Starting your career as a young professional can be overwhelming, but with the right financial guidance, you can set yourself up for success. Learn essential money management tips to secure your financial future.

Importance of Financial Planning

As a young professional just starting your career, it’s easy to get caught up in the excitement of a new job and the prospect of a regular paycheck. However, it’s crucial to prioritize financial planning from the get-go. Early financial planning is the foundation for achieving your future financial goals, whether it’s buying a house, traveling the world, or securing a comfortable retirement.

Here’s why financial planning is essential for young professionals:

- Control Over Your Finances: Financial planning empowers you to take control of your income and expenses. By creating a budget and tracking your spending, you can identify areas to save and make informed decisions about your money.

- Goal Setting and Achievement: Whether it’s saving for a down payment, paying off student loans, or investing for the future, financial planning helps you define your goals and create a roadmap to achieve them.

- Building an Emergency Fund: Unexpected events like job loss or medical emergencies can arise. Having an emergency fund provides a safety net and prevents you from going into debt when faced with unforeseen circumstances.

- Starting Early with Investing: The sooner you start investing, the more time your money has to grow through the power of compounding. Even small contributions early on can have a significant impact on your long-term wealth.

- Managing Debt Effectively: Many young professionals graduate with student loan debt, and it’s easy to accumulate credit card debt. Financial planning helps you create a strategy for managing and eventually paying off your debts, reducing financial stress.

Building an Emergency Fund

One of the most important things you can do as a young professional is to build an emergency fund. An emergency fund is a savings account that you use to cover unexpected expenses, such as a job loss, medical emergency, or car repair.

Having an emergency fund can give you peace of mind and help you avoid going into debt when unexpected events occur. Here are a few tips for building an emergency fund:

- Set a savings goal. A good rule of thumb is to save enough to cover three to six months of living expenses.

- Make saving automatic. Set up a recurring transfer from your checking account to your savings account each month.

- Cut expenses. Look for ways to reduce your spending so you can free up more money to save.

- Get a side hustle. Bring in extra income to reach your savings goal quicker.

Understanding Credit Scores

A credit score is a three-digit number that represents your creditworthiness, or how likely you are to repay borrowed money. Lenders, landlords, and even some employers use your credit score to assess your financial responsibility.

Why is a good credit score important? A good credit score can help you qualify for lower interest rates on loans, rent an apartment, and even secure certain jobs. On the other hand, a poor credit score can make it difficult to get approved for loans, rent an apartment, or even get a job.

Factors that affect your credit score:

- Payment history (whether you pay bills on time)

- Amounts owed (how much debt you have)

- Length of credit history (how long you’ve been using credit)

- Credit mix (having a variety of credit types, such as credit cards and loans)

- New credit (opening several new credit accounts in a short period can lower your score)

How to build a good credit score:

- Pay your bills on time: Set up automatic payments or reminders to avoid late payments.

- Keep your credit card balances low: Aim to use no more than 30% of your available credit.

- Check your credit report regularly: Look for errors and report them to the credit bureaus.

Building a strong credit history takes time, but it is an essential aspect of managing your finances as a young professional. By understanding how credit scores work and adopting responsible credit habits, you can set yourself up for financial success in the future.

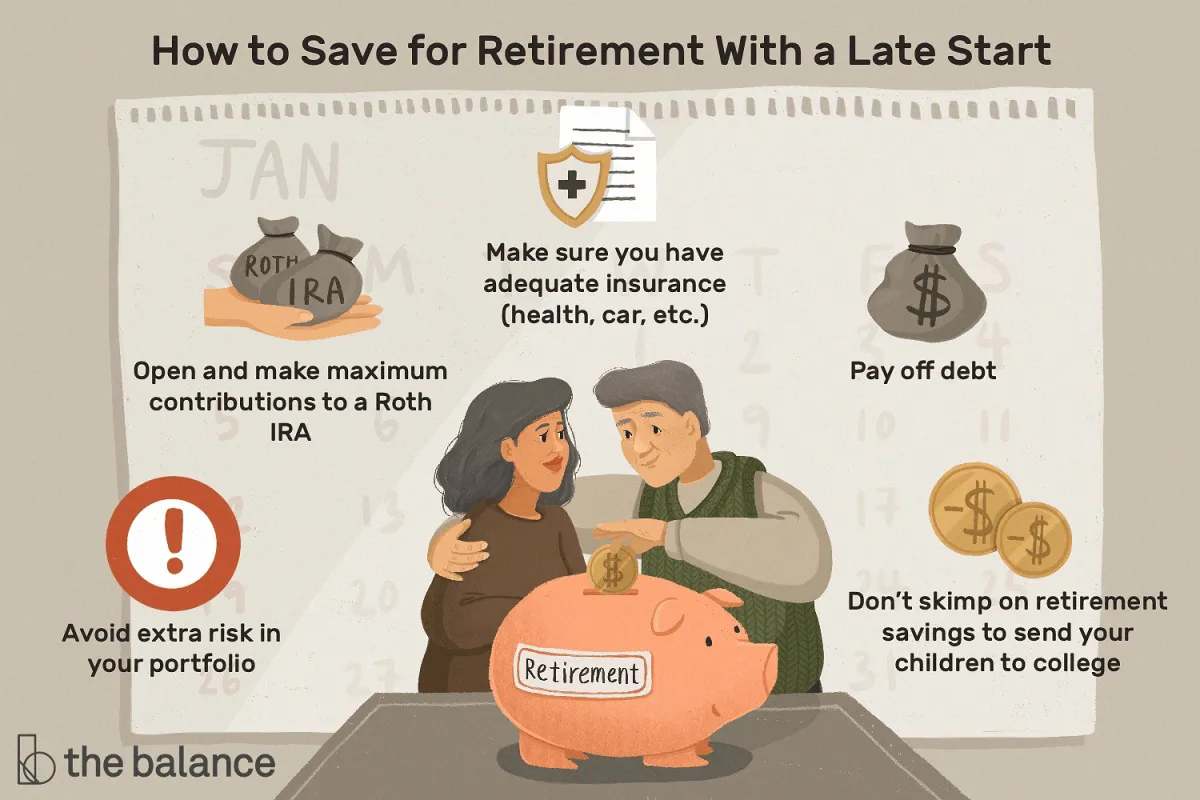

Saving for Retirement Early

Retirement might seem like a lifetime away, but starting early is crucial for building a comfortable nest egg. The power of compound interest means that even small contributions made consistently in your 20s and 30s can grow significantly over time.

Here’s why prioritizing retirement savings early is essential:

- Time is Your Greatest Asset: The earlier you begin, the longer your money has to grow, benefitting from years of compounding returns.

- Smaller Contributions, Bigger Impact: Starting young means you can contribute smaller amounts regularly and still reach your retirement goals.

- Financial Security and Flexibility: A healthy retirement fund provides peace of mind and the flexibility to retire on your own terms.

Here’s how to kickstart your retirement savings:

- Explore Employer-Sponsored Plans: Take advantage of 401(k)s or similar plans, especially if your employer offers matching contributions – it’s free money!

- Consider Individual Retirement Accounts (IRAs): Traditional and Roth IRAs offer tax advantages and a range of investment options.

- Automate Your Savings: Set up automatic transfers from your checking account to your retirement account each month. Treat it like any other essential bill.

- Start Small and Increase Gradually: If you can’t contribute a large amount right away, start with a smaller percentage of your income and increase your contributions as your salary grows.

Smart Spending Habits

As a young professional just starting your career, managing your finances effectively is crucial for building a solid financial foundation. Smart spending habits are at the heart of this endeavor. Here’s how to cultivate them:

1. Track Your Expenses

Understanding where your money goes is the first step towards controlling your finances. Utilize budgeting apps, spreadsheets, or even a simple notebook to track your income and expenses diligently.

2. Differentiate Between Needs and Wants

Clearly distinguish between essential needs (rent, food, utilities) and discretionary wants (entertainment, dining out). Prioritize needs and allocate a reasonable portion of your income for wants without overspending.

3. Create a Realistic Budget

Develop a budget that aligns with your income, expenses, and financial goals. Allocate funds wisely, ensuring you’re saving a portion of your earnings while also covering essential expenses.

4. Avoid Impulse Purchases

Impulsive buying can derail your budget quickly. Implement a “cooling-off” period before making significant purchases. Give yourself time to consider if the item aligns with your budget and if it’s a genuine need or just a fleeting desire.

5. Explore Affordable Alternatives

Seek out cost-effective alternatives without compromising quality. Consider generic brands, cook at home more often, use public transportation or carpool, and explore free or low-cost entertainment options.

6. Utilize Discounts and Rewards

Take advantage of student discounts, cashback rewards programs, and coupons to maximize your savings on everyday purchases. Small savings can accumulate significantly over time.

7. Review and Adjust Regularly

Your financial situation and goals may evolve, so it’s essential to revisit your budget regularly. Make necessary adjustments to align with your current needs and financial priorities.

Conclusion

In conclusion, young professionals embarking on their careers should prioritize budgeting, saving, investing early, and seeking financial guidance to secure their financial future.