Learn essential tips and strategies for effectively managing your business finances to ensure sustainable profitability in our article, “Managing Business Finances: Tips for Staying in the Black.”

Understanding Business Finances

A firm grasp of your business finances is non-negotiable for success. It’s not just about crunching numbers; it’s about gaining insights that drive strategic decision-making and ensure the long-term health of your business. Here’s what you need to understand:

Key Financial Statements: Your Business Dashboard

Think of financial statements as your business dashboard, providing a snapshot of your company’s financial health. These are the essentials:

- Income Statement (Profit and Loss Statement): Tracks your revenues and expenses over a specific period, showing your profitability.

- Balance Sheet: Provides a snapshot of your assets (what you own), liabilities (what you owe), and equity (the owner’s stake) at a particular point in time.

- Cash Flow Statement: Illustrates the inflow and outflow of cash, highlighting where your money is coming from and where it’s going.

Financial Ratios: Digging Deeper for Insights

Financial ratios are powerful tools that analyze the data in your financial statements. They help you assess your business’s:

- Liquidity: Can you meet your short-term obligations?

- Solvency: Can you meet your long-term debt obligations?

- Profitability: How effectively are you generating profits from your sales and assets?

- Efficiency: How well are you managing your assets and resources?

The Importance of Financial Planning

Understanding your current financial position is crucial, but it’s equally important to plan for the future. This is where budgeting and forecasting come in:

- Budgeting: Creating a detailed plan for your income and expenses over a specific period. It helps you control spending, allocate resources effectively, and track your progress.

- Forecasting: Projecting your financial performance into the future, using historical data and market trends to make informed business decisions.

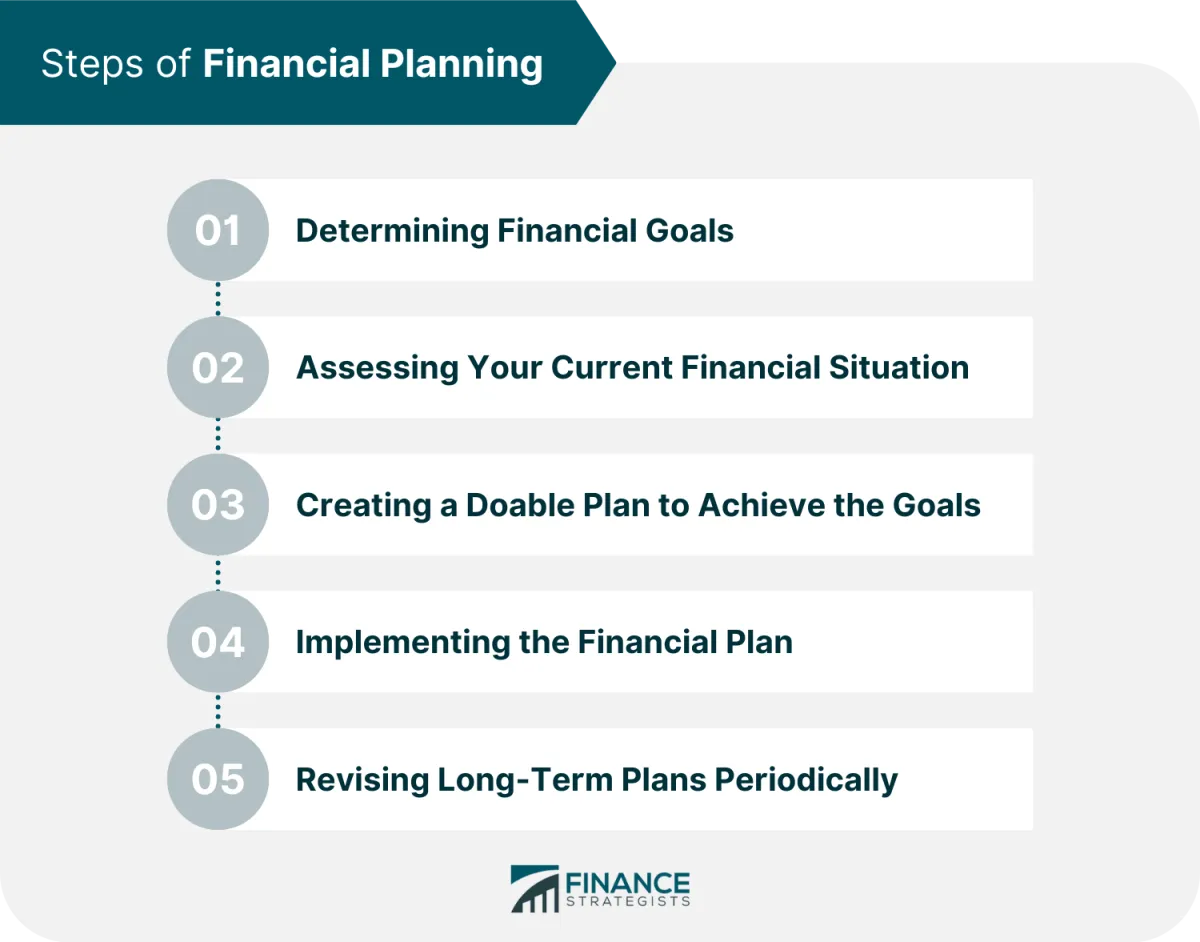

Creating a Financial Plan

A well-structured financial plan is the backbone of any successful business. It serves as a roadmap, guiding your financial decisions and helping you reach your business goals. Here’s a breakdown of how to create one:

1. Assess Your Current Financial Situation

Before you can plan for the future, you need a clear picture of your present financial health. Gather all relevant financial documents, including:

- Profit and loss statements

- Cash flow statements

- Balance sheets

Analyze these statements to understand your revenue streams, expenses, assets, and liabilities. This analysis will highlight your business’s financial strengths and weaknesses.

2. Define Your Financial Goals

What do you want to achieve financially with your business? Your goals should be specific, measurable, achievable, relevant, and time-bound (SMART). Examples include:

- Increase net profit by 15% in the next fiscal year.

- Secure a business loan of $50,000 within six months.

- Reduce operating expenses by 10% over the next two years.

Having well-defined goals gives you specific targets to work towards.

3. Develop a Budget

Your budget is the cornerstone of your financial plan. It outlines your projected income and expenses over a specific period, typically a year. Use your financial statements and goal analysis to create realistic revenue and expense projections.

4. Monitor, Analyze, and Adapt

A financial plan is not a static document; it requires regular review and adjustments. Monitor your actual performance against your budget and analyze any variances. Are you exceeding your revenue targets? Are your expenses higher than anticipated? Based on your analysis, be prepared to adapt your plan to reflect changing business conditions or new opportunities.

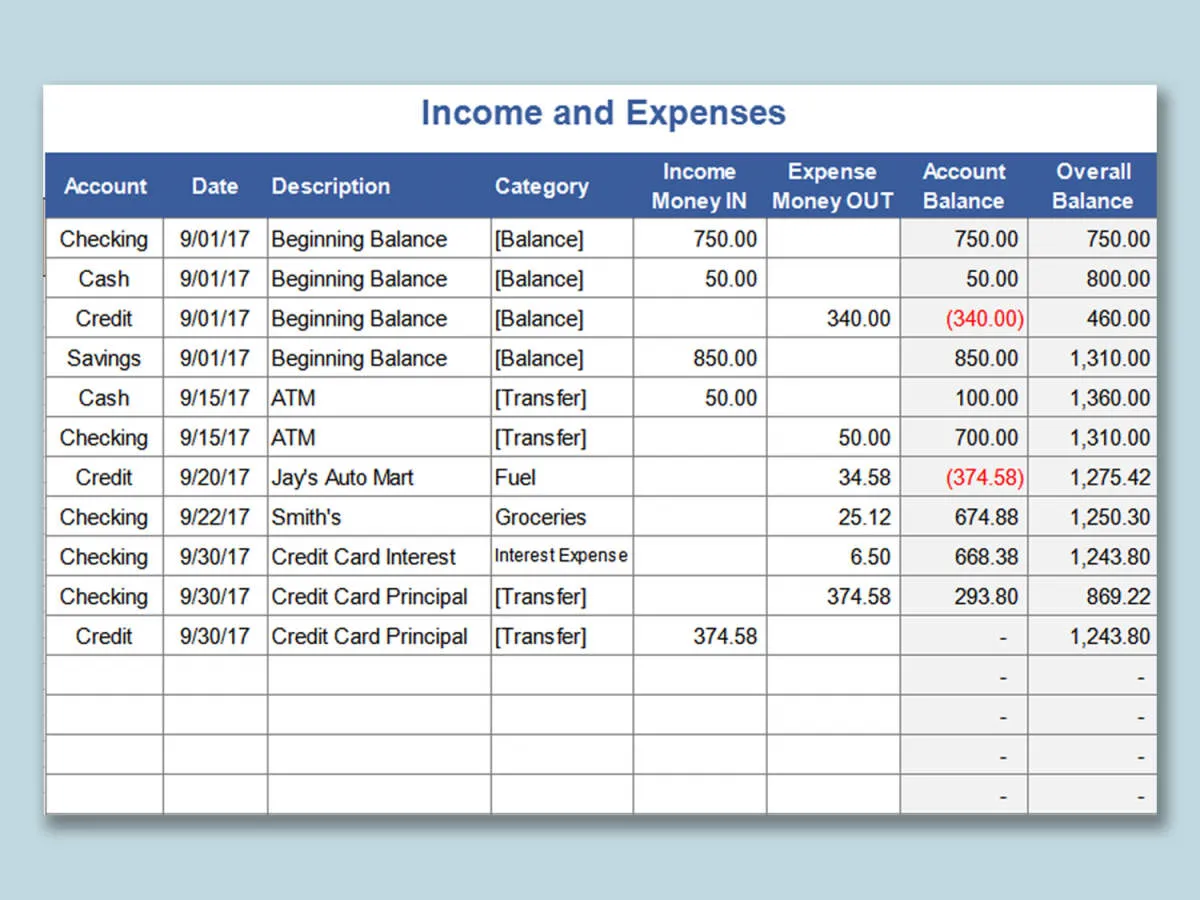

Tracking Income and Expenses

One of the most fundamental aspects of managing business finances effectively is maintaining a keen eye on your income and expenses. This involves establishing a systematic approach to recording every dollar that flows in and out of your business.

Why is tracking so important? It allows you to:

- Identify Profitability: By comparing your income and expenses, you gain a clear understanding of your business’s profitability. Are you genuinely making money, or are hidden expenses eating away at your margins?

- Control Spending: When you track expenses meticulously, you can spot areas of overspending or unnecessary costs. This awareness allows for informed decisions to optimize your budget and allocate resources effectively.

- Make Informed Decisions: Having a firm grasp on your financial data empowers you to make strategic decisions regarding pricing, investments, and expansion plans. You’ll base your choices on concrete evidence rather than assumptions.

- Prepare Accurate Taxes: Organized financial records are crucial come tax season. By diligently tracking income and expenses, you can simplify the tax filing process and avoid potential penalties.

Methods for Tracking:

The method you choose will depend on your business size and complexity. Some popular options include:

- Spreadsheets: Simple and cost-effective for smaller businesses. You can create custom spreadsheets to categorize income and expenses.

- Accounting Software: As your business grows, dedicated accounting software like QuickBooks or Xero can automate many tracking tasks, provide detailed reports, and integrate with your bank accounts.

- Hiring a Bookkeeper: For larger businesses or those requiring more specialized financial management, outsourcing to a professional bookkeeper can ensure accurate and efficient financial recordkeeping.

Key Takeaways:

- Consistency is key. Establish a regular schedule for recording transactions to avoid falling behind.

- Utilize technology to streamline the process and minimize errors.

- Don’t hesitate to seek guidance from a financial advisor or accountant if you need assistance setting up a system or interpreting your financial data.

Cutting Costs Effectively

Keeping expenses in check is crucial for maintaining a healthy business. While increasing revenue is always a goal, smart cost reduction can have a direct impact on your bottom line. Here are some key strategies for effective cost cutting:

1. Review and Renegotiate Vendor Contracts

Don’t be afraid to shop around for better deals. Regularly review contracts for services like telecommunications, internet, insurance, and office supplies. Can you secure a lower rate with your current provider or find a more competitive offer elsewhere?

2. Embrace Technology Solutions

Technology can be a powerful ally in reducing costs. Consider these areas:

- Cloud Computing: Transitioning to cloud-based software can minimize the need for expensive hardware and IT maintenance.

- Automation: Automate repetitive tasks like data entry or invoicing to free up employee time for higher-value work.

- Communication Tools: Utilize free or low-cost communication platforms for video conferencing and team collaboration, potentially reducing travel expenses.

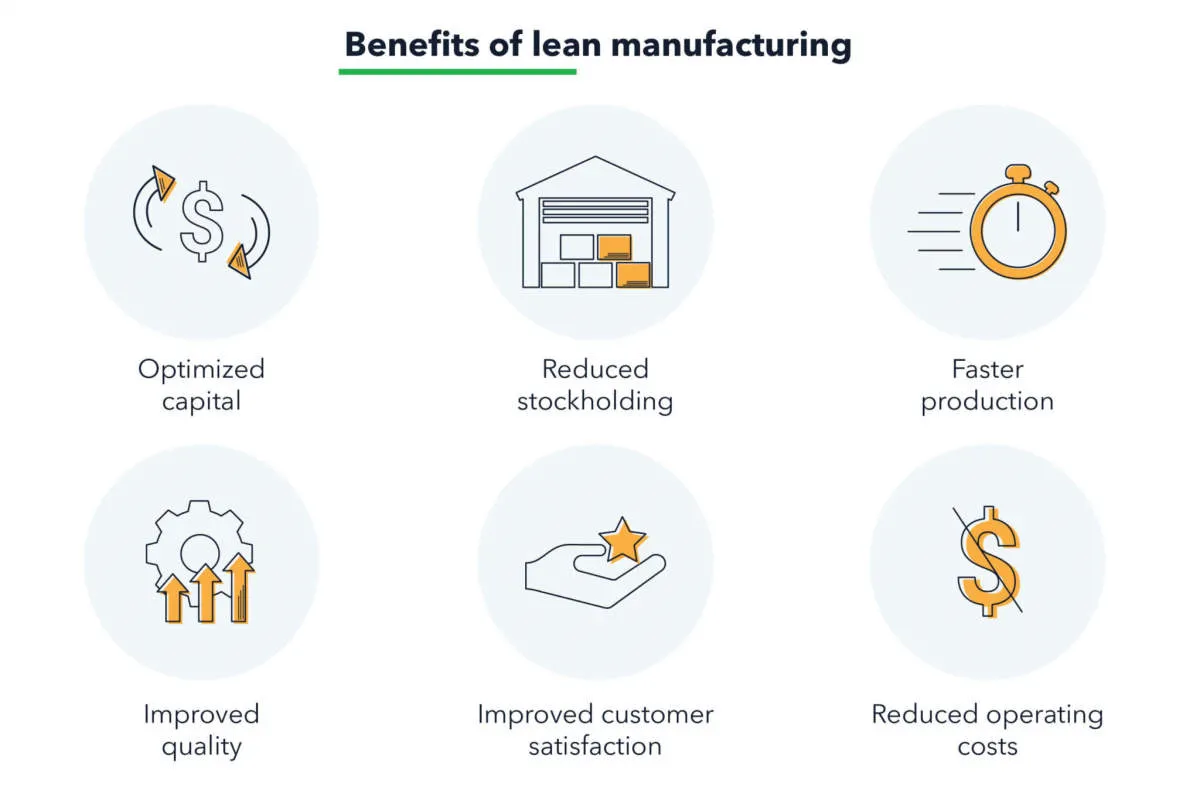

3. Optimize Inventory Management

Holding excess inventory ties up cash flow and can lead to losses from obsolescence or damage. Implement an efficient inventory management system to track stock levels accurately, optimize order quantities, and minimize waste.

4. Reduce Energy Consumption

Lower your utility bills by implementing energy-saving measures in the workplace. This can include using energy-efficient lighting, optimizing heating and cooling systems, and encouraging employees to conserve energy.

5. Explore Outsourcing Options

Consider outsourcing non-core business functions like accounting, payroll, or customer support. This can provide access to specialized expertise while potentially reducing overhead costs associated with hiring and managing in-house staff.

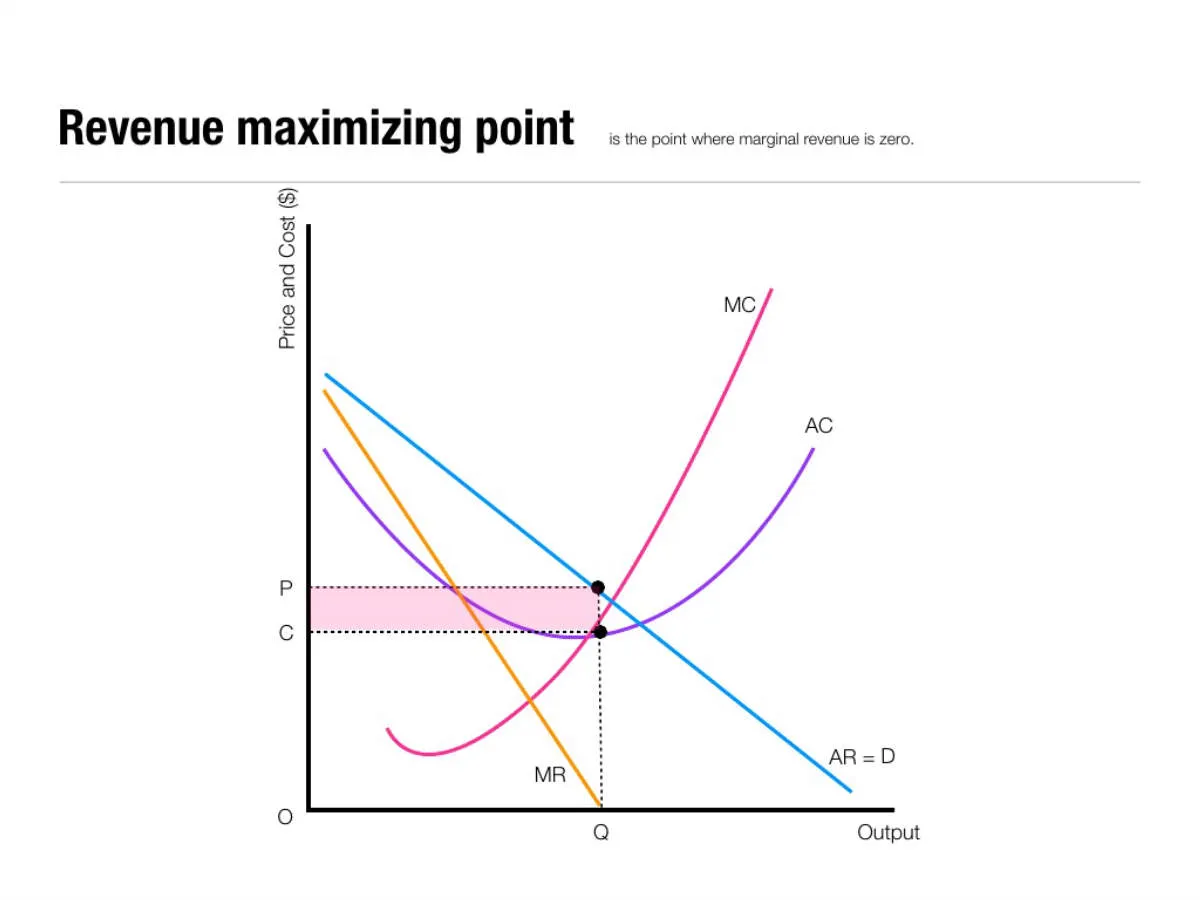

Maximizing Revenue

Maximizing revenue is the lifeblood of any successful business. It’s not just about increasing sales, but also about optimizing pricing strategies, exploring new income streams, and improving operational efficiency to boost your bottom line. Here’s how:

1. Optimize Your Pricing Strategy

Don’t undervalue your products or services. Conduct thorough market research to understand the competitive landscape and identify the optimal price point that balances value for your customers with profitability for your business. Consider dynamic pricing models, where prices fluctuate based on demand, seasonality, or other external factors.

2. Explore New Revenue Streams

Diversifying your income can significantly contribute to revenue growth. Consider offering complementary products or services, developing subscription-based models, or partnering with other businesses to tap into new customer bases. Explore innovative solutions within your industry to create additional value and generate new revenue opportunities.

3. Enhance Customer Lifetime Value

It’s more cost-effective to retain existing customers than to acquire new ones. Focus on building strong customer relationships, providing exceptional service, and implementing loyalty programs to encourage repeat business. By nurturing customer loyalty, you can increase their lifetime value and generate consistent revenue.

4. Streamline Operations for Efficiency

Analyze your business processes and identify areas where you can improve efficiency and reduce unnecessary costs. Implement automation tools, optimize inventory management, and streamline production processes to minimize waste and maximize resource utilization. Operational efficiency directly translates to higher profitability.

5. Leverage Data-Driven Insights

Utilize data analytics to gain insights into your sales patterns, customer behavior, and marketing effectiveness. By understanding what’s working and what’s not, you can make informed decisions to optimize your pricing, marketing campaigns, and product development efforts for maximum revenue generation.

Planning for Future Growth

Maintaining a healthy financial position isn’t just about staying afloat—it’s also about positioning your business for future expansion and success. Planning for growth while managing finances effectively requires a strategic approach:

1. Forecasting and Budgeting:

Develop realistic financial forecasts that project revenue streams, expenses, and cash flow over different growth scenarios. Use these forecasts to create flexible budgets that can adapt to changing circumstances while keeping growth initiatives on track.

2. Identifying Growth Opportunities:

Regularly analyze your market, industry trends, and customer base to pinpoint areas with the most growth potential. This could involve expanding into new markets, developing new products or services, or investing in strategic partnerships.

3. Funding Growth Strategically:

Determine the most suitable funding sources for your growth plans. This might include reinvesting profits, seeking external financing like loans or investment capital, or exploring alternative options like crowdfunding.

4. Measuring Return on Investment (ROI):

Establish clear metrics to track the financial performance of your growth initiatives. Continuously monitor your ROI to ensure that investments are generating the desired returns and make adjustments to your strategies as needed.

5. Building a Scalable Infrastructure:

As your business expands, your operational infrastructure needs to keep pace. This may involve investing in new technologies, streamlining processes, or building a team with the necessary skills and expertise to support future growth.

Conclusion

In conclusion, effective financial management is crucial for businesses to remain profitable and avoid deficits. By implementing these tips, businesses can successfully navigate challenges and maintain a healthy financial standing.