Embark on your journey to financial growth with our comprehensive guide to investing in the stock market. From understanding the basics to navigating through investment options, this article is your go-to resource for beginners.

Introduction to the Stock Market

The stock market can seem like a complex and intimidating world, especially for beginners. However, understanding the basics of how it works is essential for anyone looking to invest their money and potentially grow their wealth. This article serves as an introduction to the fundamental concepts of the stock market, providing a foundation for further exploration in this comprehensive guide to investing.

At its core, the stock market is a platform where buyers and sellers come together to trade pieces of publicly listed companies. These pieces, known as stocks or shares, represent fractional ownership in the company. By purchasing stock, you are essentially buying a small stake in that company and participating in its future successes (or failures).

The stock market operates through exchanges, such as the New York Stock Exchange (NYSE) or the Nasdaq. These exchanges provide a regulated and organized environment for trading to occur. The price of a stock fluctuates throughout the trading day based on supply and demand. If more people want to buy a particular stock (demand is high), the price will generally increase. Conversely, if more people want to sell a stock (supply is high), the price will generally decrease.

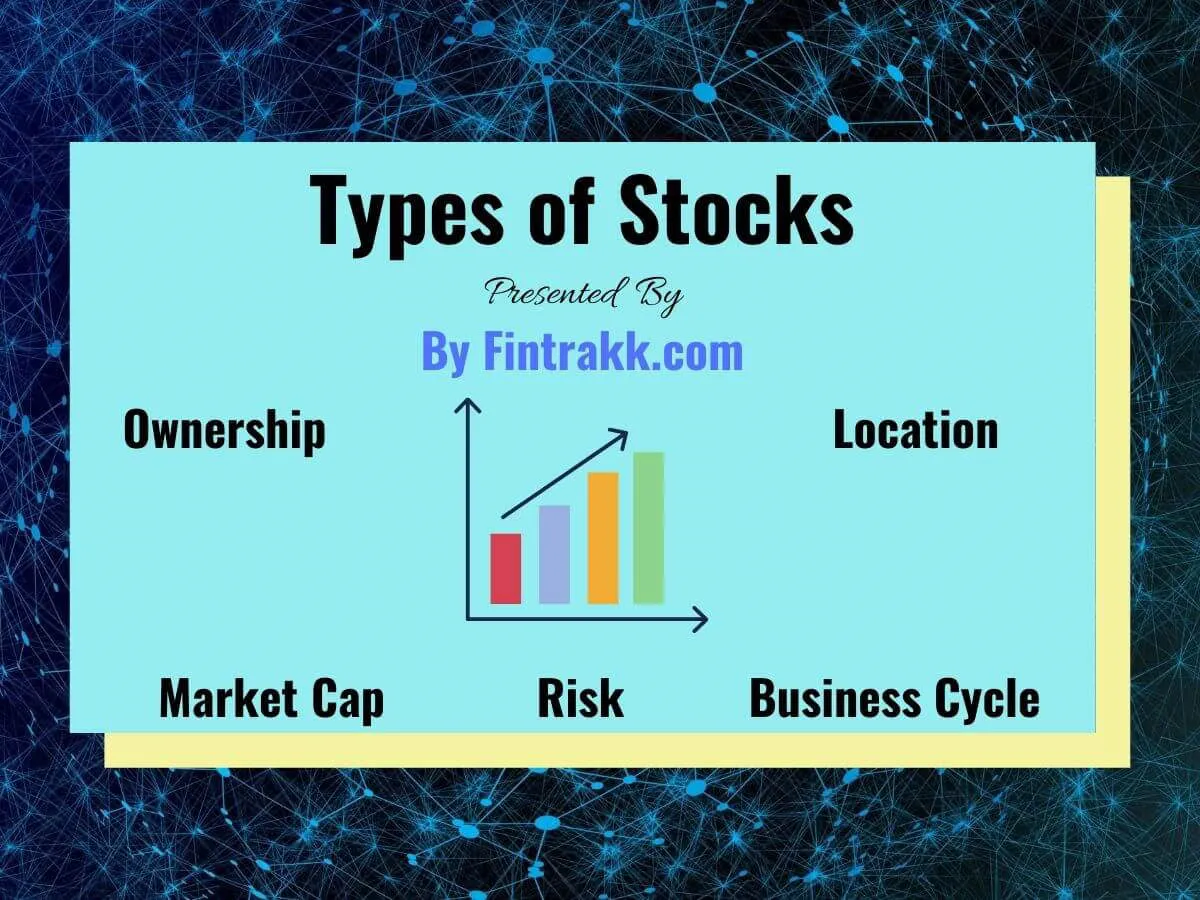

Types of Stocks

Navigating the stock market starts with understanding the building blocks: stocks. But not all stocks are created equal. They come in various flavors, each with its own risk profile and potential for return. Here’s a breakdown of some common types of stocks:

1. Common Stock

This is the most prevalent type of stock. When people talk about “buying stock,” they usually mean common stock. Here’s what you need to know:

- Ownership: Owning common stock means owning a tiny slice of the company.

- Voting Rights: You typically get voting rights on company matters, proportionate to your shares.

- Dividends: Companies may pay dividends (a portion of profits) to shareholders, though it’s not guaranteed.

- Potential for Growth: Common stocks offer the potential for significant capital appreciation if the company performs well.

2. Preferred Stock

Preferred stock occupies a space between common stock and bonds:

- Dividends: Preferred stockholders usually receive a fixed dividend, paid out before common stockholders.

- Priority in Liquidation: In case of bankruptcy, preferred stockholders are ahead of common stockholders in claiming assets.

- Potential for Growth: Generally, preferred stock offers less potential for price appreciation compared to common stock.

3. Growth Stocks

These are shares of companies expected to grow at an above-average rate compared to their industry or the overall market.

- High Expectations: Growth stocks often come with high price-to-earnings (P/E) ratios, reflecting investor optimism.

- Reinvestment: These companies often reinvest profits back into the business for expansion rather than paying large dividends.

- Volatility: Growth stocks can be more volatile, as their prices are driven by future expectations rather than current performance.

4. Value Stocks

Value stocks are like hidden gems, often perceived as undervalued by the market.

- Attractive Metrics: They typically have lower price-to-earnings (P/E) ratios and higher dividend yields than growth stocks.

- Undervalued Potential: Investors seek value stocks believing the market has mispriced them and their worth will be realized over time.

- Patience Required: Value investing can require patience, as it might take time for the market to recognize a stock’s true value.

How to Buy Stocks

Purchasing stocks might seem daunting for beginners, but the process is more straightforward than you might think. Here’s a step-by-step guide to get you started:

1. Choose a Brokerage Account

A brokerage account acts as a gateway to the stock market. You’ll need to open an account with a reputable brokerage firm. There are many options available, each offering different features, fees, and investment platforms. Consider factors like trading commissions, account minimums, research tools, and customer support when making your choice. Some popular online brokerages include:

- Fidelity

- Schwab

- TD Ameritrade

- E*TRADE

2. Fund Your Account

Once you’ve chosen a brokerage, you’ll need to deposit funds to start investing. This can typically be done through electronic transfers, bank wires, or checks. Keep in mind that some brokerages may require a minimum initial deposit.

3. Research and Select Stocks

This is where the real work begins. Before buying any stock, thoroughly research the companies you’re interested in. Consider factors like their financial health, industry performance, competitive landscape, and future growth prospects. Your brokerage’s platform likely offers research tools and analyst reports to aid your decision-making.

4. Place Your Order

Once you’ve identified promising stocks, it’s time to place your order. You’ll need to specify:

- Ticker Symbol: The unique code that identifies a stock (e.g., AAPL for Apple Inc.).

- Number of Shares: How many shares of the stock you want to purchase.

- Order Type: There are various order types, with the most common being market orders (buying at the current market price) and limit orders (buying only at or below a specific price).

5. Monitor Your Investments

After buying stocks, it’s essential to monitor their performance regularly. Track their price movements, news related to the companies, and any factors that might impact their value. Based on your assessment, you can decide whether to hold, buy more, or sell your shares. Remember, investing in the stock market requires patience and a long-term perspective. Prices fluctuate, and it’s normal for your portfolio to experience ups and downs.

Understanding Stock Market Indices

Before diving headfirst into the world of stock market investing, it’s crucial to grasp the concept of stock market indices. These indices serve as barometers of the overall market or specific sectors, providing valuable insights for investors of all levels.

What are Stock Market Indices?

In essence, a stock market index is a hypothetical basket of stocks representing a particular market or segment of the market. These indices track the performance of these selected stocks, providing a single, aggregated number that reflects the overall movement of the group.

How Indices Work

Indices are calculated based on the prices of the underlying stocks they represent. While the specific calculation methodologies vary, most indices are weighted, meaning the performance of companies with larger market capitalizations has a more significant impact on the index’s overall value.

Types of Stock Market Indices

There are numerous stock market indices available, each designed to track a specific market or sector. Some of the most widely recognized indices include:

- Global Indices: These indices track the performance of stocks across multiple countries, such as the MSCI World Index.

- Regional Indices: These focus on specific geographic regions, such as the S&P Europe 350 or the Nikkei 225 (Japan).

- Country-Specific Indices: These indices represent the performance of stocks within a single country, like the S&P 500 (United States) or the FTSE 100 (United Kingdom).

- Sector-Specific Indices: These indices track stocks within a particular industry or sector, such as the Nasdaq Biotechnology Index or the Dow Jones Transportation Average.

Why are Indices Important for Investors?

Stock market indices are essential tools for investors for several reasons:

- Benchmarking: Indices provide a benchmark against which investors can measure the performance of their own portfolios.

- Market Sentiment: Movements in major indices can reflect overall investor sentiment and market trends.

- Investment Opportunities: Indices can help investors identify potential investment opportunities in specific sectors or regions.

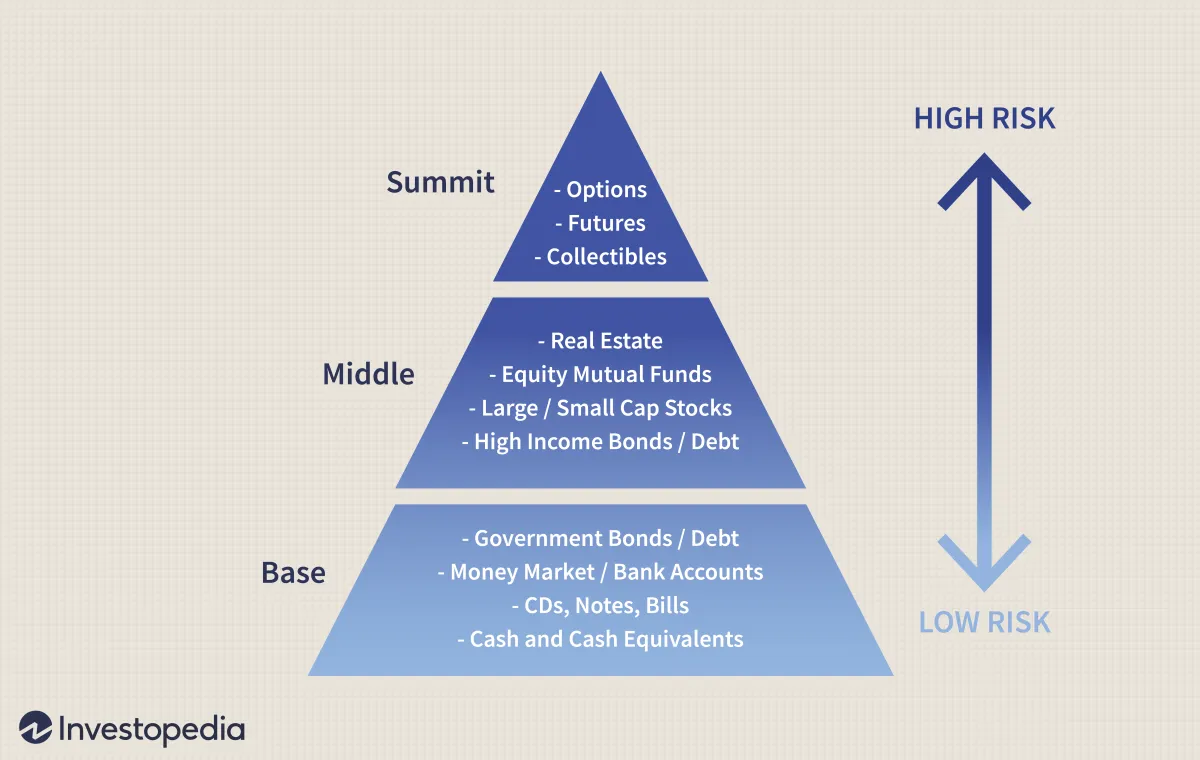

Risk Management in Stock Investing

Investing in the stock market inherently comes with risks, but understanding and managing these risks is crucial for long-term success. Here are key strategies to consider:

1. Diversification: Don’t Put All Your Eggs in One Basket

Diversification is the cornerstone of risk management. It involves spreading your investments across different asset classes, sectors, and geographies. This reduces the impact of a single stock or sector performing poorly on your overall portfolio.

2. Determine Your Risk Tolerance

Before investing, assess your risk tolerance – your capacity and willingness to withstand market fluctuations. Factors like age, financial goals, and investment timeframe play a role. A younger investor with a longer horizon might be comfortable with higher-risk investments, while someone nearing retirement might prefer more conservative options.

3. Set Realistic Expectations

While the stock market offers potential for high returns, it’s essential to have realistic expectations. Don’t expect to get rich quickly. Market fluctuations are normal, and patience is key.

4. Start Small and Gradually Increase Investments

For beginners, starting with a smaller investment amount can be a good approach. As you gain experience and comfort, you can gradually increase your investment capital.

5. Use Stop-Loss Orders

A stop-loss order is an instruction to automatically sell a stock when it reaches a certain price. This helps limit potential losses by setting a predetermined exit point.

6. Research and Due Diligence

Thorough research is essential before investing in any stock. Understand the company’s business model, financials, industry, and growth prospects. Informed decisions are better than impulsive ones.

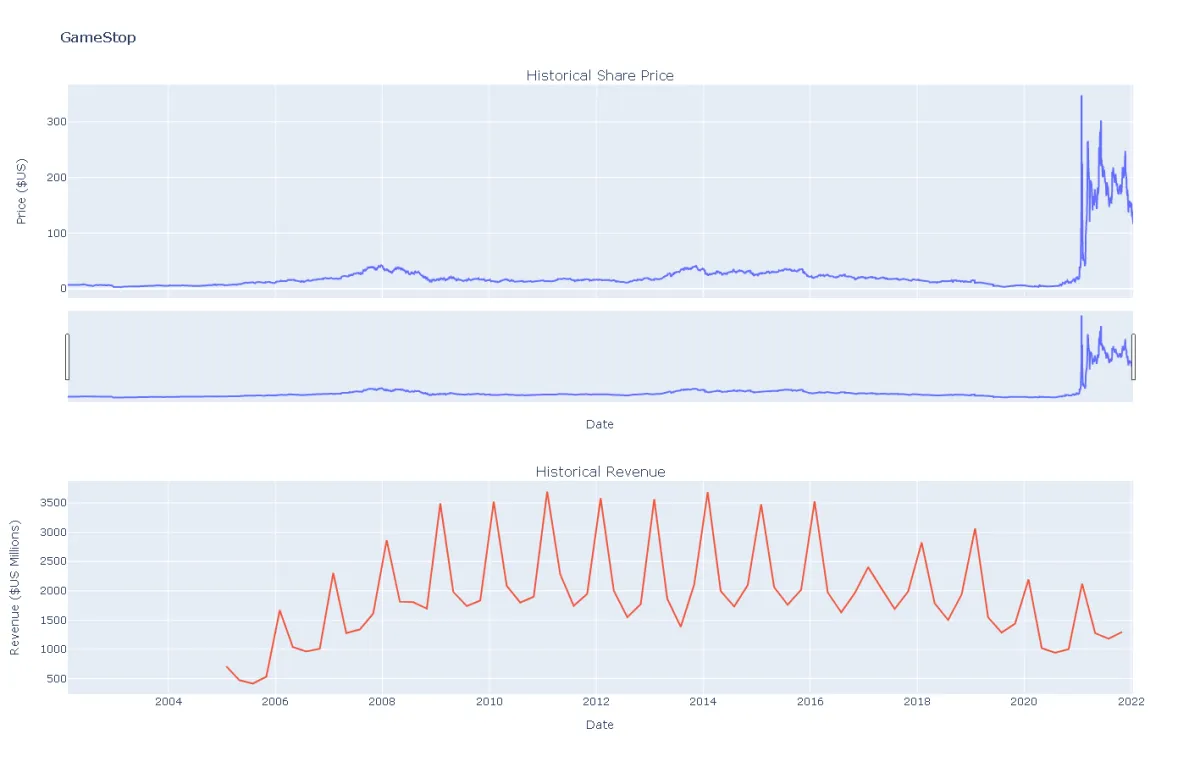

Analyzing Stock Performance

Understanding how to analyze stock performance is crucial for making informed investment decisions. While past performance isn’t a guarantee of future returns, it provides valuable insights into a company’s health and growth potential. Here’s what to consider:

Fundamental Analysis

This approach focuses on evaluating a company’s intrinsic value by examining its financial statements and overall industry position. Key aspects include:

- Earnings per Share (EPS): This metric indicates a company’s profitability. Higher EPS generally suggests stronger financial performance.

- Price-to-Earnings Ratio (P/E): This ratio compares a company’s stock price to its earnings per share. It can help determine if a stock is overvalued or undervalued.

- Debt-to-Equity Ratio: This measures a company’s financial leverage. High debt levels can pose risks, while low debt suggests financial stability.

- Return on Equity (ROE): This metric shows how efficiently a company utilizes shareholder investments to generate profits. Higher ROE generally indicates better management and growth prospects.

Technical Analysis

Technical analysis involves studying historical price and volume data to identify patterns and trends. Traders often use this approach for short-term trading strategies. Common tools include:

- Moving Averages: These lines on price charts smooth out fluctuations, revealing potential trends.

- Support and Resistance Levels: These are price points where a stock tends to find buying or selling pressure, indicating potential price reversals.

- Chart Patterns: Traders look for recognizable patterns in charts, such as head and shoulders or double bottoms, that suggest future price movements.

Qualitative Factors

Beyond numbers, consider these qualitative aspects:

- Industry Trends: Is the company operating in a growing industry with strong future prospects?

- Management Team: A strong and experienced management team can drive a company’s success.

- Competitive Advantage: What sets this company apart from its competitors? Unique products, brand recognition, or a strong market position are positive signs.

- News and Events: Stay updated on company-specific news, industry developments, and economic events that could impact stock performance.

Conclusion

In conclusion, investing in the stock market can be a rewarding journey for beginners. By understanding the basics, conducting thorough research, and staying disciplined, individuals can potentially build wealth over time through smart investment decisions.