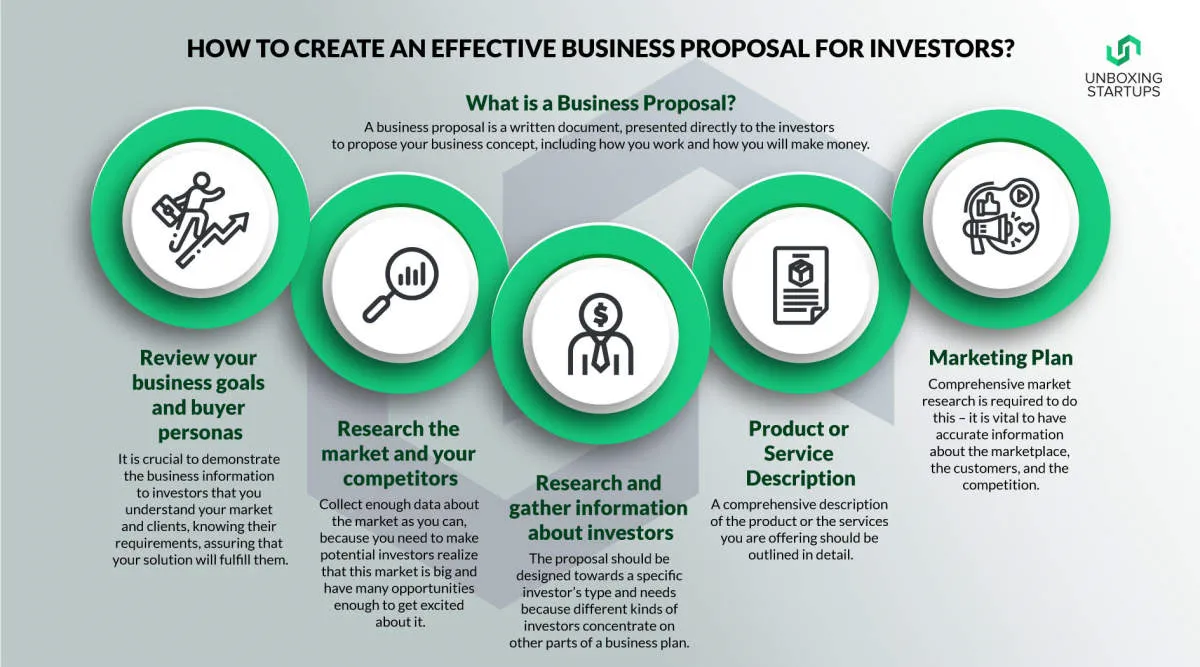

Learn how to create a compelling business plan that will capture the attention of investors. From executive summaries to financial projections, discover key strategies to attract potential investors to your business venture.

Importance of a Business Plan

A business plan is a crucial document that outlines your business goals, strategies, and how you plan to achieve them. It serves as a roadmap for your company’s future and is essential for attracting investors and securing funding.

Here’s why a business plan is so important, especially for attracting investors:

1. Demonstrates Viability and Potential

Investors are looking for businesses with strong growth potential and a clear path to profitability. A well-structured business plan provides a comprehensive analysis of your target market, competitive landscape, and financial projections. It showcases the viability of your business idea and its potential for success, convincing investors that their investment is worthwhile.

2. Communicates Your Vision and Strategy

A business plan effectively communicates your vision, mission, and long-term goals to potential investors. It outlines your business model, value proposition, and competitive advantage, demonstrating a clear understanding of your industry and target audience. A compelling business plan helps investors align with your vision and builds confidence in your ability to execute your strategy.

3. Provides a Basis for Financial Projections

Investors need to see realistic financial projections to assess the potential return on their investment. Your business plan should include detailed financial statements, such as income statements, cash flow projections, and balance sheets. These projections demonstrate your understanding of revenue streams, expenses, and profitability, giving investors a clear picture of the financial health and potential of your business.

4. Mitigates Risk

A well-crafted business plan identifies potential risks and outlines strategies to mitigate them. By addressing challenges upfront, you demonstrate to investors that you have considered potential obstacles and have plans in place to overcome them. This proactive approach minimizes investor risk and instills confidence in your ability to navigate uncertainty.

5. Serves as a Management Tool

Beyond attracting investors, a business plan serves as a valuable management tool. It helps you track progress, measure performance, and make informed decisions as your business grows. Regularly reviewing and updating your plan ensures you stay on track and adapt to changing market conditions.

Executive Summary

A compelling business plan is essential for attracting investors and securing funding for your venture. This plan serves as a roadmap, outlining your business goals, strategies, and potential for success. It provides investors with the critical information they need to evaluate the viability of your business and make informed investment decisions. This article serves as a guide to crafting a powerful business plan that captures the attention of investors and inspires confidence in your vision.

We will explore the key components of a winning business plan, including a compelling executive summary, thorough market analysis, and a realistic financial plan. By following the outlined steps and strategies, you can create a persuasive document that showcases the strength of your business idea and attracts the necessary capital to turn your entrepreneurial dreams into reality.

Market Analysis

A robust market analysis is an essential part of a business plan aimed at attracting investors. It provides potential funders with a clear understanding of your target market, competitive landscape, and industry trends, giving them the confidence to invest in your vision. Here’s what your market analysis section should cover:

1. Target Market Definition

Clearly define your ideal customer. Go beyond basic demographics and delve into their psychographics – their values, interests, and motivations. This demonstrates a deep understanding of who you’re selling to and why they would choose your product or service.

2. Market Size and Growth Potential

Investors want to see a substantial and growing market. Provide data on the overall market size, projected growth rate, and key trends driving this growth. This substantiates the opportunity and potential for return on investment.

3. Competitive Analysis

Identify and analyze your main competitors. Outline their strengths and weaknesses, pricing strategies, market share, and competitive advantages. More importantly, explain how you differentiate yourself and why you have a competitive edge.

4. Market Segmentation

Divide your target market into smaller segments with shared characteristics. This showcases a strategic approach to reaching specific customer groups with tailored marketing messages and offerings.

5. Market Needs and Trends

Highlight the existing needs and demands within your target market. Additionally, discuss relevant industry trends, technological advancements, or regulatory changes that might impact your business positively or negatively.

6. Marketing and Sales Strategy

Briefly outline your plan for reaching your target market. This includes your marketing channels, sales approach, pricing strategy, and distribution model. This demonstrates a clear path to market penetration and revenue generation.

By providing a thorough and data-driven market analysis, you can convince investors that your business is positioned for success in a lucrative and well-understood market.

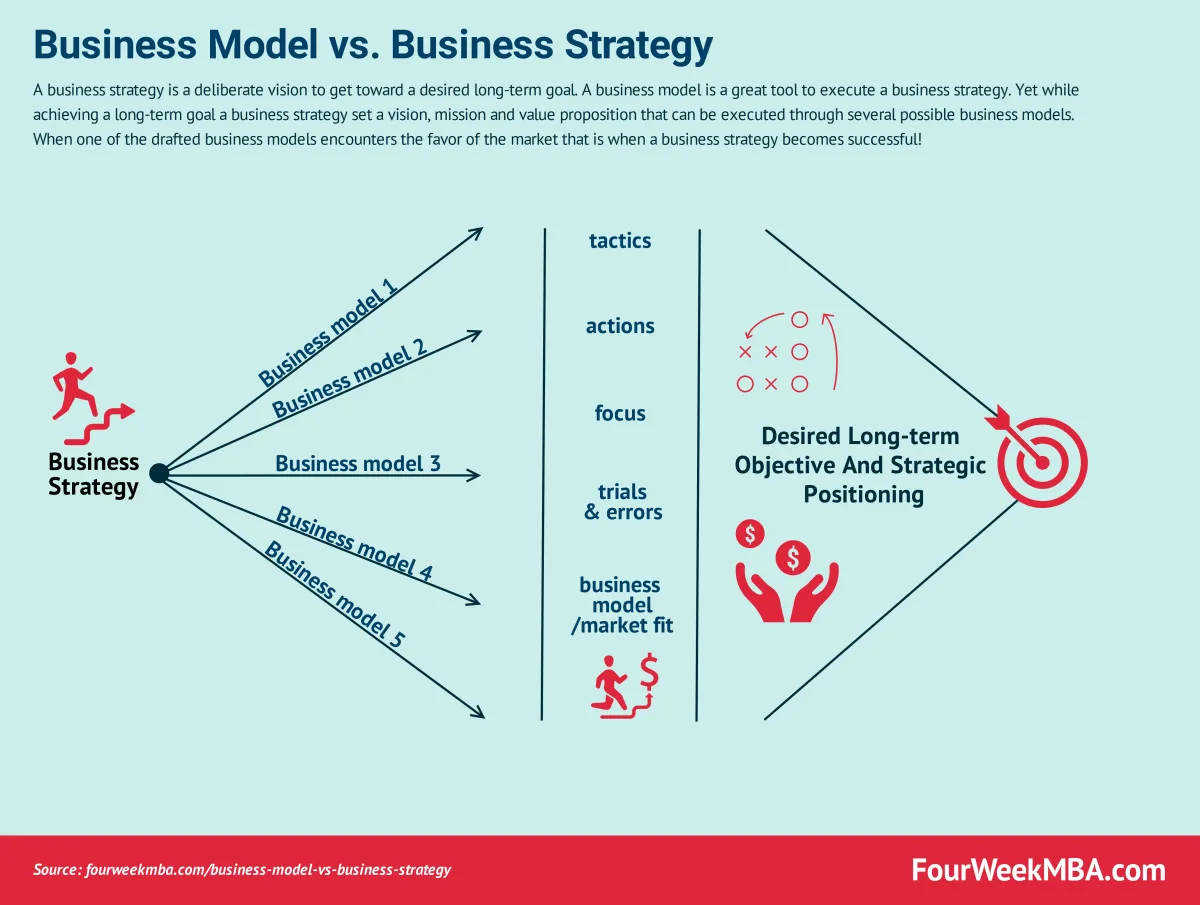

Business Model and Strategy

This section is the heart of your business plan. It’s where you paint a clear picture of how your business will operate and achieve its goals. Investors want to see a well-defined path to profitability, and that’s precisely what this section provides.

1. Business Model Canvas

Consider using the Business Model Canvas framework to outline your business model. This visual tool breaks down your business into key components:

- Customer Segments: Who are you targeting?

- Value Propositions: What problem do you solve for your customers?

- Channels: How will you reach your customers?

- Customer Relationships: How will you acquire and retain customers?

- Revenue Streams: How will you make money?

- Key Activities: What are the most important things your business needs to do?

- Key Resources: What resources do you need to operate your business?

- Key Partnerships: Who are your critical partners?

- Cost Structure: What are your main costs?

2. Competitive Advantage

Clearly articulate what sets your business apart from the competition. This could be:

- Unique technology or innovation

- A superior business model

- Strong branding and customer loyalty

- Exclusive partnerships or distribution channels

- A highly skilled and experienced team

3. Go-to-Market Strategy

Detail your plan for reaching your target market and acquiring customers. Address:

- Marketing and Sales Channels: How will you generate leads and close deals (e.g., online advertising, content marketing, direct sales)?

- Pricing Strategy: How will you price your products or services (e.g., cost-plus, value-based, competitive)?

- Sales and Distribution: Will you sell directly, through partners, or a combination?

4. Scalability

Investors are looking for businesses with the potential for significant growth. Demonstrate how your business model can scale efficiently to meet increasing demand without a proportional increase in costs.

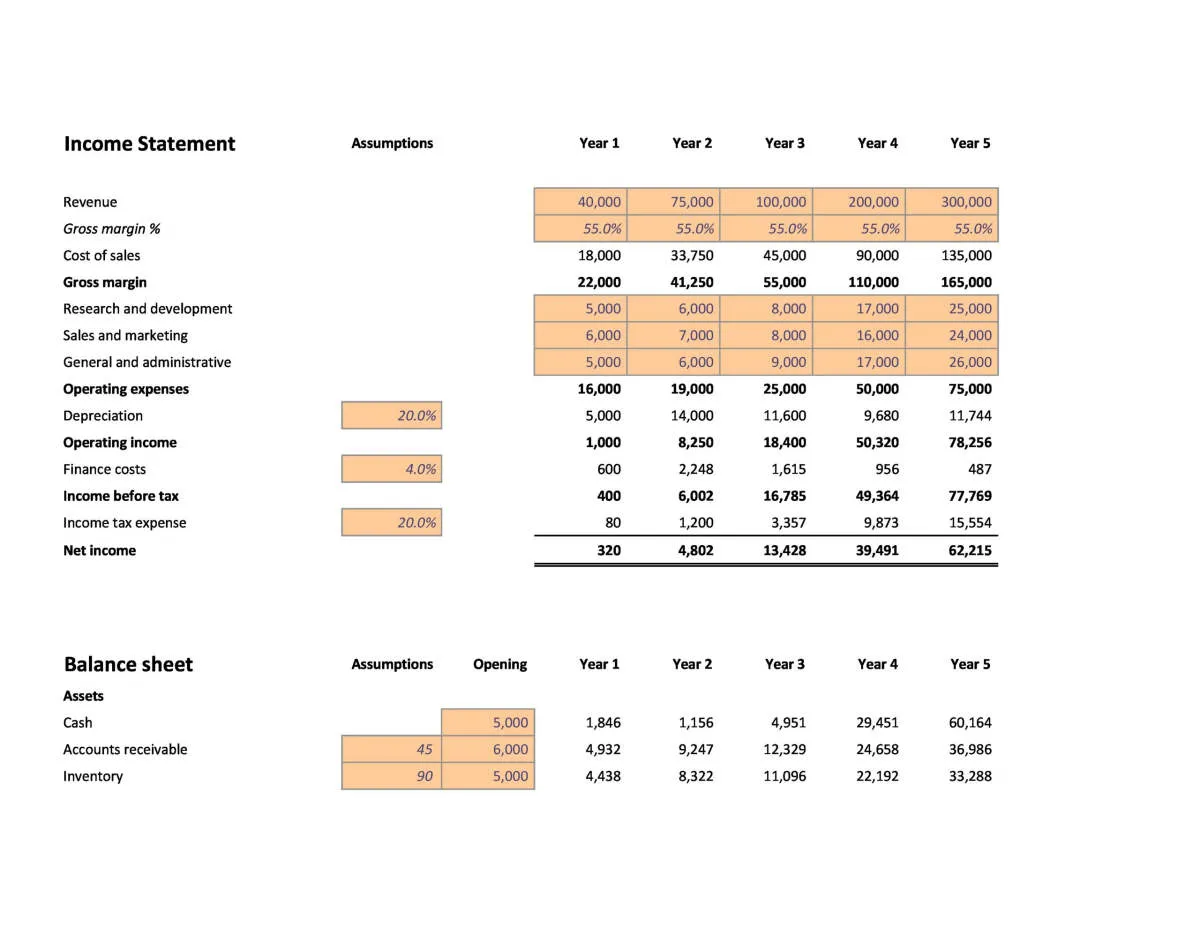

Financial Projections

Financial projections are a crucial part of your business plan, providing potential investors with a clear picture of your company’s financial future. This section needs to be comprehensive and credible, demonstrating your understanding of the market and your ability to generate returns.

Key Components to Include:

- Income Statement Projections: Project your revenues, cost of goods sold, and operating expenses over the next 3-5 years. Be realistic and back up your assumptions with market research and industry benchmarks.

- Cash Flow Projections: Detail the inflow and outflow of cash in your business. This is critical for investors to understand your burn rate, runway, and ability to meet financial obligations.

- Balance Sheet Projections: Provide a snapshot of your projected assets, liabilities, and equity at different points in time. This demonstrates your understanding of your company’s financial position.

- Key Financial Metrics: Highlight important ratios and metrics such as gross margin, net profit margin, customer acquisition cost, and customer lifetime value. These offer insights into your business’s profitability and efficiency.

- Funding Requirements and Use of Funds: Clearly state how much funding you’re seeking and how you plan to utilize the capital. Explain how the investment will fuel growth and achieve your milestones.

Tips for Compelling Financial Projections:

- Be Realistic and Data-Driven: Avoid overly optimistic assumptions. Base your projections on thorough market research, competitor analysis, and historical data where applicable.

- Clearly State Assumptions: Investors need to understand the basis of your projections. Outline key assumptions you’ve made regarding market growth, pricing, and expenses.

- Provide Multiple Scenarios: Include best-case, most likely, and worst-case scenarios to showcase your preparedness and flexibility.

- Use Visual Aids: Graphs and charts can enhance the clarity and impact of your financial projections, making it easier for investors to grasp key trends and insights.

- Seek Professional Help: Consider consulting with an accountant or financial advisor to ensure accuracy and credibility in your projections.

Preparing for Investor Meetings

You’ve crafted a compelling business plan designed to attract investors. Now, it’s time to prepare for the crucial investor meetings. This stage is your opportunity to bring your business plan to life and make a lasting impression.

1. Research Your Audience

Before stepping into any investor meeting, conduct thorough research on the investors you’ll be meeting. Understand their investment focus, portfolio companies, and track record. Look for any common ground you share, such as industry experience or investment interests. This knowledge will help you tailor your pitch to their specific priorities and demonstrate your preparedness.

2. Craft a Clear and Concise Pitch

Your pitch is your story. It should be a clear and concise narrative that captures the essence of your business plan. Focus on the problem you’re solving, your solution, your target market, your competitive advantage, and your team’s expertise. Importantly, articulate your financial projections and the investment opportunity. Keep your pitch deck visually appealing, informative, and to the point.

3. Anticipate and Address Questions

Investors will likely have questions about your business plan. Anticipate the questions they might ask and prepare clear, compelling answers. Be ready to discuss your financials in detail, your revenue model, your marketing strategy, and your competitive landscape. Practice your responses to ensure you come across as knowledgeable and confident.

4. Build Rapport and Connections

Investor meetings are not solely about presenting numbers; they’re also about building relationships. Investors invest in people as much as ideas. Be authentic, enthusiastic, and passionate about your business. Demonstrate strong communication skills and make an effort to connect with the investors on a personal level.

5. Follow Up Strategically

After the meeting, send a personalized thank-you note reiterating your key points and expressing your continued interest. If you promised to provide additional information, follow up promptly. Stay in touch with the investors and keep them updated on your progress. Building strong relationships takes time and effort, so be persistent and professional in your communications.

Conclusion

Developing a business plan that resonates with investors requires thorough research, clear articulation of your value proposition, and a compelling financial forecast. By incorporating these elements, your business plan can attract the right investors and support the growth of your venture.