Understanding financial statements is essential for small business owners to make informed decisions about their finances. This guide will help you navigate through the key components of financial statements and empower you to manage your business effectively.

Importance of Financial Statements

Financial statements are the backbone of your small business. They provide a snapshot of your company’s financial health and performance, offering crucial insights to make informed decisions. Here’s why they are indispensable:

1. Tracking Business Performance

Financial statements like the income statement and cash flow statement allow you to monitor your business’s profitability and cash flow over time. Are revenues increasing? Are expenses under control? These statements reveal trends and potential red flags.

2. Securing Funding

Need a loan or investment? Lenders and investors rely heavily on financial statements to assess your creditworthiness and potential for returns. Accurate and well-organized statements build trust and credibility.

3. Making Informed Decisions

Should you expand your product line? Hire more staff? Financial statements provide the data-driven foundation for strategic decisions, helping you allocate resources wisely and minimize risks.

4. Meeting Legal Requirements

In many jurisdictions, businesses are legally obligated to maintain and report financial statements. Failing to comply can result in penalties and legal issues.

5. Attracting & Managing Investors

Investors want to see how their money is being used and the returns it generates. Transparent financial statements are essential for attracting and retaining investors.

Types of Financial Statements

There are three primary financial statements that businesses use to track their financial performance and position. These statements provide a comprehensive overview of a company’s financial health and are essential for decision-making by owners, managers, investors, and lenders. The three main types of financial statements are:

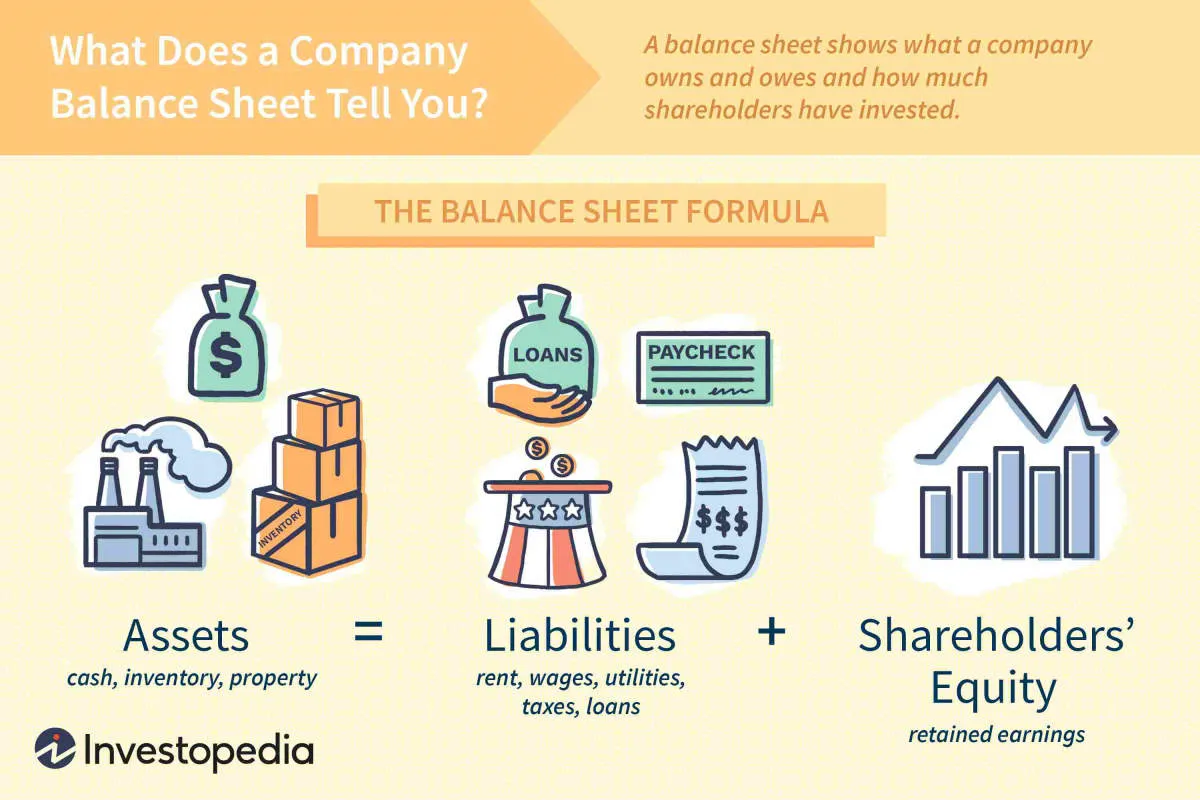

1. Balance Sheet

The balance sheet provides a snapshot of a company’s assets, liabilities, and equity at a specific point in time. It follows the basic accounting equation:

Assets = Liabilities + Equity

- Assets are what the company owns, such as cash, accounts receivable, inventory, and property, plant, and equipment.

- Liabilities are what the company owes to others, such as accounts payable, salaries payable, and loans.

- Equity represents the owners’ stake in the company, which is the difference between assets and liabilities.

2. Income Statement

The income statement, also known as the profit and loss (P&L) statement, reports a company’s financial performance over a specific period, such as a month, quarter, or year. It shows the company’s revenues, expenses, and resulting profit or loss.

Revenues – Expenses = Net Income (Profit) or Net Loss

- Revenues are the income generated from the company’s primary business activities, such as sales of goods or services.

- Expenses are the costs incurred in generating revenue, such as the cost of goods sold, salaries, rent, and utilities.

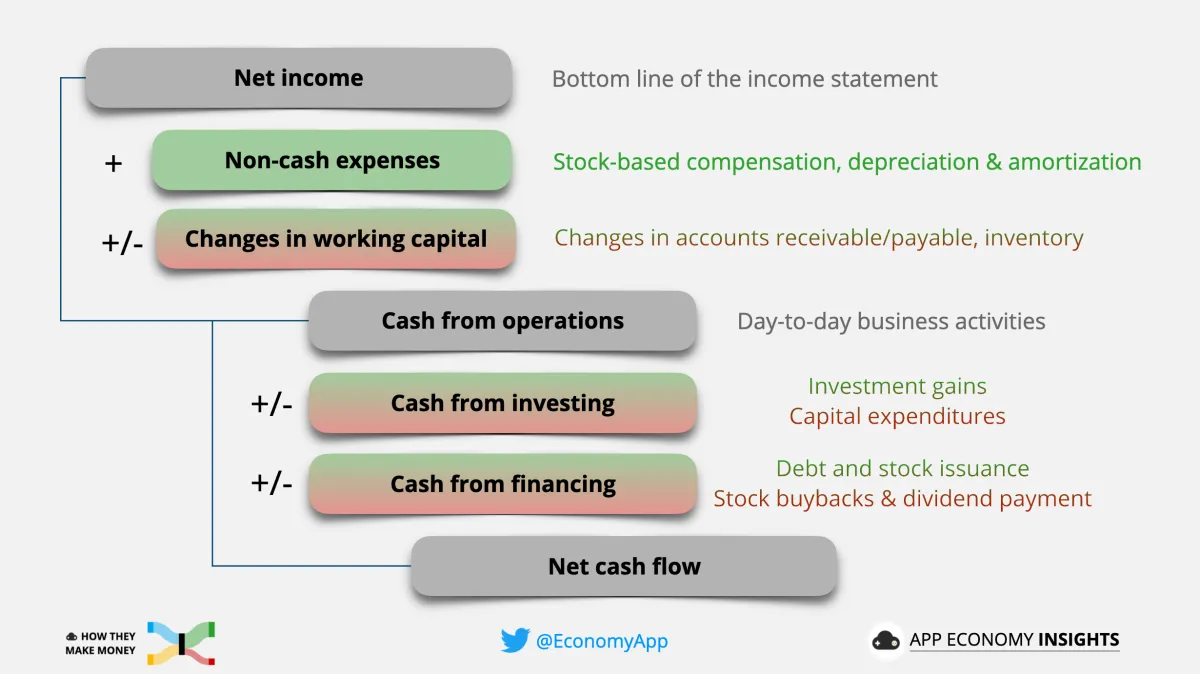

3. Cash Flow Statement

The cash flow statement tracks the movement of cash both into and out of a company over a specific period. It shows how much cash the company generated from its operations, investments, and financing activities. The cash flow statement is essential for understanding a company’s liquidity and ability to meet its short-term obligations.

The cash flow statement is divided into three sections:

- Operating Activities: Cash flows from the company’s core business operations.

- Investing Activities: Cash flows related to the purchase and sale of long-term assets, such as property, plant, and equipment.

- Financing Activities: Cash flows related to debt, equity, and dividends.

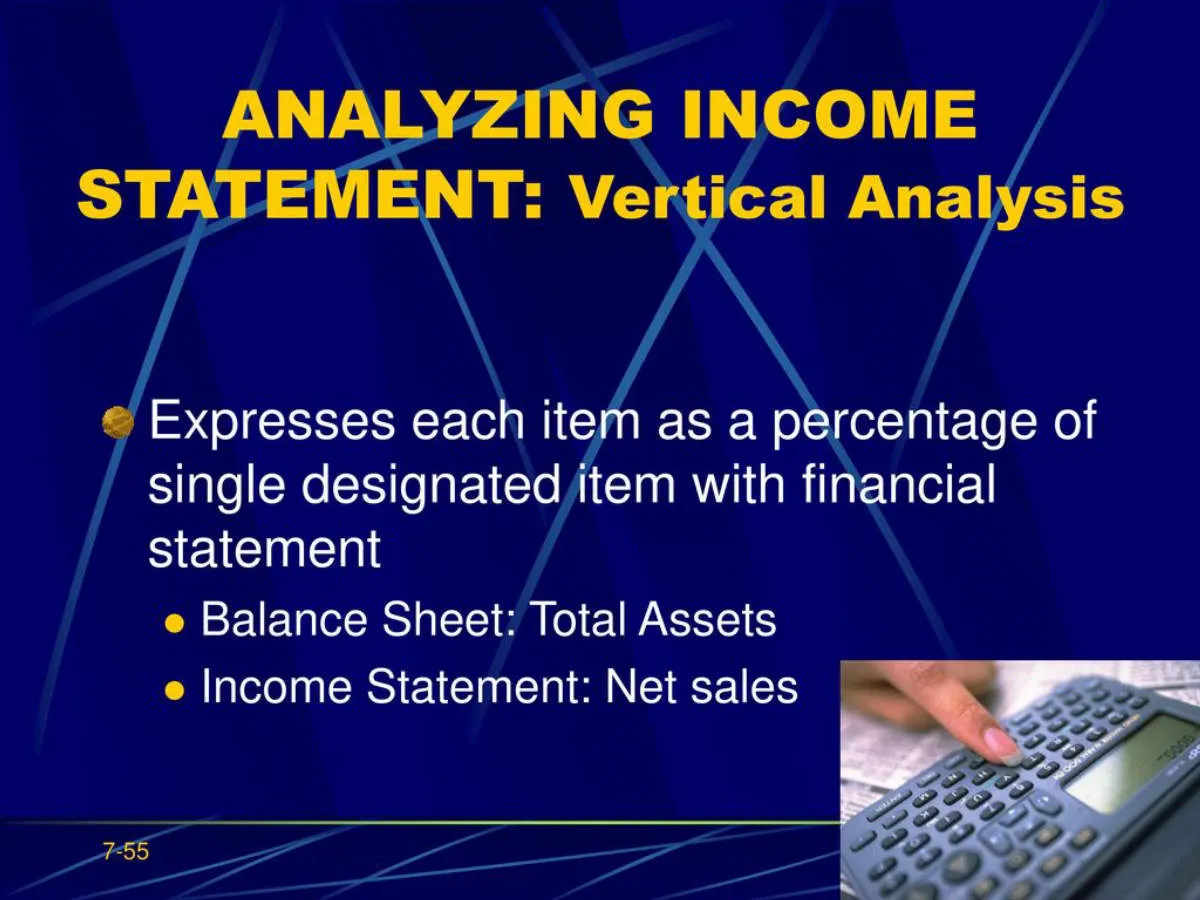

Analyzing the Income Statement

The income statement, also known as the profit and loss (P&L) statement, summarizes your business’s financial performance over a specific period, such as a month, quarter, or year. It reports:

- Revenues: Money generated from selling goods or services.

- Expenses: Costs incurred to generate revenue.

The basic formula of the income statement is:

Revenues – Expenses = Net Income (or Net Loss)

Key Components to Analyze:

- Revenue: Examine revenue trends over time. Are they increasing or decreasing? Identify the sources of revenue and their respective contributions to the total. This analysis helps you understand what’s working well and what might need attention.

- Cost of Goods Sold (COGS): For businesses selling goods, COGS represents the direct costs associated with producing those goods. Analyze COGS as a percentage of revenue to assess efficiency in production or sourcing.

- Gross Profit: Calculated as Revenue – COGS, gross profit indicates your profitability after covering the direct costs of goods sold. Monitoring gross profit margin helps you assess pricing strategies and control production costs.

- Operating Expenses: These are expenses incurred through normal business operations, like rent, salaries, and marketing. Analyze individual expense categories and their proportions to total expenses to identify areas for potential cost savings.

- Operating Income: Calculated as Gross Profit – Operating Expenses, this metric reflects the profitability of your core business operations before considering taxes and other financial items.

- Net Income: This is the bottom line – your profit after all expenses, including taxes and interest, have been deducted from revenue. A positive net income indicates profitability, while a negative net income (net loss) signifies a loss.

Analyzing the Income Statement: Tips & Considerations

- Compare: Analyze income statements over multiple periods to identify trends and seasonality in your business.

- Benchmark: Compare your financial performance to industry averages or competitors to gauge your relative standing.

- Contextualize: Consider external factors like economic conditions or industry trends that might be impacting your results.

Understanding the Balance Sheet

The balance sheet provides a snapshot of your business’s financial health at a specific point in time. It follows the basic accounting equation:

Assets = Liabilities + Equity

Let’s break down each component:

Assets

Assets are what your business owns. They are typically categorized as current or non-current:

- Current Assets: Items expected to be converted into cash or used up within one year. Examples include cash, accounts receivable, and inventory.

- Non-current Assets: Assets with a lifespan longer than one year. This includes fixed assets like property, plant, and equipment (PP&E), and intangible assets like patents or trademarks.

Liabilities

Liabilities represent what your business owes to others. Like assets, they are also classified as current or non-current:

- Current Liabilities: Debts due within one year, such as accounts payable, short-term loans, and accrued expenses.

- Non-current Liabilities: Long-term obligations due after one year. Examples are long-term loans, mortgages, and deferred revenue.

Equity

Equity is the owner’s stake in the business. It’s the residual interest in the assets of the entity after deducting liabilities. Equity can be increased by profits, owner contributions, and stock issuances, and it can be decreased by losses and distributions to owners.

Understanding how these three elements interact is crucial to analyzing your business’s financial position. The balance sheet can help you:

- Assess your business’s liquidity (ability to meet short-term obligations).

- Evaluate your business’s solvency (ability to meet long-term obligations).

- Identify areas of financial strength and weakness.

- Track your business’s financial progress over time.

Cash Flow Statement Insights

The cash flow statement is like a financial GPS for your business. While the income statement shows profitability and the balance sheet offers a snapshot of your assets, liabilities, and equity, the cash flow statement tracks the movement of cash both into and out of your business over a specific period.

Why is understanding cash flow so crucial? Simply put, it reveals the liquidity of your business – its ability to pay bills, cover expenses, and invest in growth opportunities. Even a profitable business can face hardship without healthy cash flow.

Key Components of the Cash Flow Statement:

The cash flow statement is divided into three main sections:

- Cash Flow from Operating Activities: This section reflects the cash generated or used in your core business operations. It includes cash from:

- Sales of products or services

- Payments received from customers

- Payments made to suppliers and employees

- Cash Flow from Investing Activities: This section focuses on cash related to long-term investments, such as:

- Purchasing or selling property, plant, and equipment

- Investing in other businesses

- Cash Flow from Financing Activities: This section deals with cash from financing your business, including:

- Proceeds from issuing stock or taking on debt

- Repayments of loans

- Dividends paid to shareholders

Using the Cash Flow Statement to Make Informed Decisions:

Analyzing your cash flow statement can help you:

- Identify potential cash flow problems early on: A declining cash balance or consistent negative cash flow from operations could signal trouble ahead.

- Make informed decisions about investments: Understanding your cash position can help you determine whether you can afford new equipment or expansion projects.

- Secure financing: Lenders and investors often scrutinize cash flow statements to assess creditworthiness and investment potential.

- Improve cash flow management: By tracking your cash flow, you can implement strategies to optimize inflows and manage outflows effectively.

Using Financial Statements for Decision Making

Financial statements are more than just regulatory requirements; they are powerful tools for decision-making. For small business owners, understanding how to interpret and leverage this financial data is crucial for growth and sustainability. Here’s how you can use your financial statements to make informed decisions:

1. Assessing Overall Financial Health

Your balance sheet, income statement, and cash flow statement collectively provide a comprehensive picture of your business’s financial well-being. They can help you:

- Identify profitability trends: Are your profits increasing or decreasing over time?

- Monitor cash flow: Do you have enough liquid assets to cover short-term obligations?

- Analyze debt levels: Is your business carrying too much debt?

- Evaluate asset utilization: Are you efficiently using your assets to generate revenue?

2. Making Strategic Decisions

Financial statements provide the data-driven insights needed for making key strategic decisions, such as:

- Investing in new equipment or technology: Can your business afford the upfront costs and potential return on investment?

- Expanding into new markets or product lines: Do your financials support the risks and potential rewards of expansion?

- Hiring new employees: Can your business sustain the additional payroll expenses?

- Securing funding from lenders or investors: Do your financials demonstrate creditworthiness and growth potential?

3. Monitoring Performance and Tracking Progress

By regularly reviewing your financial statements, you can:

- Track key performance indicators (KPIs): Are you meeting your sales targets, controlling expenses, and maintaining healthy profit margins?

- Identify areas for improvement: Are there operational inefficiencies or pricing strategies that need adjustment?

- Measure the effectiveness of implemented changes: Have your decisions positively impacted your bottom line?

4. Communicating with Stakeholders

Financial statements are essential for communicating your business’s performance to key stakeholders, including:

- Lenders and investors: Providing financial transparency can help secure funding and build trust.

- Potential buyers or partners: Demonstrating financial stability can be attractive to potential collaborators.

Conclusion

Understanding financial statements is crucial for small business owners to make informed decisions and ensure financial stability.