Discover effective strategies to manage financial stress and anxiety with expert tips and techniques in our comprehensive guide.

Understanding Financial Stress

Financial stress is a common experience, impacting people of all income levels. It’s a state of worry, fear, and anxiety related to your financial situation. This could stem from various sources such as:

- Debt: High levels of credit card debt, student loans, or personal loans can create significant stress.

- Low Income: Struggling to make ends meet or living paycheck to paycheck can lead to constant financial worry.

- Unexpected Expenses: Job loss, medical emergencies, or car repairs can throw off your budget and trigger anxiety.

- Lack of Control: Feeling like you have limited control over your finances can contribute to feelings of helplessness and stress.

Financial stress isn’t just an emotional burden; it can manifest physically as well. Common symptoms include:

- Headaches

- Difficulty sleeping

- Digestive issues

- Irritability and mood swings

- Difficulty concentrating

Recognizing the signs of financial stress is the first step towards managing it. Once you understand the source of your stress and how it affects you, you can begin to explore strategies for coping and regaining control of your finances.

Identifying Stressors

The first step towards effectively managing financial stress and anxiety is to pinpoint the exact sources causing it. While it might seem obvious that “money issues” are the root of the problem, gaining a more granular understanding of the specific stressors can empower you to take targeted action.

Consider these key areas and questions to help identify your personal financial stressors:

1. Current Financial Situation:

- Are you struggling to pay bills on time?

- Do you have a large amount of debt that feels overwhelming?

- Are you living paycheck to paycheck with little to no savings?

- Is there a significant discrepancy between your income and expenses?

2. Future Financial Concerns:

- Are you worried about job security or potential income loss?

- Do you have anxiety about saving for retirement or other long-term goals?

- Are you concerned about unexpected expenses, like medical bills or car repairs?

- Do you feel financially unprepared for major life events, like having children or buying a house?

3. Financial Habits and Mindset:

- Do you engage in impulsive spending or overspending?

- Do you avoid dealing with financial matters, leading to further anxiety?

- Do you compare your financial situation to others, leading to feelings of inadequacy?

- Do you have a history of financial trauma or negative experiences with money?

Take your time to reflect on these areas and honestly assess which factors are causing the most stress in your life. Once you have a clearer picture of your personal financial stressors, you can begin developing strategies and seeking resources to address them effectively.

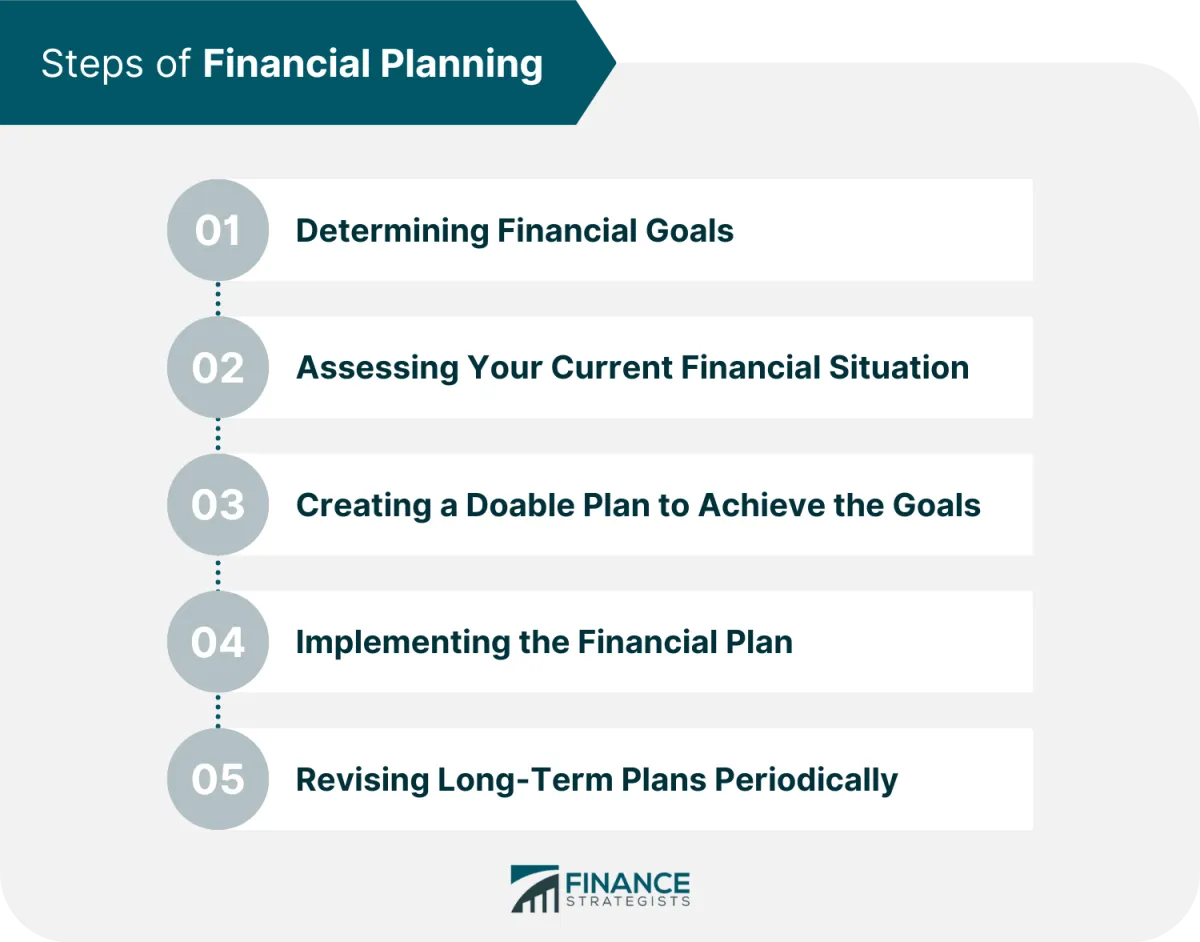

Creating a Financial Plan

One of the most effective ways to combat financial stress and anxiety is to create a solid financial plan. This provides a structured approach to managing your money, allowing you to feel more in control of your finances and less overwhelmed by uncertainty.

Here’s a breakdown of how to create a comprehensive financial plan:

1. Assess Your Current Financial Situation

Before you can plan for the future, you need to understand your present. Start by:

- Tracking your income and expenses: Identify where your money is coming from and where it’s going.

- Calculating your net worth: Determine your assets (what you own) and liabilities (what you owe) to get a clear picture of your overall financial health.

2. Set Financial Goals

Having clear financial goals provides direction and motivation. Consider both short-term goals (e.g., building an emergency fund, paying off a credit card) and long-term goals (e.g., buying a home, retirement planning). Make your goals SMART – Specific, Measurable, Achievable, Relevant, and Time-Bound.

3. Create a Budget

A budget is the cornerstone of any financial plan. It outlines how you will allocate your income to cover expenses, savings, and debt repayments. There are various budgeting methods (50/30/20, zero-based budgeting), so find one that suits your needs and preferences.

4. Build an Emergency Fund

Life is full of unexpected events, so having a financial safety net is essential. Aim to save 3-6 months’ worth of living expenses in an easily accessible account. This fund provides a buffer against financial shocks and helps you avoid going into debt when unexpected costs arise.

5. Manage Debt Strategically

High-interest debt can be a major source of stress. Create a plan for managing and paying down your debts, such as the debt snowball or debt avalanche method. Prioritize high-interest debts first while making minimum payments on others.

6. Plan for the Future

Think about your long-term financial goals, such as retirement or your children’s education. Explore different saving and investment options to ensure your money grows over time. Consider consulting with a financial advisor to get personalized advice tailored to your circumstances and goals.

7. Review and Adjust Regularly

Your financial plan is a living document. Review it regularly (e.g., quarterly or annually) and make adjustments as needed. Life circumstances change, and your financial plan should adapt accordingly.

Seeking Professional Advice

Sometimes, managing financial stress requires more than just budgeting and lifestyle changes. If your financial worries are causing significant distress and impacting your daily life, it’s crucial to seek professional advice.

Financial advisors can help you create a personalized financial plan, address your specific concerns, and provide guidance on debt management, investing, and saving.

Therapists and counselors specializing in financial therapy can help you understand and address the emotional and psychological aspects of your financial stress. They can teach you coping mechanisms for anxiety and help you develop healthier financial behaviors.

Remember, seeking professional help is a sign of strength, not weakness. It demonstrates your commitment to taking control of your finances and your well-being.

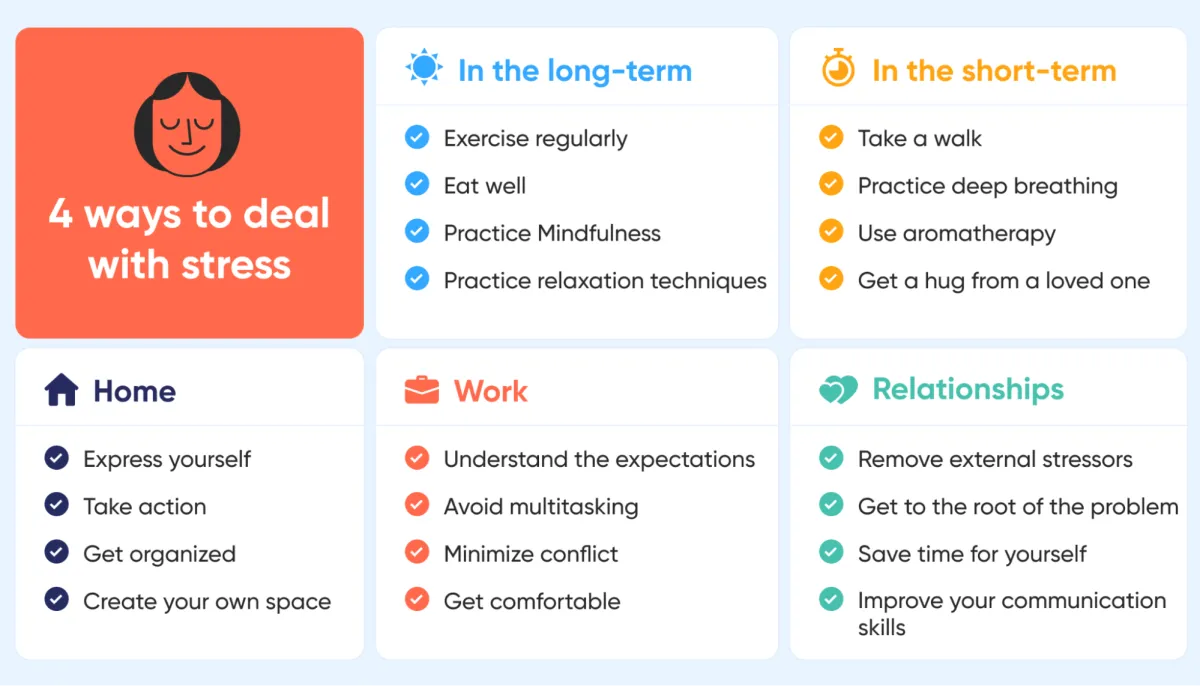

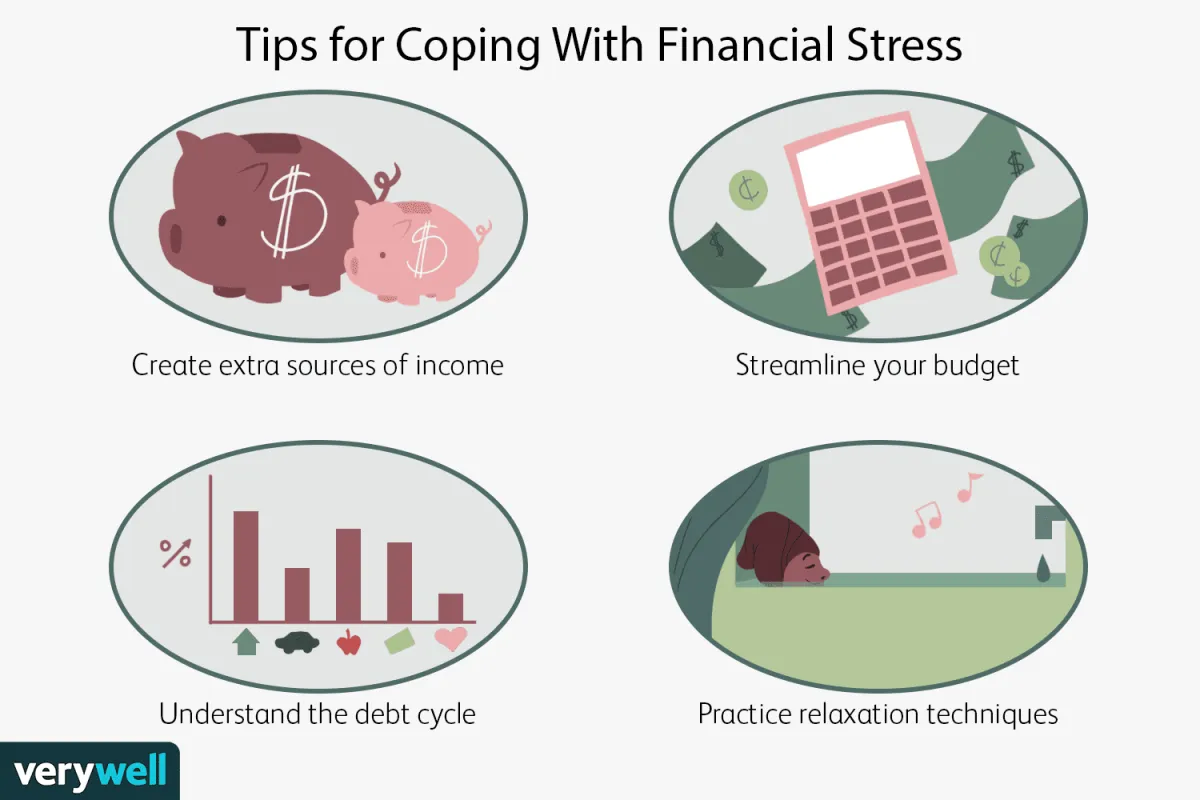

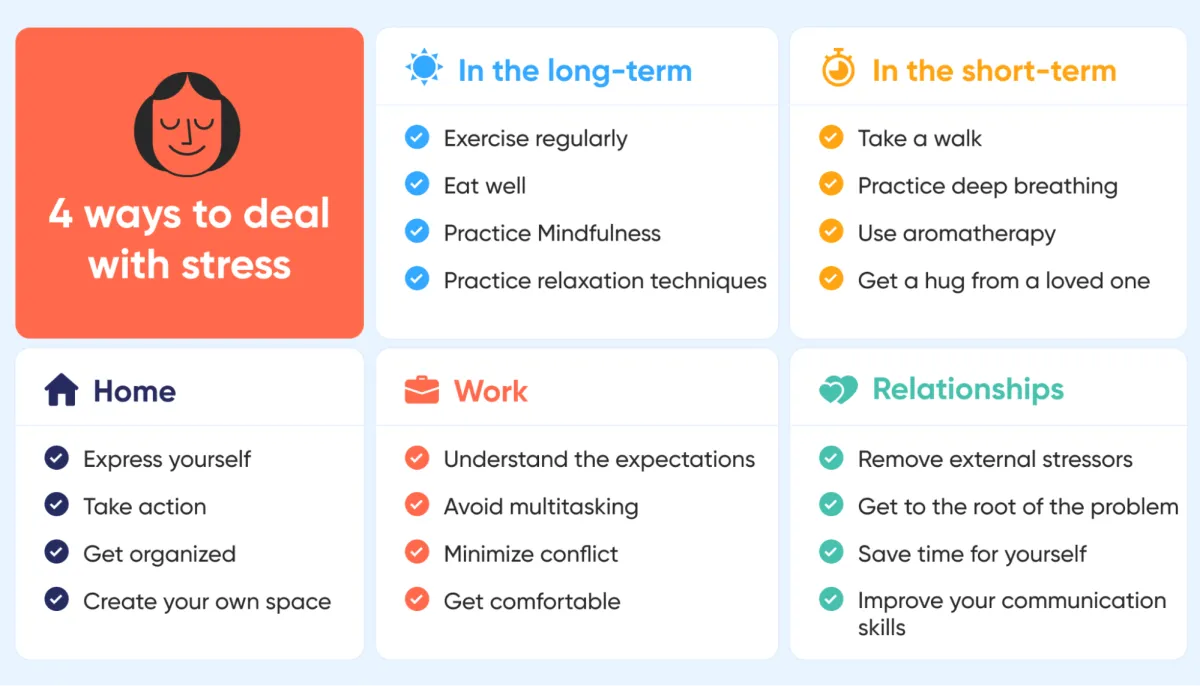

Implementing Stress-Relief Techniques

While addressing the root causes of financial stress is crucial, incorporating stress-relief techniques can provide immediate relief and improve your overall well-being. These techniques can help you manage anxiety, gain perspective, and approach your financial challenges with a calmer mindset.

Mindfulness and Meditation:

Practicing mindfulness and meditation can help calm your mind and reduce anxiety. Even a few minutes of daily meditation can make a significant difference. Numerous apps and online resources offer guided meditations specifically designed for stress relief.

Deep Breathing Exercises:

Deep breathing exercises are a simple yet effective way to alleviate stress. When you feel overwhelmed, take a few moments to breathe deeply and slowly. This can help slow your heart rate, relax your muscles, and clear your mind.

Physical Activity:

Engaging in regular physical activity has been proven to reduce stress and improve mood. Whether it’s going for a walk, jogging, or participating in a sport, find an activity you enjoy and make it a part of your routine.

Healthy Lifestyle Choices:

Maintaining a healthy lifestyle can significantly impact your stress levels. Ensure you get enough sleep, eat a balanced diet, and limit your intake of caffeine and alcohol. These habits can contribute to better physical and mental well-being.

Seeking Support:

Don’t hesitate to reach out for support when you need it. Talk to a trusted friend or family member about what you’re going through. Consider seeking professional guidance from a therapist or counselor who can provide coping strategies and support.

Maintaining a Positive Outlook

When facing financial stress, it’s easy to fall into a cycle of negative thinking. However, maintaining a positive outlook is crucial for effectively managing stress and finding solutions. Here’s how:

Focus on What You Can Control

Instead of dwelling on factors beyond your control, focus your energy on what you can influence. This might include creating a budget, exploring additional income sources, or seeking guidance from a financial advisor.

Practice Gratitude

Take time to appreciate what you do have, rather than dwelling on what you lack. Cultivating gratitude can shift your perspective and boost your overall well-being.

Celebrate Small Victories

Acknowledge and celebrate your progress, no matter how small. Whether it’s sticking to your budget for a week or paying off a small debt, each step forward deserves recognition.

Surround Yourself with Support

Don’t hesitate to reach out to friends, family, or a therapist for support. Talking about your feelings and seeking guidance can provide valuable perspective and emotional relief.

Conclusion

In conclusion, implementing effective financial management habits and seeking support can greatly alleviate stress and anxiety related to finances, leading to improved overall well-being and peace of mind.