Single parents face unique financial challenges. This article provides essential tips to help single parents achieve and maintain financial stability.

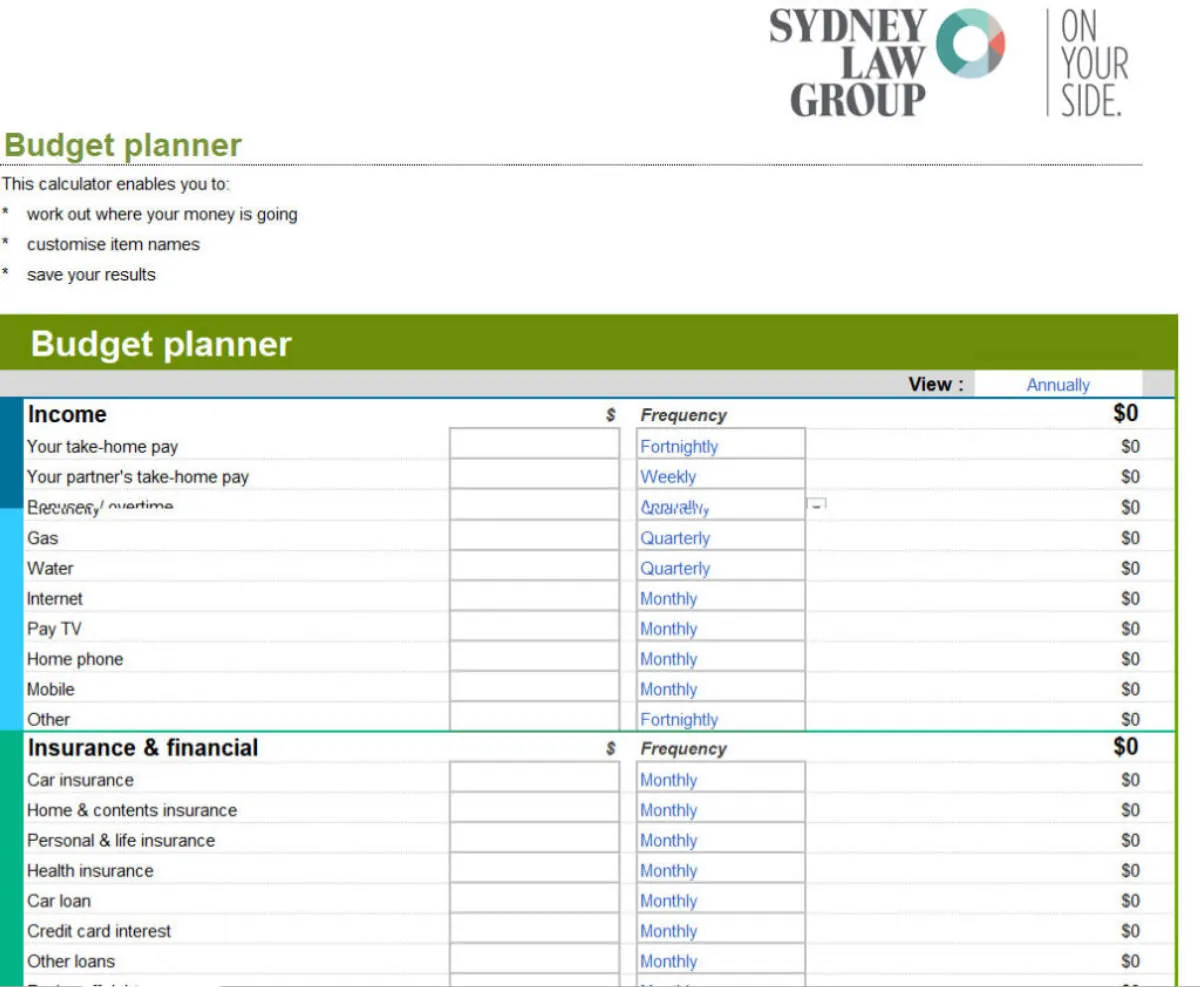

Creating a Budget for Single Parents

One of the most crucial aspects of achieving financial stability as a single parent is creating and maintaining a realistic budget. Knowing where your money is going can empower you to make informed decisions and ensure your financial resources are being used effectively.

1. Track Your Income and Expenses:

Start by listing all sources of income, including child support, alimony (if applicable), and your salary. Next, diligently track all your expenses. Utilize a budgeting app, spreadsheet, or even a notebook to record every dollar spent.

2. Categorize and Analyze Spending:

Divide your expenses into categories like housing, food, transportation, childcare, healthcare, and debt repayment. This allows you to identify areas where you might be overspending and opportunities for potential savings.

3. Prioritize Essential Expenses:

When budgeting on a single income, it’s vital to prioritize needs over wants. Ensure essential expenses like housing, utilities, food, and childcare are covered before allocating funds to discretionary spending.

4. Explore Cost-Cutting Measures:

Look for ways to reduce expenses in each category. Can you reduce grocery costs by meal planning? Are there opportunities to save on transportation or explore more affordable childcare options? Small changes can make a significant difference over time.

5. Set Realistic Financial Goals:

Having clear financial goals can keep you motivated and provide a roadmap for your budget. Whether it’s building an emergency fund, saving for your child’s education, or planning for retirement, align your budget with your aspirations.

6. Review and Adjust Regularly:

Life circumstances change, and so will your financial needs. Regularly review and adjust your budget to reflect these changes, ensuring it remains relevant and effective in helping you reach your financial goals.

Building an Emergency Fund

As a single parent, facing unexpected expenses without a financial safety net can be incredibly stressful. That’s why building an emergency fund is crucial. This fund acts as a buffer, protecting you from going into debt when unexpected costs arise, such as:

- Medical bills

- Car repairs

- Home repairs

- Job loss

How much should you save? Ideally, aim for 3-6 months’ worth of living expenses. This may seem daunting, but start small. Even setting aside $10 or $20 a week can make a difference over time.

Where to keep your emergency fund? Opt for a separate, easily accessible savings account. This prevents accidental spending and allows your money to grow with interest.

Tips for Building Your Fund:

- Create a budget: Track your income and expenses to identify areas where you can cut back and save.

- Automate savings: Set up automatic transfers from your checking to your emergency fund account each month.

- Find extra income: Explore side hustles or freelance work to boost your savings faster.

- Sell unused items: Declutter your home and sell unwanted items online or at consignment stores.

Managing Childcare Expenses

Childcare is often one of the biggest expenses for single parents. Finding ways to manage and potentially reduce these costs can significantly impact your financial stability.

Explore Affordable Options:

- Consider subsidized programs: Check into government-funded programs or subsidies that can help offset childcare costs based on your income and family size.

- Explore shared childcare: Connect with other single parents in your area to see if you can create a shared childcare arrangement, taking turns caring for each other’s children.

- Involve family or friends: If you have trusted family or friends who are willing and able, explore the possibility of them providing childcare assistance, even if it’s just for a few hours a week.

- Negotiate rates: Don’t hesitate to discuss rates and payment plans with potential childcare providers. Some might be open to negotiation, especially if you have more than one child.

Maximize Benefits and Tax Breaks:

- Dependent Care Flexible Spending Accounts (DCFSAs): If your employer offers this pre-tax benefit, contribute to it to reduce your taxable income and lower your overall childcare expenses.

- Child and Dependent Care Tax Credit: This tax credit can help offset some of your childcare expenses when you file your taxes. Check your eligibility requirements and how to claim it.

Maximizing Income Opportunities

Being a single parent often means being the sole provider, making income maximization crucial. Here are some avenues to explore:

1. Career Advancement:

Prioritize upskilling. Look for affordable online courses, workshops, or certification programs that can enhance your skills and make you more competitive in your current field or a new one.

Network strategically. Attend industry events, join online communities, and connect with people in your field. Networking can open doors to new opportunities and provide valuable insights.

2. Exploring Additional Income Streams:

Side hustles offer flexibility and the potential for extra income. Consider your skills and interests: freelance writing, graphic design, virtual assisting, crafting, or even driving for a ride-sharing service are just a few possibilities.

Monetize your hobbies. If you’re passionate about something, see if you can turn it into a source of income. Selling handmade goods online, teaching classes, or offering consulting services are ways to leverage your skills.

3. Utilizing Resources and Support:

Research government assistance programs. Many countries offer programs to support single parents with job training, childcare subsidies, or financial aid. Don’t hesitate to explore these options.

Seek support from community organizations. Non-profit organizations and community centers often provide resources, workshops, and support groups specifically for single parents seeking to improve their financial situations.

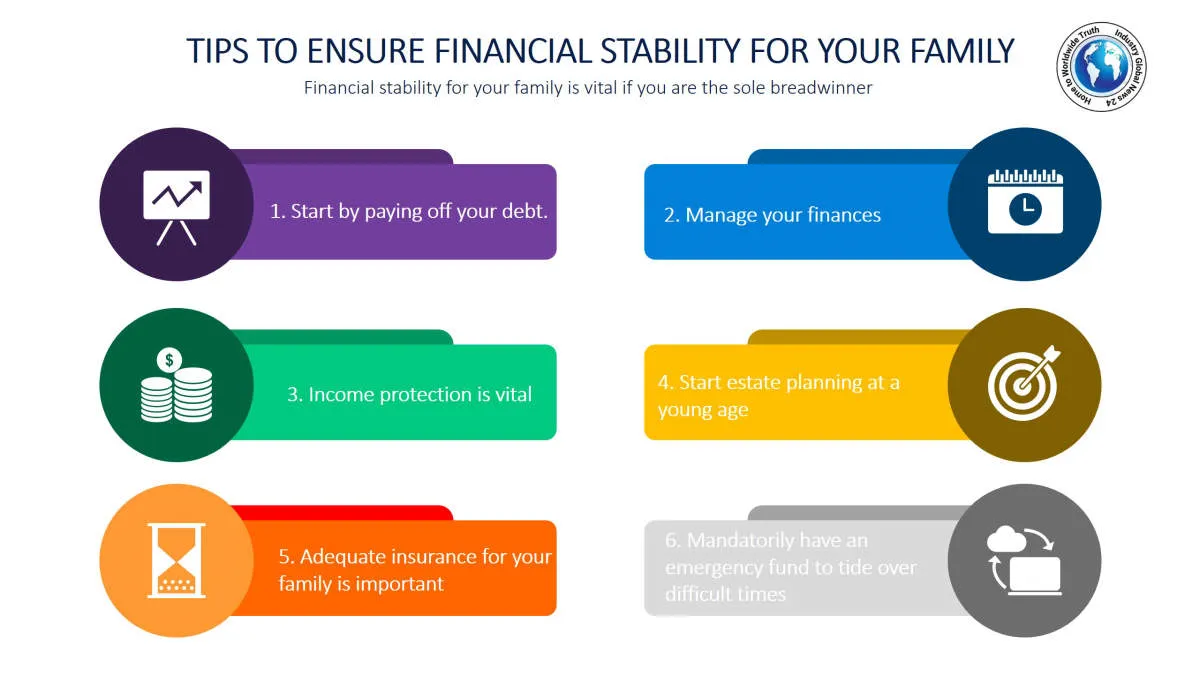

Planning for Future Expenses

As a single parent, ensuring your children have a bright future is a top priority. Financial planning plays a crucial role in making their future secure, even when you’re not around. Here’s how to plan for those future expenses:

1. Life Insurance:

Life insurance is crucial. It provides a financial safety net for your children if something happens to you. The death benefit can cover living expenses, education costs, and other financial needs. When determining coverage, consider your outstanding debts, your children’s future needs, and the cost of living in your area.

2. Education Fund:

Start saving for your children’s education as early as possible. Even small contributions to a dedicated education savings plan can add up over time. Explore options like 529 plans, which offer tax advantages for education expenses. Having a plan in place can relieve the future financial burden of college tuition.

3. Emergency Fund:

Unexpected expenses can arise, and they often come at the worst times. A robust emergency fund acts as a buffer against these unforeseen events. This fund should be easily accessible and cover 3-6 months’ worth of living expenses.

4. Estate Planning:

Estate planning is not just for the wealthy; it’s essential for single parents. It involves creating a will to designate a guardian for your children and specify how your assets should be distributed. You can also establish a trust to manage assets for your children’s benefit and consider a durable power of attorney for financial and healthcare decisions.

Seeking Financial Assistance

Being a single parent often means navigating financial challenges alone. Don’t hesitate to seek out assistance when needed. There are many resources available to help ease the burden:

Government Programs:

- Temporary Assistance for Needy Families (TANF): Provides temporary financial assistance and support services to eligible families.

- Supplemental Nutrition Assistance Program (SNAP): Offers assistance with grocery costs to ensure families have access to nutritious food.

- Child Care Assistance: Helps eligible families afford quality childcare, allowing parents to work or attend school.

- Earned Income Tax Credit (EITC): A tax credit for low-to-moderate income working individuals and families, potentially providing a significant refund at tax time.

Community Resources:

- Local food banks and pantries: Offer free or low-cost groceries and household items to those in need.

- Charities and non-profit organizations: Many organizations provide financial assistance, job training, counseling, and other support services tailored to single parents.

- Housing assistance programs: Explore options like Section 8 housing vouchers or public housing programs that provide affordable housing options.

Other Options:

- Negotiate with creditors: If struggling with bills, contact creditors to explain your situation. They may be willing to work out a payment plan or offer temporary hardship programs.

- Seek free or low-cost financial counseling: A financial counselor can help create a budget, manage debt, and improve your overall financial literacy.

Conclusion

In conclusion, single parents can achieve financial stability by budgeting wisely, building an emergency fund, securing insurance, and seeking financial advice. Prioritizing financial literacy and planning for the future are key steps to ensure a strong financial foundation.