Learn how to build a diversified investment portfolio to minimize risk and maximize returns. Discover the key principles and strategies to achieve a well-rounded investment mix that aligns with your financial goals.

Importance of Diversification

Diversification is an essential principle in building a resilient investment portfolio. It involves spreading your investments across different asset classes, sectors, industries, and geographical regions. This strategic allocation of your capital aims to mitigate risk by reducing the impact of potential losses in any single investment or asset class.

Here’s why diversification is crucial:

1. Risk Management

The most significant benefit of diversification is its ability to reduce overall portfolio volatility. By investing in assets that are not perfectly correlated, meaning they don’t move in the same direction at the same time, you can cushion the impact of market fluctuations. When one investment declines in value, others may rise or remain stable, offsetting potential losses and stabilizing your portfolio’s performance.

2. Potential for Enhanced Returns

While diversification is primarily associated with risk management, it can also enhance your potential for returns. Different asset classes and sectors tend to perform differently over time. By diversifying, you gain exposure to a wider range of investment opportunities and increase the likelihood of capturing positive returns from various market segments.

3. Long-Term Growth

A well-diversified portfolio is better positioned for long-term growth. By reducing the impact of short-term market swings, diversification allows you to stay invested and benefit from the power of compounding over time. Even small gains can accumulate significantly over the long term, contributing to the overall growth of your investments.

4. Reduced Emotional Investing

Market fluctuations are inevitable, and emotional reactions to these swings can lead to impulsive investment decisions. When your portfolio is diversified, the impact of losses in any one area is minimized, reducing the likelihood of making rash decisions based on fear or panic. This emotional stability promotes a more disciplined and rational approach to investing.

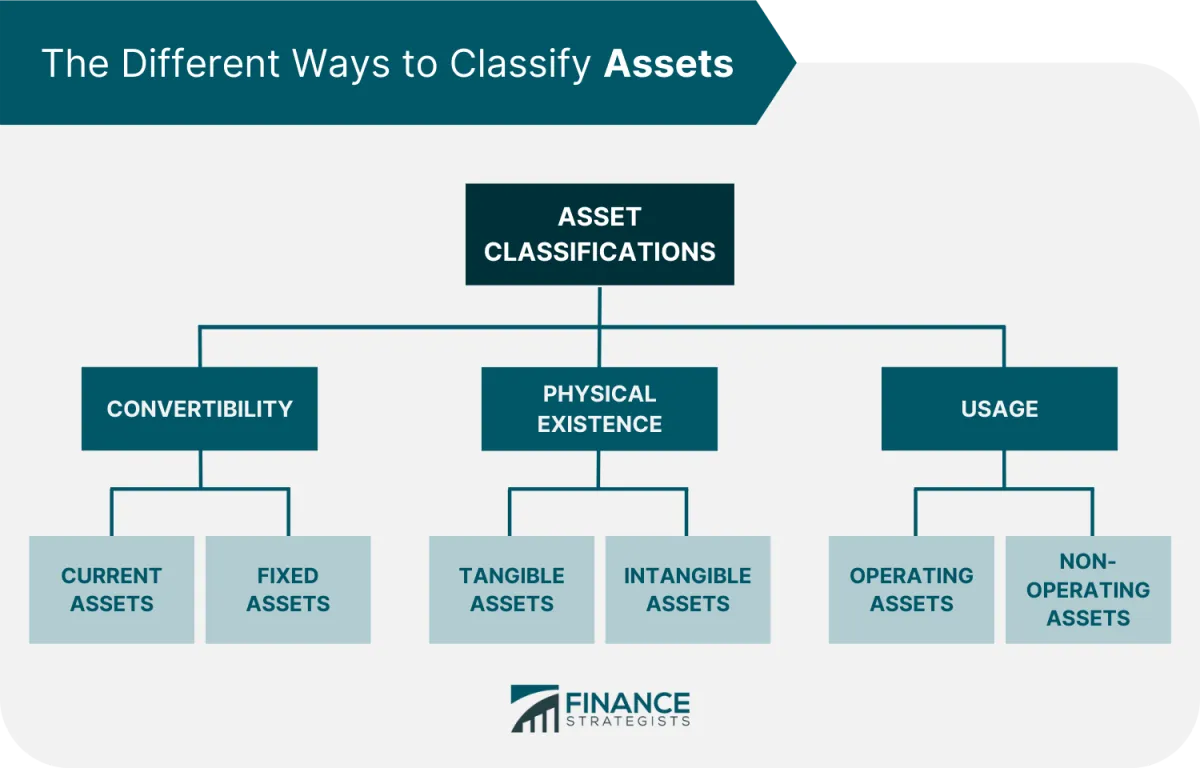

Types of Investment Assets

Building a diversified investment portfolio requires understanding the variety of asset classes available. Each comes with its own risk and return characteristics. Here’s a breakdown of some common investment assets:

1. Stocks (Equities)

Stocks represent ownership in publicly traded companies. When you buy a stock, you’re buying a small piece of that company. Stocks offer the potential for high returns over the long term, but also come with higher volatility and risk compared to other asset classes.

2. Bonds (Fixed Income)

Bonds are essentially loans you make to governments or corporations. When you buy a bond, you’re lending money in exchange for regular interest payments (coupon payments) and the return of your principal at maturity. Bonds are generally considered less risky than stocks but offer lower potential returns.

3. Real Estate

Investing in real estate involves purchasing physical properties like residential homes, commercial buildings, or land. Real estate can provide rental income, potential appreciation in value, and act as a hedge against inflation. However, it requires significant capital, can be illiquid, and comes with property management responsibilities.

4. Cash and Cash Equivalents

This category includes highly liquid assets like savings accounts, money market accounts, and short-term certificates of deposit (CDs). These options offer safety and stability but typically come with very low returns, often failing to outpace inflation.

5. Commodities

Commodities are raw materials or primary agricultural products, such as gold, oil, natural gas, corn, or coffee. Investing in commodities can be done directly through futures contracts or indirectly through exchange-traded funds (ETFs). Commodity prices are often volatile and influenced by factors like supply and demand, geopolitical events, and weather patterns.

6. Alternative Investments

This broad category includes investments beyond traditional asset classes. Examples include private equity, hedge funds, venture capital, collectibles, and precious metals. Alternative investments often have high minimum investment requirements, limited historical data, and may be less liquid than traditional investments. They offer diversification potential but also come with higher risks.

Building Your Portfolio

Building a diversified investment portfolio is an ongoing process that requires careful planning and regular adjustments. Here’s a step-by-step approach to guide you:

1. Define Your Investment Goals and Risk Tolerance:

Before you start investing, clarify your financial goals. Are you aiming for long-term growth, saving for retirement, or seeking short-term gains? Understanding your investment timeline and risk appetite is crucial for making appropriate investment choices.

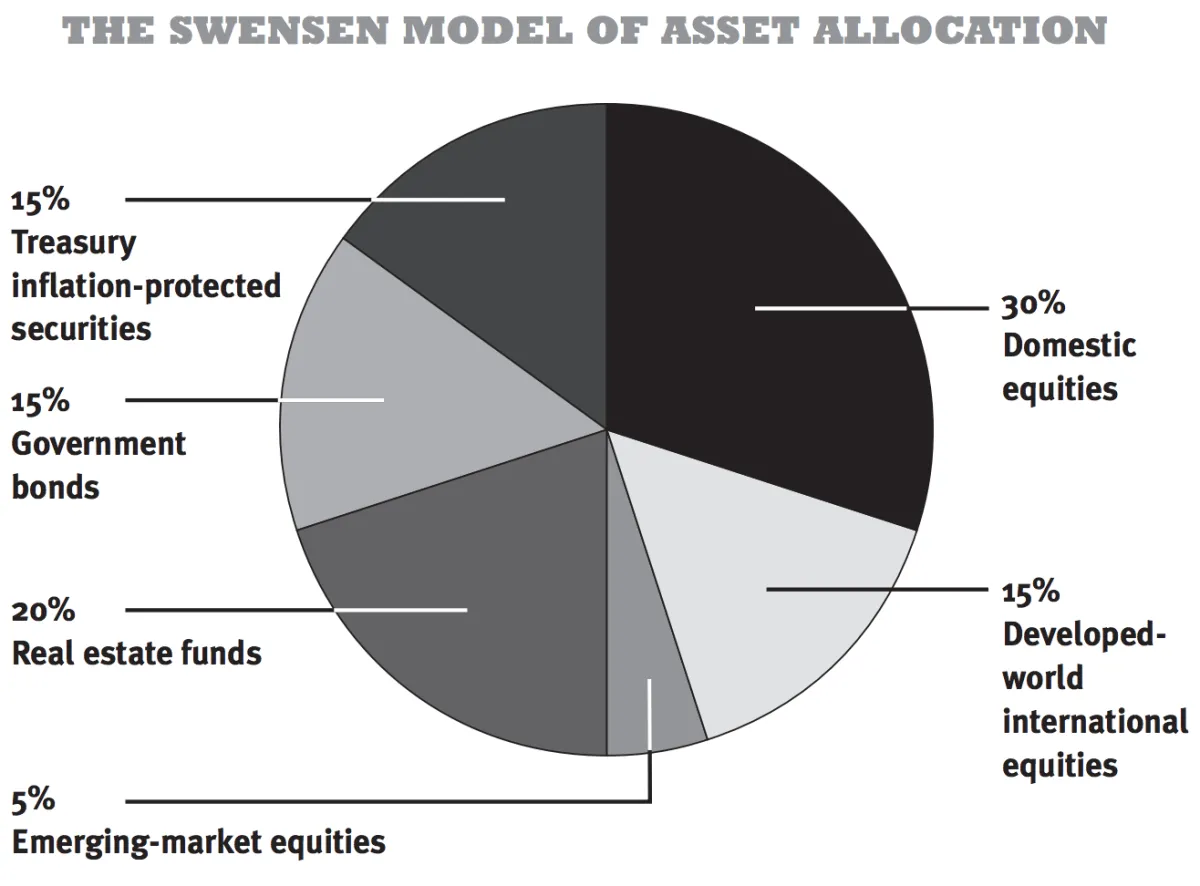

2. Determine Your Asset Allocation:

Asset allocation involves dividing your investment capital among different asset classes such as stocks, bonds, and real estate. The specific allocation will depend on your risk tolerance, time horizon, and financial goals. A well-diversified portfolio typically includes a mix of asset classes to mitigate risk and optimize returns.

3. Choose Your Investments:

Once you’ve determined your asset allocation, you can start selecting specific investments within each asset class. Consider factors such as:

- Stocks: Large-cap vs. small-cap, growth vs. value, domestic vs. international

- Bonds: Government vs. corporate, short-term vs. long-term

- Real Estate: Rental properties, REITs

- Other Alternatives: Commodities, precious metals, cryptocurrencies (consider these with caution due to volatility)

4. Diversify Within Asset Classes:

Don’t put all your eggs in one basket. Within each asset class, diversify further by investing in a variety of sectors, industries, and geographical regions. This helps to reduce the impact of any single investment performing poorly.

5. Regular Portfolio Review and Rebalancing:

Your investment portfolio is not static. It’s essential to review it periodically and make adjustments as needed. Market fluctuations can cause your initial asset allocation to drift, so rebalancing helps maintain your desired risk level and aligns with your long-term goals.

Balancing Risk and Reward

Building a diversified investment portfolio is about more than just choosing a variety of assets. It’s about strategically balancing potential risks and rewards to align with your financial goals, time horizon, and risk tolerance.

Understanding Risk Tolerance: Before diving into asset allocation, it’s crucial to assess your risk tolerance. This essentially means how comfortable you are with the possibility of your investments fluctuating in value. Are you someone who prioritizes preserving capital, even if it means lower returns? Or are you comfortable with higher volatility in pursuit of potentially higher gains?

The Risk-Return Spectrum: Generally, investments with higher potential returns come with higher risk, and vice versa. For example:

- Stocks: Offer the potential for high growth but can also experience significant volatility.

- Bonds: Generally considered less risky than stocks, offering more stable income but potentially lower returns.

- Real Estate: Can provide steady cash flow and long-term appreciation but is less liquid than stocks or bonds.

Diversification is Key: Spreading your investments across different asset classes is essential for managing risk. This doesn’t guarantee profits or eliminate losses, but it can help mitigate the impact of any one investment performing poorly.

Time Horizon Matters: Your investment time horizon, or how long you plan to invest, significantly influences your asset allocation. If you have a longer time horizon, you can typically tolerate more risk as you have more time to recover from potential losses.

Regularly Reviewing and Rebalancing

Creating a diversified investment portfolio isn’t a “set it and forget it” task. Markets fluctuate, your financial goals evolve, and the risk you’re comfortable taking may change over time. That’s why regularly reviewing and, if necessary, rebalancing your portfolio is crucial for long-term success.

Reviewing Your Portfolio:

Aim to review your portfolio at least once a year, or more frequently if there are significant market movements or changes in your personal circumstances. During your review, consider the following:

- Performance: How have your investments performed relative to each other and the overall market?

- Asset Allocation: Has your target asset allocation drifted due to market fluctuations?

- Risk Tolerance: Has your risk appetite increased or decreased?

- Financial Goals: Are you on track to meet your short-term and long-term financial goals?

Rebalancing Your Portfolio:

Rebalancing involves buying or selling assets to bring your portfolio back to your desired asset allocation. For example, if your stocks have outperformed your bonds, you might sell some stocks and buy more bonds to maintain your target allocation.

There are two main approaches to rebalancing:

- Calendar-based rebalancing: Rebalance your portfolio at set intervals, such as quarterly or annually.

- Threshold-based rebalancing: Rebalance whenever an asset class deviates from your target allocation by a certain percentage.

The best approach for you depends on your individual circumstances and risk tolerance.

Common Diversification Mistakes

While diversification is a key element of a successful investment strategy, many investors make critical errors in their approach. Here are some common diversification mistakes to avoid:

1. Over-diversification:

More is not always better when it comes to diversification. Holding too many investments can dilute potential returns and make it difficult to track and manage your portfolio effectively. Aim for a well-balanced portfolio, not necessarily the largest one.

2. Ignoring Asset Allocation:

Simply owning a variety of investments doesn’t guarantee diversification. You need to consider the right mix of asset classes (stocks, bonds, real estate, etc.) that align with your risk tolerance and investment goals.

3. Confusing Correlation with Diversification:

It’s crucial to understand how different assets behave in relation to each other. Owning investments that tend to move in the same direction (high correlation) doesn’t offer true diversification, even if they seem different on the surface.

4. Neglecting Rebalancing:

Your portfolio’s asset allocation can drift over time as some investments perform better than others. Regularly rebalancing involves selling a portion of over-performing assets and buying under-performing ones to maintain your desired asset mix and risk level.

5. Chasing Past Performance:

Don’t fall into the trap of solely relying on past returns when selecting investments. Just because an asset class or sector has performed well recently doesn’t mean it will continue to do so. Focus on your long-term investment strategy and diversification principles.

Conclusion

Creating a diversified investment portfolio is essential for risk management and potential growth. By spreading investments across different asset classes, you can increase your chances of achieving long-term financial goals while minimizing exposure to volatility.