Explore the dynamic landscape of investment opportunities in emerging markets and navigate the interplay between risks and rewards. Discover the potential for growth and the challenges that investors face in these evolving economies.

Understanding Emerging Markets

Emerging markets represent a compelling investment landscape, characterized by their dynamic growth trajectories and evolving economic structures. These markets are typically found in countries experiencing rapid industrialization, economic liberalization, and structural reforms. While the specific criteria for classification may vary, common characteristics of emerging markets include:

- Accelerated Economic Growth: Emerging markets often exhibit higher GDP growth rates compared to their developed counterparts, driven by factors such as industrialization, urbanization, and rising productivity.

- Evolving Infrastructure: Significant investments in infrastructure, including transportation, energy, and telecommunications, are characteristic of emerging markets. These investments support economic expansion and attract foreign direct investment.

- Expanding Middle Class: Rising incomes and a growing middle class fuel consumption and demand across various sectors, creating investment opportunities in consumer goods, healthcare, and other industries.

- Structural Reforms: Many emerging markets are undergoing structural reforms aimed at improving governance, enhancing transparency, and fostering a more business-friendly environment.

- Increased Integration into the Global Economy: Emerging markets are becoming increasingly integrated into the global economy through trade, investment, and participation in international institutions.

Investing in emerging markets offers the potential for significant returns, driven by these growth drivers. However, it is crucial to acknowledge the inherent risks associated with these markets, which include political instability, currency fluctuations, and regulatory uncertainties. A comprehensive understanding of these risks and rewards is essential for making informed investment decisions.

Benefits of Investing in Emerging Markets

Investing in emerging markets presents an array of potential benefits for investors seeking growth and diversification beyond developed economies. Here are some key advantages:

1. High Growth Potential

Emerging markets typically experience faster economic growth rates compared to their developed counterparts. This growth is often driven by factors like rapid industrialization, increasing urbanization, and a burgeoning middle class. As these economies expand, companies operating within them have the potential to generate substantial profits, translating into attractive returns for investors.

2. Diversification Benefits

Adding emerging market assets to a portfolio can reduce overall portfolio risk through diversification. Emerging markets often have different economic cycles and market dynamics compared to developed markets. This means that when one market is performing poorly, another may be performing well, smoothing out overall returns and reducing volatility.

3. Favorable Demographics

Many emerging markets have young and growing populations, leading to a demographic dividend. A larger working-age population can drive economic growth, increase consumer spending, and contribute to a vibrant and expanding market for businesses.

4. Untapped Potential and Innovation

Emerging markets are fertile ground for innovation. With increasing access to technology and a drive to catch up with developed nations, these economies often witness the emergence of new business models, disruptive technologies, and creative solutions to local challenges. Investing in such an environment can expose investors to cutting-edge companies and industries.

5. Currency Appreciation Potential

As emerging markets grow and mature, their currencies often appreciate in value. This can provide an additional layer of returns for foreign investors, as their investments increase in value when converted back to their home currency. However, it’s important to note that currency fluctuations can also work against investors.

Identifying Investment Opportunities

Successfully navigating investment opportunities in emerging markets requires careful research and due diligence. While high-growth potential exists, understanding the specific dynamics of each market is crucial. Here are key areas to consider:

1. Macroeconomic Indicators:

Analyze a country’s economic fundamentals, including:

- GDP growth: Sustained growth can indicate investment potential.

- Inflation rates: High or volatile inflation can erode returns.

- Interest rates: Central bank policies impact borrowing costs and investment attractiveness.

- Currency stability: Fluctuations can affect investment value.

2. Sector-Specific Analysis:

Identify promising sectors within an emerging market, such as:

- Technology: Rapidly growing middle classes and increasing digital penetration drive tech adoption.

- Consumer goods: Rising disposable incomes create demand for consumer products.

- Healthcare: Expanding populations and increasing healthcare needs fuel growth in this sector.

- Infrastructure: Emerging economies often require significant infrastructure development, presenting investment opportunities.

3. Company Research:

Thoroughly evaluate individual companies within chosen sectors:

- Financial performance: Analyze revenue growth, profitability, and debt levels.

- Management team: Assess the experience and track record of company leadership.

- Competitive landscape: Understand the company’s position within its industry and potential challenges.

- Regulatory environment: Consider the impact of regulations and government policies on the business.

Assessing Risks

Investing in emerging markets, while potentially lucrative, comes with inherent risks that require careful assessment. These risks can stem from various factors, impacting the profitability and stability of investments. Here are key areas to consider:

Political and Regulatory Risks

Emerging markets often have evolving political landscapes and regulatory frameworks. Changes in government policies, political instability, or corruption can significantly impact investments. Investors should scrutinize the political climate, track regulatory changes, and assess the effectiveness of legal frameworks in protecting their interests.

Economic Risks

While emerging markets promise high growth potential, they are also susceptible to economic volatility. Factors like inflation, currency fluctuations, and commodity price swings can affect investment returns. Understanding the economic structure, dependence on specific industries, and resilience to external shocks is crucial.

Market Liquidity Risks

Emerging markets often have less developed and less liquid financial markets compared to developed economies. This can make it challenging to buy or sell assets quickly without significantly impacting prices. Investors need to evaluate trading volumes, market depth, and the potential for price volatility when entering and exiting positions.

Currency Risks

Investments in emerging markets are often denominated in local currencies. Fluctuations in exchange rates can significantly impact returns for foreign investors. A depreciating local currency can erode profits when converted back to the investor’s home currency. Assessing currency volatility and hedging strategies is vital.

Diversifying Investments

One of the key strategies for mitigating risk in emerging markets is diversification. This involves spreading investments across a variety of asset classes, sectors, and countries.

Here are several diversification strategies for emerging market investments:

- Asset Class Diversification: Don’t limit yourself to just stocks or bonds. Explore other asset classes like real estate, commodities, or private equity within emerging markets. Each asset class comes with its own risk and return profile, contributing to a more balanced portfolio.

- Sector Diversification: Emerging markets often have rapidly growing sectors like technology, healthcare, or consumer goods. Diversifying across different sectors can help offset losses if one sector experiences a downturn.

- Geographic Diversification: Different emerging markets have varying economic and political landscapes. Investing in multiple countries reduces the impact of a single country’s performance on your overall portfolio.

However, it’s crucial to note that diversification in emerging markets doesn’t completely eliminate risk. Correlations between asset classes can still exist, especially during global economic events.

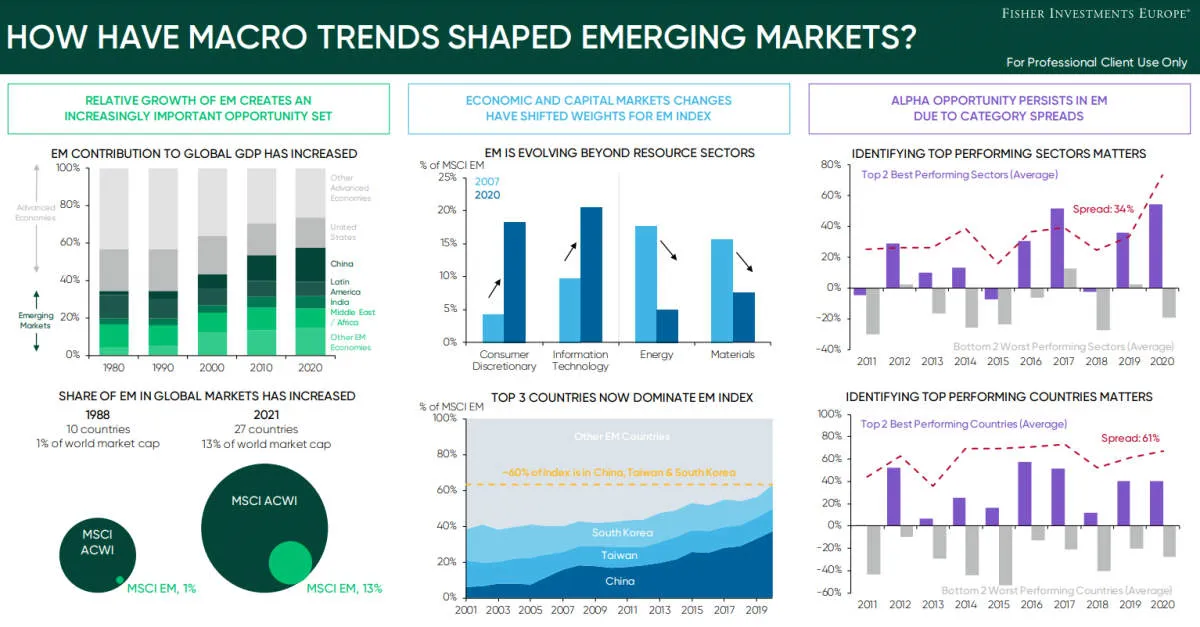

Monitoring Emerging Market Trends

Staying informed about emerging market trends is crucial for identifying promising investment opportunities and mitigating potential risks. Investors need to adopt a proactive approach to monitoring various economic, political, and social indicators that can impact their investments.

Here are some key areas to focus on:

- Economic Growth: Track GDP growth rates, inflation, interest rates, and currency fluctuations. Rapid economic expansion can create attractive investment opportunities, but high inflation or volatile currencies can erode returns.

- Political Stability and Governance: Assess the political landscape, regulatory environment, and the rule of law. Political instability, corruption, or weak governance can significantly impact investment climate and returns.

- Demographics and Social Trends: Analyze population growth, urbanization rates, income levels, and education levels. A young, growing, and increasingly affluent population can drive consumer spending and economic growth.

- Technological Advancement: Monitor the adoption of new technologies, infrastructure development, and innovation within emerging markets. Technological leapfrogging can create unique investment opportunities in sectors such as e-commerce, fintech, and renewable energy.

- Global Market Dynamics: Understand how global economic trends, commodity prices, and geopolitical events can impact emerging markets. For example, changes in global interest rates or commodity demand can significantly influence investment flows into these markets.

Investors can leverage a variety of resources to monitor emerging market trends, including:

- International organizations like the World Bank and the International Monetary Fund (IMF)

- Financial news outlets and research reports

- Government publications and industry associations

By closely monitoring these trends, investors can gain valuable insights into the evolving risks and rewards of emerging markets, allowing them to make more informed investment decisions.

Conclusion

Investing in emerging markets offers both risks and rewards. With careful research and diversification, investors can capitalize on growth potential while managing potential volatility effectively.