Financial literacy is crucial for teens to build essential skills that will secure their future financial well-being. Empowering young people with knowledge about budgeting, saving, and investing early on lays a strong foundation for a stable financial future.

Importance of Financial Literacy

Financial literacy is crucial for everyone, especially for teenagers who are about to embark on their adult lives. It empowers them to make informed financial decisions, setting the stage for a secure and successful future. Here’s why:

1. Smart Money Management

Financial literacy provides teenagers with the skills to manage their money effectively. They learn about budgeting, saving, and spending wisely, preventing potential financial pitfalls like debt and overspending.

2. Goal Setting and Achievement

Having financial knowledge helps teenagers set realistic financial goals, whether it’s saving for a car, college, or a future down payment on a house. They can create a roadmap for achieving these goals and track their progress along the way.

3. Understanding Debt and Credit

Navigating the world of credit cards and loans can be tricky. Financial literacy equips teenagers with the knowledge to understand how interest rates, credit scores, and debt work. They can make responsible borrowing decisions and avoid falling into debt traps.

4. Making Informed Financial Decisions

From choosing the right bank account to understanding investment options, financially literate teenagers can make sound financial choices that align with their goals. They can weigh the risks and benefits of different financial products and services.

5. Building a Secure Future

By developing strong financial habits early on, teenagers lay the foundation for a secure financial future. They can achieve financial independence, plan for retirement, and navigate unexpected financial challenges with greater confidence.

Basic Money Management Skills

Mastering basic money management skills is crucial for teens to build a strong financial foundation. Here’s what you need to know:

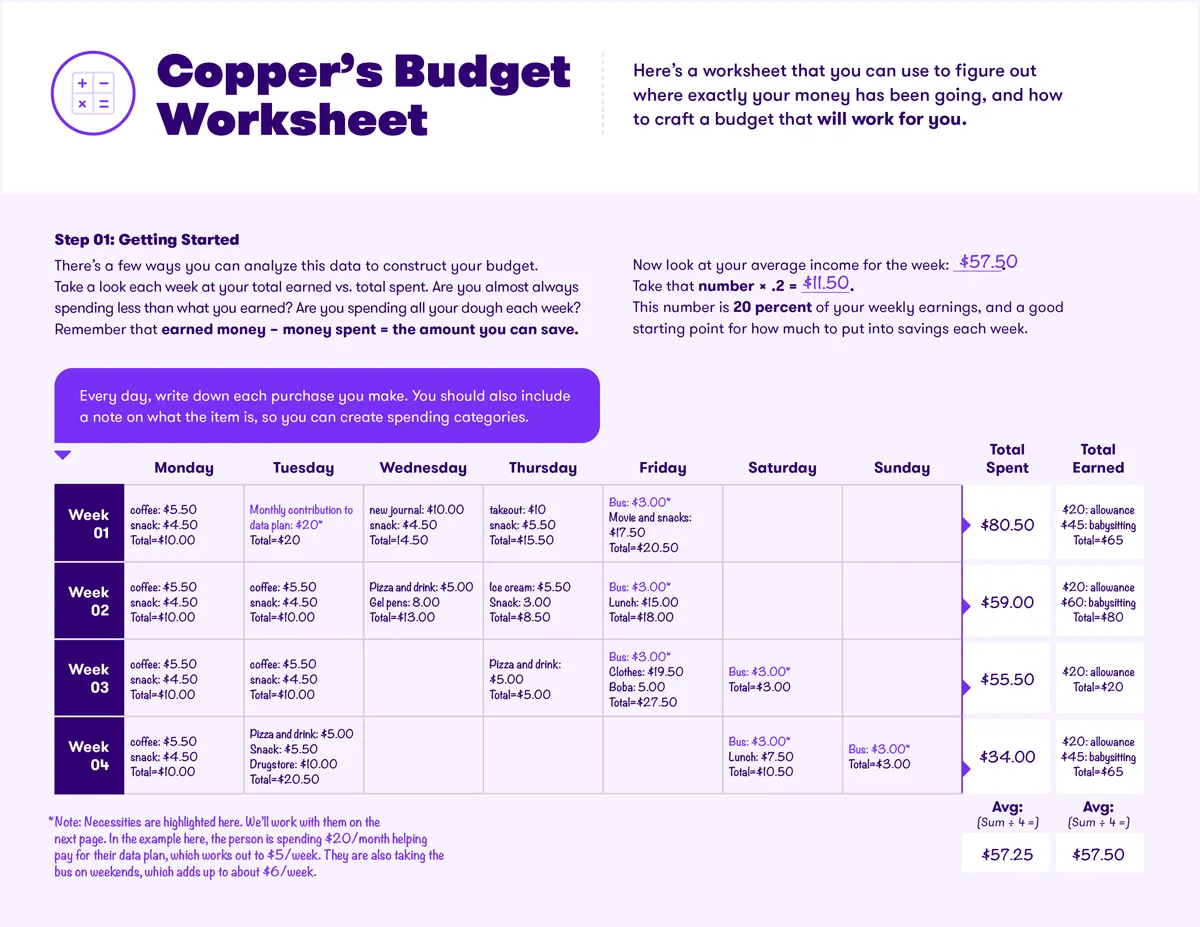

1. Budgeting: Planning Where Your Money Goes

A budget is a roadmap for your money. It helps you track your income, expenses, and savings goals.

- Track Your Income: Note down all sources of income, whether it’s an allowance, part-time job earnings, or gifts.

- List Your Expenses: Identify where your money goes each month, including food, entertainment, transportation, and clothing.

- Set Financial Goals: Determine short-term and long-term goals, such as buying a new phone, saving for a car, or college tuition.

- Allocate Your Money: Decide how much money you’ll allocate to each category based on your income and goals.

- Review and Adjust Regularly: Your budget isn’t set in stone. Monitor your spending, make adjustments as needed, and stay on track with your financial goals.

2. Saving: Paying Yourself First

Saving is about setting aside money for future use, whether it’s for a specific purchase, an emergency fund, or long-term goals like retirement.

- Start Early: The sooner you start saving, the more time your money has to grow through the power of compound interest.

- Set a Savings Goal: Having a specific target in mind will keep you motivated and make it easier to track your progress.

- Make Saving Automatic: Set up automatic transfers from your checking account to your savings account each month.

- Explore Savings Options: Research different savings accounts, such as high-yield savings accounts or certificates of deposit (CDs), to find the best interest rates.

3. Spending Wisely: Making Informed Choices

Spending wisely means making thoughtful decisions about your purchases and avoiding impulsive spending.

- Needs vs. Wants: Differentiate between essential needs (food, shelter) and wants (designer clothes, expensive gadgets).

- Comparison Shopping: Don’t buy the first thing you see. Compare prices from different retailers to find the best deals.

- Shop Around for Big Purchases: For significant purchases like electronics or furniture, take your time to research and compare options before making a decision.

- Avoid Impulse Buys: Don’t be swayed by marketing tactics or peer pressure. Give yourself time to think before making a purchase, especially for non-essential items.

Understanding Credit and Debt

Credit and debt are fundamental concepts in personal finance that can significantly impact your financial well-being. Understanding how they work is crucial for making informed financial decisions.

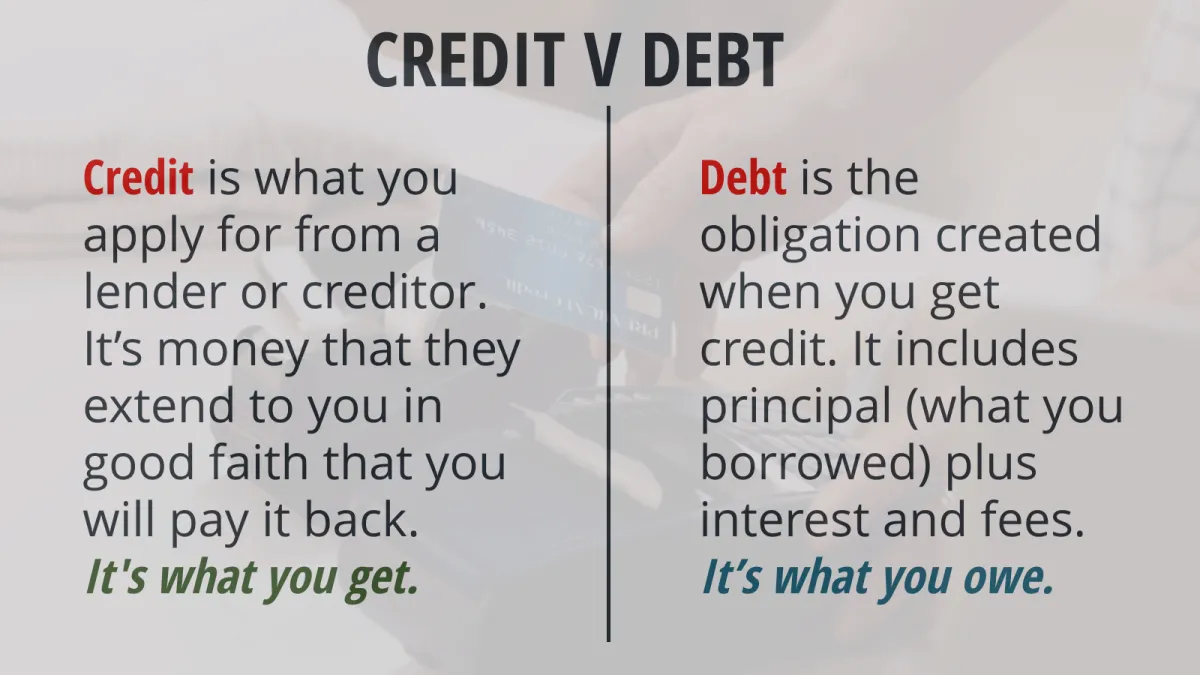

What is Credit?

Credit is the ability to borrow money or access goods and services with the promise to pay later. When you use credit, you’re essentially taking out a loan that you need to repay with interest.

Types of Credit:

- Credit Cards: Allow you to make purchases up to a certain limit and carry a balance.

- Personal Loans: A lump sum of money borrowed from a lender, repaid over a set term with interest.

- Student Loans: Used to finance education expenses, with repayment typically starting after graduation.

- Mortgages: Loans used to purchase a home, typically repaid over a long term.

What is Debt?

Debt is the amount of money you owe to someone else. It’s created when you borrow money or use credit that you haven’t yet repaid.

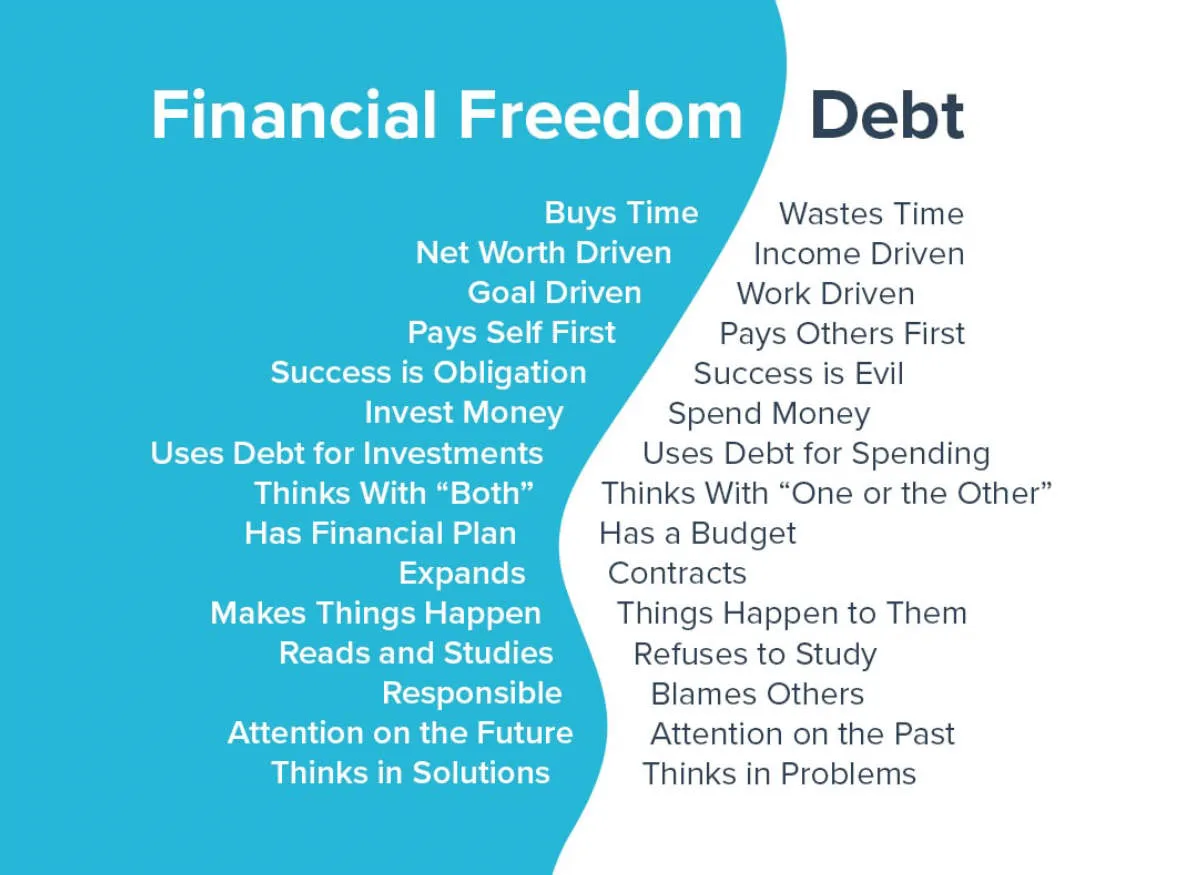

Good Debt vs. Bad Debt

Not all debt is bad. Some debts can help you build wealth or improve your financial situation, while others can lead to financial difficulties.

- Good Debt: Typically involves borrowing money for investments that are expected to increase in value or generate income, such as education or a home.

- Bad Debt: Involves borrowing money for things that depreciate in value quickly or don’t provide long-term benefits, such as expensive clothing or entertainment.

Credit Scores

Your credit score is a numerical representation of your creditworthiness. It’s based on your credit history, including factors like payment history, amounts owed, and length of credit history. A good credit score makes it easier to access credit and secure favorable interest rates.

Managing Debt

Managing debt effectively is essential for financial stability. This includes:

- Creating a budget and tracking your spending.

- Making timely payments on all debts.

- Avoiding unnecessary debt.

- Building an emergency fund to cover unexpected expenses.

Saving and Investing

Saving and investing are essential skills for financial security, and it’s never too early to start. Even as a teenager, you can build habits that will benefit you for a lifetime.

Why Save?

Saving involves setting aside money regularly for future use. This could be for:

- Short-term goals: A new phone, concert tickets, clothes.

- Mid-term goals: A car, college tuition, a down payment on an apartment.

- Long-term goals: Retirement, a down payment on a house.

- Emergencies: Unexpected expenses like medical bills or car repairs.

Getting Started with Saving

Saving might seem hard, but it doesn’t have to be. Here are some tips:

- Track your spending: Understanding where your money goes is the first step.

- Create a budget: Plan how you’ll spend and save your money each month.

- Set realistic goals: Don’t try to save everything at once. Start small and gradually increase your savings.

- Open a savings account: Keep your savings separate from your spending money.

Why Invest?

Investing means putting your money to work for you. When you invest, you’re buying assets that have the potential to increase in value over time, helping your money grow faster than it would in a regular savings account.

Types of Investments

There are many different types of investments, each with its own level of risk and potential return. Some common investment options for beginners include:

- High-yield savings accounts and CDs: These offer higher interest rates than traditional savings accounts but may have limited flexibility.

- Index funds and mutual funds: These allow you to invest in a diversified portfolio of stocks or bonds with a single purchase, reducing risk.

Getting Started with Investing

Investing can seem complicated, but there are resources to help you get started:

- Do your research: Learn about different investment options and understand the risks involved.

- Start small: You don’t need a lot of money to begin investing.

- Consider a robo-advisor: These online platforms can help you create and manage a portfolio based on your goals and risk tolerance.

Budgeting for Teens

Budgeting might sound boring, but trust us, it’s the key to unlocking your financial freedom! Imagine being able to afford the things you really want, like that new phone or a weekend trip with friends, without constantly worrying about money. That’s what budgeting can help you achieve.

What is a Budget?

Simply put, a budget is a plan for your money. It tracks the money coming in (your income) and the money going out (your expenses).

Why Budgeting Matters (Even as a Teen)

- Control Your Spending: Ever wonder where your allowance or part-time job money went? A budget helps you track your expenses so you can see where your money is actually going.

- Reach Your Goals: Want to buy a car, save for college, or travel the world? A budget helps you save for those big goals.

- Avoid Debt: Overspending can lead to debt, which can be a huge burden. Budgeting helps you live within your means and avoid unnecessary debt.

- Learn Financial Responsibility: Budgeting is a life skill that will serve you well beyond your teenage years.

Getting Started: Creating Your Budget

- Track Your Income: Write down all sources of income – allowance, part-time job earnings, gifts, etc.

- Identify Your Expenses: Keep a record of everything you spend money on for a month. Be thorough! Include everything from food and entertainment to transportation and clothes.

- Categorize Your Spending: Divide your expenses into categories (e.g., Needs vs. Wants, Food, Entertainment, Savings, etc.). This will give you a clearer picture of your spending habits.

- Set Spending Limits: Determine how much you can realistically afford to spend in each category. Be honest with yourself and prioritize your needs.

- Make Adjustments: Life happens! If you find yourself consistently overspending in a certain category, adjust your budget accordingly.

Planning for Financial Independence

Financial independence means having the freedom to make choices about your life without being limited by money worries. It doesn’t necessarily mean being rich, but rather having enough financial security to pursue your goals and live comfortably. For teens, planning for financial independence means developing good financial habits early on and setting yourself up for success in the future.

Setting Financial Goals:

Start by thinking about what you want to achieve in life. Do you want to go to college? Travel the world? Buy a house? Once you have a clear vision, you can set financial goals that will help you get there. These goals should be:

- Specific: Clearly define what you want to achieve (e.g., save $10,000 for a down payment on a car).

- Measurable: Quantify your goals so you can track progress (e.g., save $500 per month).

- Achievable: Make sure your goals are realistic and attainable.

- Relevant: Align your goals with your values and aspirations.

- Time-bound: Set a deadline for achieving your goals (e.g., save $10,000 in 2 years).

Budgeting and Saving:

Creating a budget is crucial for understanding your income, expenses, and how much money you can allocate towards your goals. Start by tracking your spending for a month to see where your money goes. Then, create a budget that outlines your income and expenses, ensuring you’re spending less than you earn. Make saving a priority by setting aside a portion of your income each month. Even small amounts add up over time!

Earning Money:

Explore different ways to earn money, such as part-time jobs, freelancing, or starting a small business. Earning your own income not only provides financial resources but also teaches valuable skills like responsibility, time management, and financial planning.

Conclusion

Financial literacy is crucial for teens to ensure a secure future. Equipping them with essential money management skills empowers them to make sound financial decisions and build a stable foundation for their financial well-being.