Looking to make the most of your investments? Discover top smart investment tips to maximize your returns in our comprehensive guide. Learn how to navigate the market and make informed decisions for a successful investment portfolio.

Setting Investment Goals

Before you even think about investing, you need to know why you’re doing it. What are you hoping to achieve with your investments? Clearly defined goals provide direction and motivation, helping you stay focused on your long-term financial aspirations.

Consider these factors when setting your investment goals:

- Time Horizon: When do you need the money? Investing for retirement requires a different strategy than saving for a down payment on a house in 5 years.

- Risk Tolerance: How much volatility are you comfortable with? Your willingness to accept potential losses in pursuit of higher returns will shape your investment choices.

- Investment Amount: How much money can you realistically invest regularly? Even small amounts, invested consistently, can grow significantly over time thanks to the power of compounding.

Be specific with your goals. Instead of a vague goal like “financial security,” aim for something concrete like “saving $50,000 for a down payment in 7 years.” Write your goals down and revisit them periodically to make adjustments as your life circumstances change.

Researching Investment Options

Thorough research is the cornerstone of smart investing. Before putting your hard-earned money into any investment, it’s crucial to understand what you’re getting into and how it aligns with your financial goals.

Here’s a breakdown of how to research investment options effectively:

1. Identify Your Investor Profile

Before diving into specific investments, determine your risk tolerance, investment timeline, and financial goals. Are you a conservative investor seeking steady growth, or are you comfortable with higher-risk, higher-reward options? Understanding your investor profile will help narrow down suitable investments.

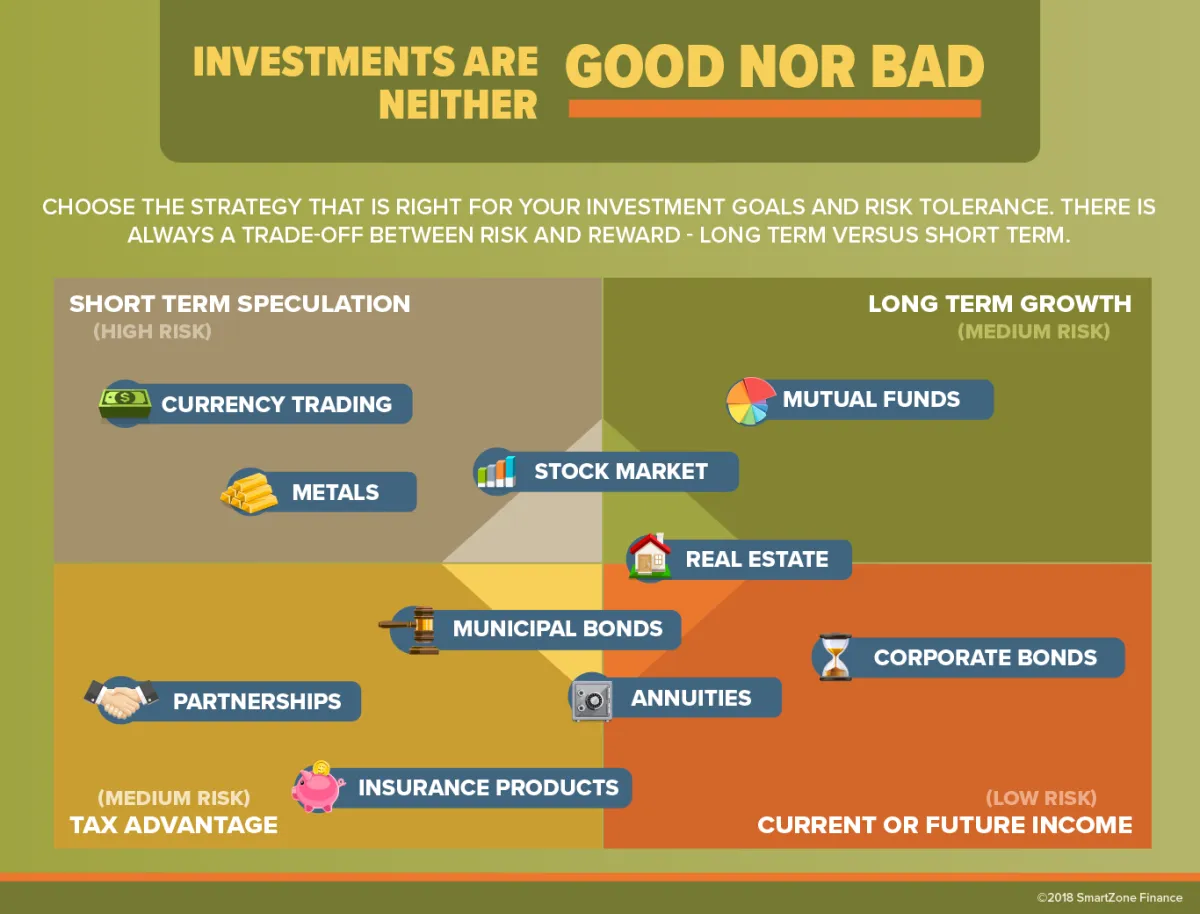

2. Explore Different Asset Classes

Familiarize yourself with various asset classes, including:

- Stocks: Represent ownership in publicly traded companies, offering potential for high growth but also carrying higher risk.

- Bonds: Essentially loans to governments or corporations, typically offering lower returns than stocks but considered lower risk.

- Mutual Funds and ETFs: Baskets of stocks, bonds, or other assets, providing diversification and professional management.

- Real Estate: Investing in physical properties, REITs, or real estate crowdfunding platforms.

- Commodities: Raw materials like gold, oil, or agricultural products, often used as inflation hedges.

3. Analyze Specific Investments

Once you’ve identified asset classes aligning with your risk tolerance and goals, delve into individual investment options. For example, if considering stocks, research specific companies:

- Review their financial statements (income statement, balance sheet, cash flow statement).

- Analyze their industry, competitive landscape, and management team.

- Use online resources like financial news websites and investment research platforms to gather insights.

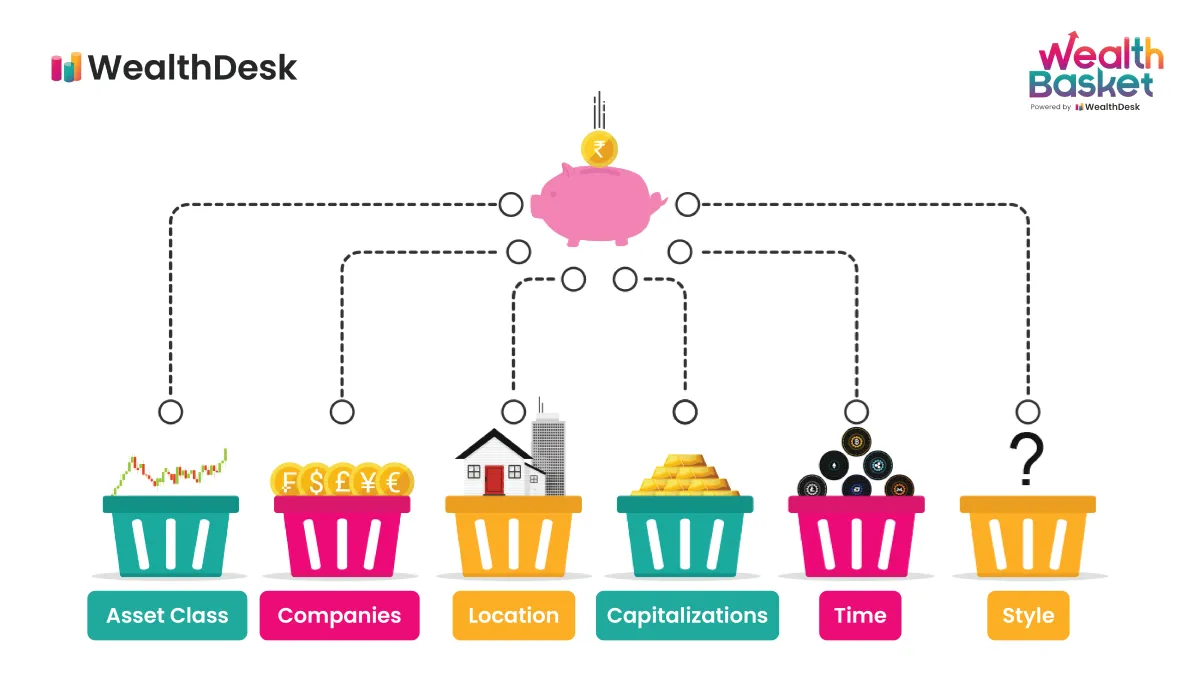

4. Consider Diversification

Don’t put all your eggs in one basket. Diversifying your portfolio across different asset classes, industries, and geographies can help mitigate risk. When one investment isn’t performing well, others may be able to cushion the impact.

5. Seek Professional Advice

If you’re feeling overwhelmed or unsure about your investment choices, don’t hesitate to consult a financial advisor. A professional can provide personalized guidance based on your circumstances and goals.

Diversifying Your Portfolio

Diversification is a key principle in investment management. It involves spreading your investments across a range of asset classes, such as stocks, bonds, real estate, and commodities. By diversifying your portfolio, you can reduce the impact of volatility and potentially enhance your returns.

Here are some key benefits of diversification:

- Risk reduction: Diversification helps to mitigate risk by ensuring that if one investment performs poorly, others may perform well, balancing out potential losses.

- Volatility management: A diversified portfolio tends to be less volatile than one that is concentrated in a few assets or sectors.

- Potential for enhanced returns: By investing in a variety of assets, you increase your chances of capturing returns from different sectors and market conditions.

When diversifying your portfolio, consider the following:

- Asset Allocation: Determine the appropriate mix of stocks, bonds, and other asset classes based on your risk tolerance, time horizon, and financial goals.

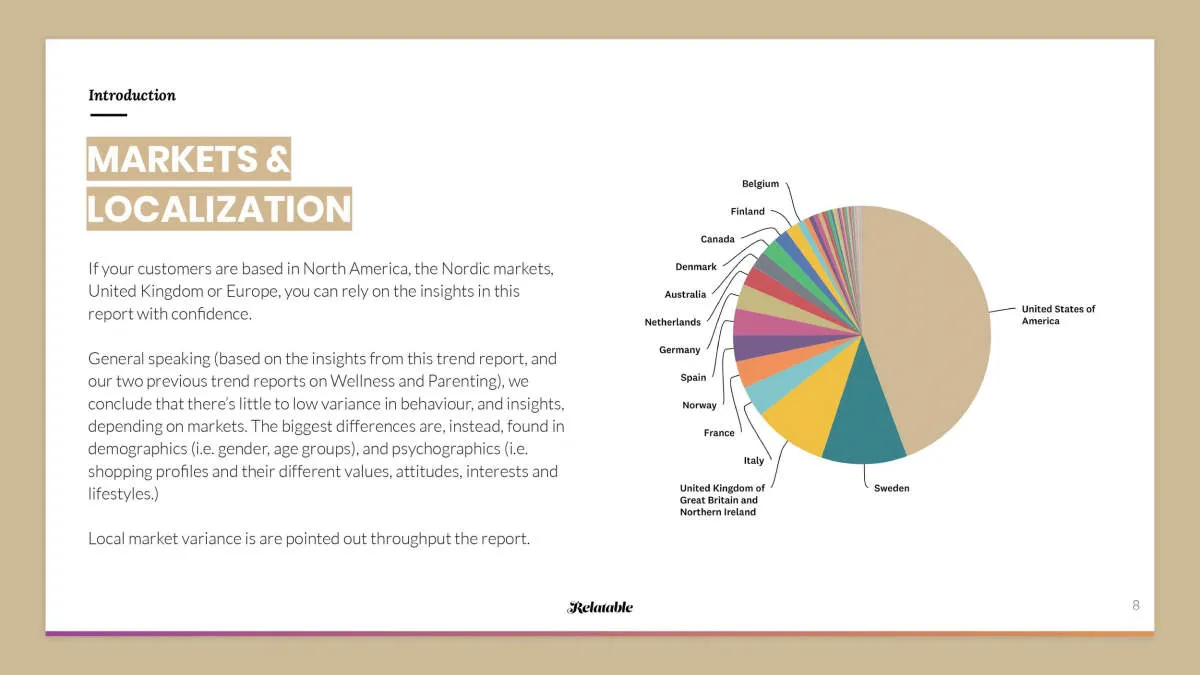

- Geographic Diversification: Consider investing in both domestic and international markets to broaden your opportunities and manage geopolitical risks.

- Regular Review and Rebalancing: Regularly review your portfolio’s performance and make adjustments as needed to maintain your desired asset allocation.

Managing Investment Risks

Every investment comes with inherent risks. It’s impossible to eliminate risk entirely, but smart investors aim to manage and mitigate it. Here’s how:

1. Diversification: Don’t Put All Your Eggs in One Basket

Diversifying your portfolio is the cornerstone of risk management. By spreading your investments across different asset classes (stocks, bonds, real estate, etc.), industries, and geographical locations, you reduce the impact of a single investment’s poor performance on your overall portfolio.

2. Understand Your Risk Tolerance

Your risk tolerance refers to how much volatility you’re comfortable with in your investments. It’s influenced by factors like your investment timeframe, financial goals, and personal comfort with market fluctuations. Understanding your risk tolerance is crucial for making investment decisions aligned with your overall financial plan.

3. Conduct Thorough Research

Before investing, dedicate time to thoroughly research the investment opportunity. This includes understanding the company or asset, its financials, the industry outlook, and potential risks involved. The more informed you are, the better equipped you’ll be to make sound investment decisions.

4. Start Small and Scale Gradually

Instead of investing a large sum at once, consider starting small and gradually increasing your investment as you become more comfortable with the market and your chosen investments. This approach allows you to learn and adjust your strategy along the way.

5. Have a Long-Term Perspective

Investing is a marathon, not a sprint. Market fluctuations are inevitable, but maintaining a long-term perspective can help you ride out short-term volatility and focus on your long-term financial goals.

6. Review and Rebalance Regularly

As market conditions change, so too should your investment strategy. Regularly review and rebalance your portfolio to ensure it still aligns with your risk tolerance, financial goals, and the current market landscape.

7. Seek Professional Advice

If you’re unsure about managing investment risks or creating a diversified portfolio, don’t hesitate to seek advice from a qualified financial advisor. They can provide personalized guidance tailored to your specific financial situation and investment objectives.

Staying Informed on Market Trends

In the dynamic world of investing, staying informed about market trends is crucial for making smart decisions and maximizing your returns. The market is constantly influenced by a myriad of factors, from economic indicators to geopolitical events. By keeping your finger on the pulse of these trends, you can identify potential opportunities and mitigate risks.

Here are some key strategies for staying informed:

- Follow Financial News: Reputable financial news sources, such as The Wall Street Journal, Bloomberg, and Financial Times, provide up-to-date coverage of market movements, economic data releases, and company-specific news.

- Utilize Research Reports: Brokerage firms and financial institutions often publish in-depth research reports on various industries and companies. These reports can provide valuable insights and analysis to inform your investment decisions.

- Engage with Online Communities: Online forums and social media platforms can be valuable resources for gathering information and engaging in discussions with other investors. However, it’s important to exercise caution and verify information from unofficial sources.

- Track Economic Indicators: Pay attention to key economic indicators like inflation rates, interest rate changes, and GDP growth. These indicators can provide insights into the overall health of the economy and potentially impact market performance.

- Consider Professional Advice: If you’re feeling overwhelmed or lack the time to stay fully informed, consider consulting with a financial advisor. These professionals can provide personalized guidance and help you navigate market trends effectively.

Regularly Reviewing Your Investments

A “set it and forget it” approach might sound appealing, but the reality is that smart investing requires consistent monitoring. Regularly reviewing your investments allows you to ensure they’re still aligned with your financial goals and risk tolerance, and make adjustments as needed.

How Often Should You Review?

The frequency of your reviews depends on your investment strategy and time horizon. As a general rule, consider reviewing your portfolio at least:

- Annually: This allows you to assess your overall performance, rebalance your portfolio if needed, and make adjustments based on your changing financial situation.

- Quarterly: More frequent checks can be helpful, especially during periods of market volatility. This gives you a chance to react to significant market shifts and make smaller adjustments to your strategy.

- When major life events occur: Job changes, marriage, retirement – these milestones often necessitate a review of your investment strategy and risk tolerance.

What to Look for During a Review:

- Performance: How have your investments performed compared to their benchmarks and your overall goals?

- Asset Allocation: Is your portfolio still aligned with your desired asset allocation (stocks, bonds, real estate, etc.) based on your risk tolerance and time horizon?

- Fees and Expenses: Are you paying high fees that could be eating into your returns? Consider lower-cost alternatives if necessary.

- Tax Efficiency: Are you minimizing your tax liability by using tax-advantaged accounts like IRAs or 401(k)s?

- Changes in Your Life: Have there been any major changes in your personal or financial situation that might warrant adjustments to your investment strategy?

Conclusion

In conclusion, by diversifying your investments, staying informed, and focusing on long-term goals, you can maximize returns and build a successful investment portfolio.