Discover effective real estate investment strategies to build long-term wealth through property acquisition and management.

Benefits of Real Estate Investing

Investing in real estate offers numerous advantages that make it an attractive option for building long-term wealth. Here are some key benefits:

1. Cash Flow and Passive Income

Rental properties can generate a steady stream of passive income. As a landlord, you’ll receive regular rent payments from tenants, providing consistent cash flow. This passive income stream can supplement your primary income source and enhance your financial security.

2. Appreciation Potential

Real estate values tend to appreciate over time. As demand for housing rises and inflation occurs, property values generally increase. This appreciation potential allows you to build equity in your investments and benefit from long-term growth.

3. Tax Advantages

Real estate investors enjoy various tax benefits. These may include deductions for mortgage interest, property taxes, depreciation, and capital gains exclusions. These tax advantages can significantly reduce your tax liability and enhance your overall returns.

4. Inflation Hedge

Real estate acts as a hedge against inflation. As the cost of goods and services rises, so do rental incomes and property values. This correlation protects your investment from inflation erosion, preserving and even growing your purchasing power.

5. Tangible Asset

Unlike stocks or bonds, real estate is a tangible asset. You’re investing in a physical property with intrinsic value. This tangibility provides a sense of security and control over your investment.

6. Leverage Opportunities

Real estate allows for leverage, meaning you can purchase a property with a portion of your own capital and finance the rest through a mortgage. Leverage amplifies your potential returns, enabling you to control a larger asset with a smaller upfront investment.

7. Portfolio Diversification

Adding real estate to your investment portfolio provides diversification. Real estate returns often have a low correlation with stocks and bonds, reducing overall portfolio volatility and mitigating risks.

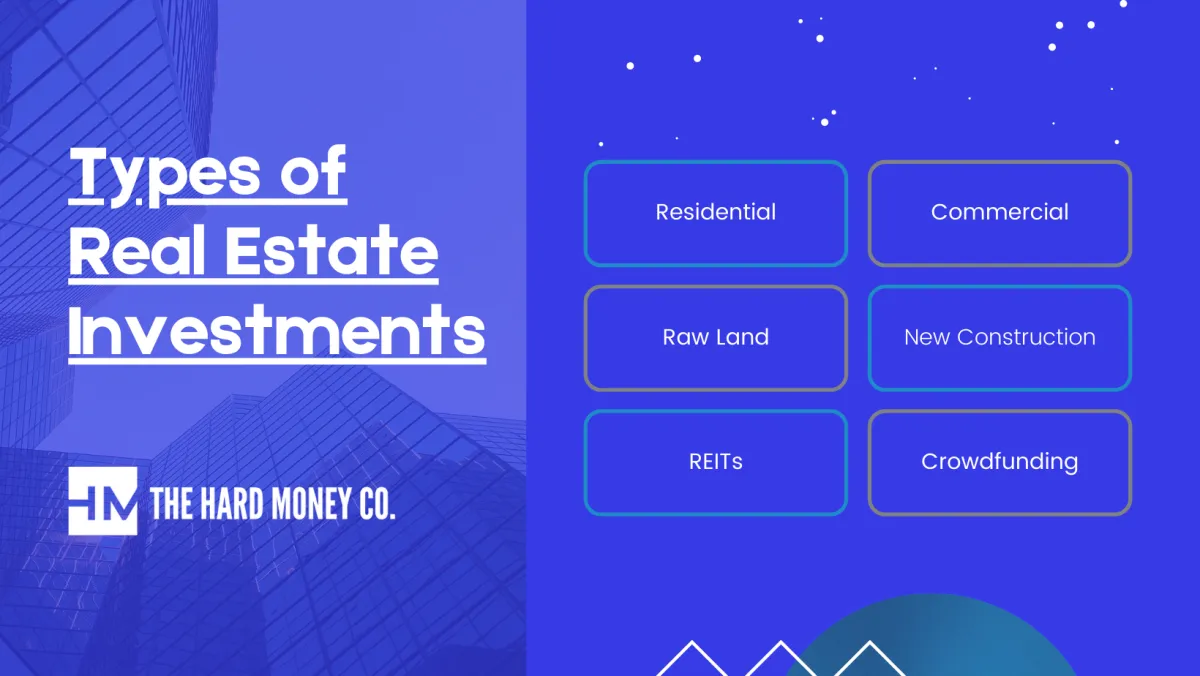

Types of Real Estate Investments

Real estate investing offers a diverse range of options to suit different investment goals and risk tolerances. Here are some common types of real estate investments:

1. Residential Real Estate

Residential properties are designed for individuals and families to live in. This category includes:

- Single-Family Homes: Standalone houses intended for one family.

- Multifamily Homes: Properties with multiple units, such as duplexes, triplexes, and apartment buildings.

- Condominiums: Individually owned units within a larger building or complex.

- Townhouses: Multi-story homes that share a wall with an adjacent property.

2. Commercial Real Estate

Commercial properties are used for business purposes and encompass:

- Office Buildings: Spaces designed for businesses to conduct operations.

- Retail Spaces: Properties used for selling goods and services directly to consumers.

- Industrial Properties: Warehouses, factories, and other facilities used for manufacturing, storage, or distribution.

3. Industrial Real Estate

Industrial properties cater to businesses involved in production, storage, and distribution. These properties include:

- Warehouses: Large facilities used for storing goods.

- Manufacturing Plants: Buildings equipped for manufacturing processes.

- Distribution Centers: Hubs for receiving, sorting, and distributing goods.

4. Land

Investing in land involves purchasing vacant land for various purposes, such as:

- Residential Development: Subdividing land into individual lots for building homes.

- Commercial Development: Constructing commercial buildings like shopping malls or office parks.

- Agricultural Use: Farming or ranching activities.

5. REITs (Real Estate Investment Trusts)

REITs are companies that own and manage income-producing real estate. Investors can buy shares of REITs to participate in the real estate market without directly owning properties.

Finding Profitable Properties

One of the cornerstones of successful real estate investing lies in identifying properties with strong profit potential. This involves a blend of market analysis, due diligence, and a keen understanding of your investment goals. Here’s a closer look at key strategies:

1. Leverage Market Data and Trends

Real estate markets are dynamic. Staying informed about local trends is crucial. Utilize resources like real estate portals, local market reports, and demographic data to understand:

- Average property prices and rental rates: This helps determine potential returns.

- Inventory levels: A buyer’s or seller’s market can impact your negotiating power.

- Demand drivers: Job growth, infrastructure projects, and population trends can signal areas ripe for appreciation.

2. Define Your Investment Niche

Are you seeking cash flow through rentals, long-term appreciation, or a combination? Your investment strategy should dictate the type of property you target. For example:

- Single-family homes: Often attractive to long-term renters, offering steady cash flow.

- Multi-family properties: Can provide higher rental income, but also come with increased management.

- Commercial real estate: Potentially higher returns but requires specialized knowledge.

3. Conduct Thorough Due Diligence

Never skip a comprehensive property inspection. Hire qualified professionals to assess:

- Physical condition: Uncover potential maintenance costs and structural issues.

- Legal and financial history: Title searches, liens, and permits are essential.

- Neighborhood analysis: Evaluate safety, schools, and amenities that impact value.

4. Network and Build Relationships

Real estate is often about who you know. Cultivating a network of real estate agents, contractors, and other investors can provide invaluable insights and off-market opportunities.

Financing Your Investments

Securing the right financing is crucial for successful real estate investing. Here’s a breakdown of common financing options:

1. Mortgages

Traditional mortgages are a popular choice for real estate investors. They typically require a down payment, which can range from 5% to 20% or more, depending on the lender and type of property. You’ll make regular mortgage payments covering principal and interest over the loan term.

2. Cash

If you have substantial savings, buying properties with cash can be advantageous. You’ll avoid interest payments and have more equity from day one. However, it ties up a significant amount of capital that you could potentially leverage for multiple investments.

3. Hard Money Loans

Hard money loans are short-term loans secured by real estate. They’re typically offered by private lenders and have higher interest rates than traditional mortgages. These loans are suitable for investors who need quick funding for projects with a clear exit strategy, such as fix-and-flips.

4. Private Loans

Private loans come from individuals or groups rather than traditional lenders. They can offer greater flexibility in terms of loan amounts, interest rates, and repayment schedules. It’s crucial to carefully vet potential lenders and have clear loan agreements in place.

5. Partnership

Partnering with other investors allows you to pool resources and share the financial burden of purchasing and managing properties. This can be particularly beneficial for larger projects or for those new to real estate investing.

6. Line of Credit

A home equity line of credit (HELOC) or a business line of credit can provide access to funds as needed. This can be useful for covering renovation costs, unexpected expenses, or making down payments on additional properties.

Carefully analyze your financial situation, investment goals, and risk tolerance before choosing a financing method. Consulting with a financial advisor experienced in real estate investing can help you make informed decisions that align with your long-term wealth-building strategy.

Managing Real Estate Properties

Effective management is crucial for maximizing returns and ensuring the long-term success of your real estate investments. Whether you’re dealing with residential or commercial properties, a proactive and strategic approach to management can save you time, money, and unnecessary headaches. Here’s what you need to consider:

1. Tenant Screening and Management

Finding and retaining good tenants is paramount. Implement a rigorous screening process that includes background checks, credit history reviews, and income verification. Once tenants are in place, clear communication, prompt maintenance, and fair rent adjustments are key to fostering positive relationships and minimizing vacancies.

2. Property Maintenance and Repairs

Regular maintenance preserves the value of your property and prevents costly repairs down the road. Develop a preventative maintenance schedule for routine tasks and be prepared to address unexpected issues promptly. Consider using reputable contractors and always factor maintenance costs into your budget.

3. Rent Collection and Financial Management

Establish clear rent payment procedures and enforce late fees consistently. Utilize technology to streamline rent collection and track expenses. Maintain detailed financial records for each property to monitor performance and make informed decisions about future investments.

4. Legal Compliance

Real estate regulations vary by location. Stay informed about local landlord-tenant laws, safety codes, and fair housing practices. Ensure your properties comply with all applicable regulations to avoid legal issues and potential liabilities.

5. Consider Property Management Services

For investors with large portfolios or those who prefer a hands-off approach, hiring a professional property management company can be beneficial. These companies handle tenant screening, rent collection, maintenance, and legal compliance on your behalf, allowing you to focus on other aspects of your investment strategy.

Planning for Long-Term Growth

Investing in real estate with a long-term mindset requires careful planning and consideration. It goes beyond simply buying a property and hoping for its value to appreciate. Here are key strategies to consider:

Market Research and Due Diligence

Thorough market research is crucial to identify areas with strong growth potential. Analyze population trends, economic indicators, infrastructure development, and local amenities. Conduct due diligence on specific properties, including inspections, appraisals, and title searches.

Location, Location, Location

The adage remains true: location is paramount in real estate investing. Invest in properties in desirable neighborhoods with good schools, low crime rates, access to amenities, and proximity to employment centers.

Diversification

Diversifying your real estate portfolio can mitigate risk. Consider investing in different property types (residential, commercial, industrial), geographic locations, and price points.

Cash Flow and Appreciation

Aim for properties that generate positive cash flow through rental income while also having the potential for long-term appreciation. Analyze rental yields, vacancy rates, and potential for rent increases.

Property Management

Efficient property management is crucial for maximizing returns. Consider hiring a professional property manager to handle tenant screening, rent collection, maintenance, and legal compliance.

Financial Planning

Develop a sound financial plan that aligns with your long-term goals. Determine your investment budget, secure financing if needed, and establish a reserve fund for unexpected expenses.

Patience and Discipline

Real estate investing is a long-term game. Be patient, ride out market fluctuations, and stick to your investment strategy. Avoid making impulsive decisions based on short-term market trends.

Conclusion

Utilizing diverse real estate investment approaches is key for building sustainable long-term wealth in the market.